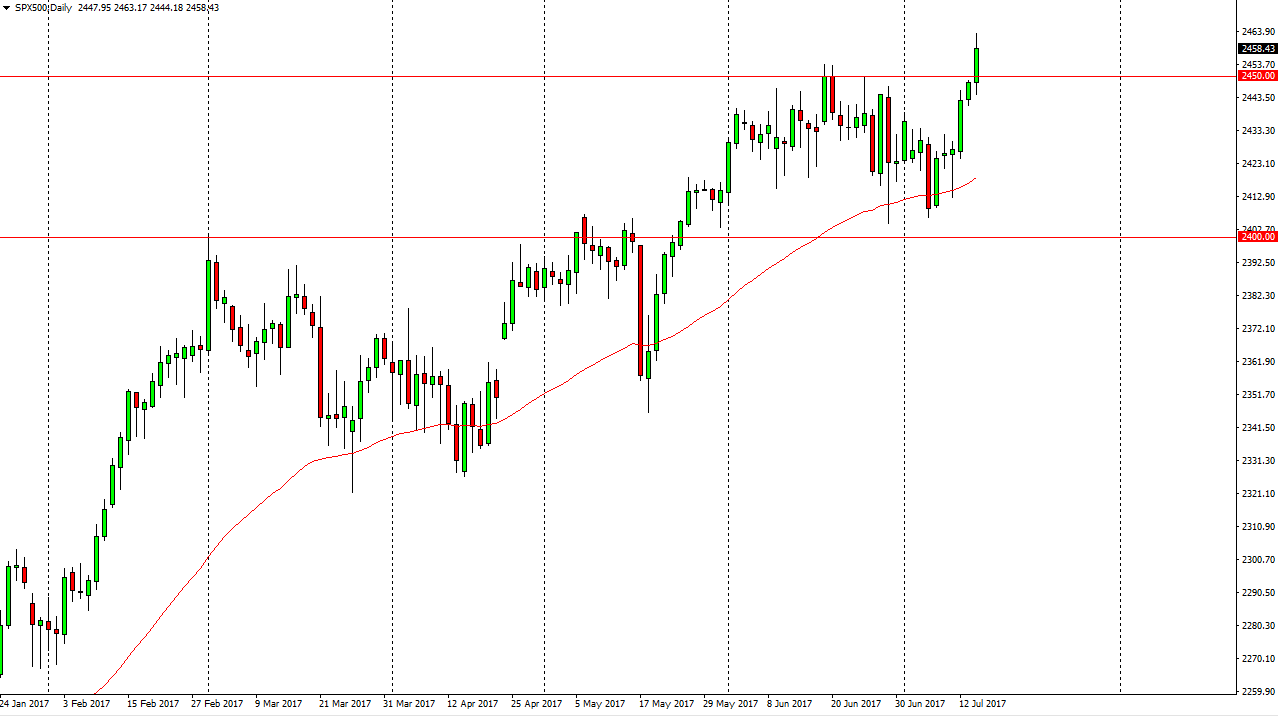

S&P 500

The S&P 500 initially fell on Friday, but bounce significantly and broke above the 2450 handle. We are now at fresh, new highs, so I think that short-term pullbacks will be buying opportunities in a market that looks ready to go to the 2500 level. I have no interest in shorting this market, and I believe that supportive candles are an opportunity to take advantage of what has been a very bullish move. The 50-day exponential moving average continues to offer a significant amount of support, and therefore I feel that it is only a matter of time before we reach the 2500 level, which should be massively resistive. Once we break above there, the market becomes more of a “buy-and-hold” situation.

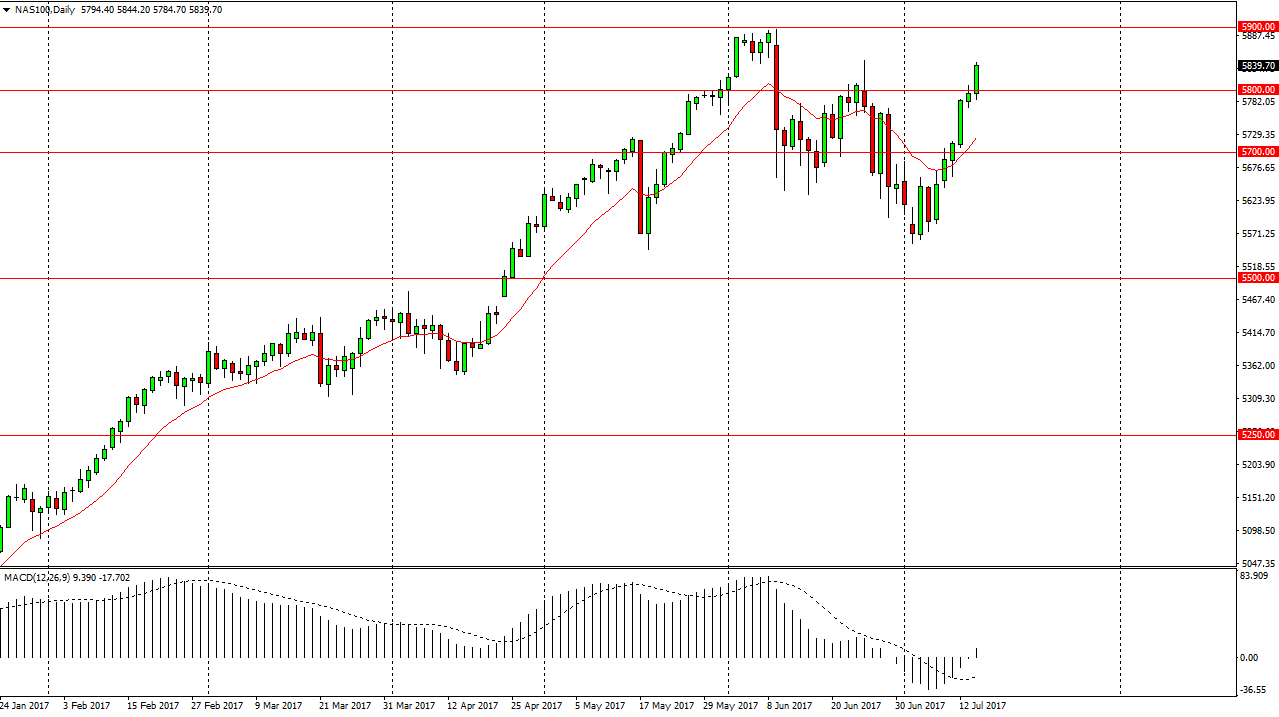

NASDAQ 100

The NASDAQ 100 broke above the 5800 level, which of course was massive resistance. Now that we have broken above there, and more importantly, close at the very top of the candle. Because of this, I think it’s only a matter of time before reach towards the 5900 level. That’s an area that has been massively resistive, but I do think that were to break above it now that the US dollar has been falling significantly. The Federal Reserve looking a little less hawkish of course does a lot for stock markets, so that being the case it’s likely that value hunters will return every time we pull back. I think longer-term, we should then go looking towards the 6000 handle above which is a much more psychologically important level.

We might get volatility, but I still believe that the market is one that you can short. The last several sessions have been massively bullish, as we have seen a resurgence of the strength in the market. Stock markets in general look very strong.