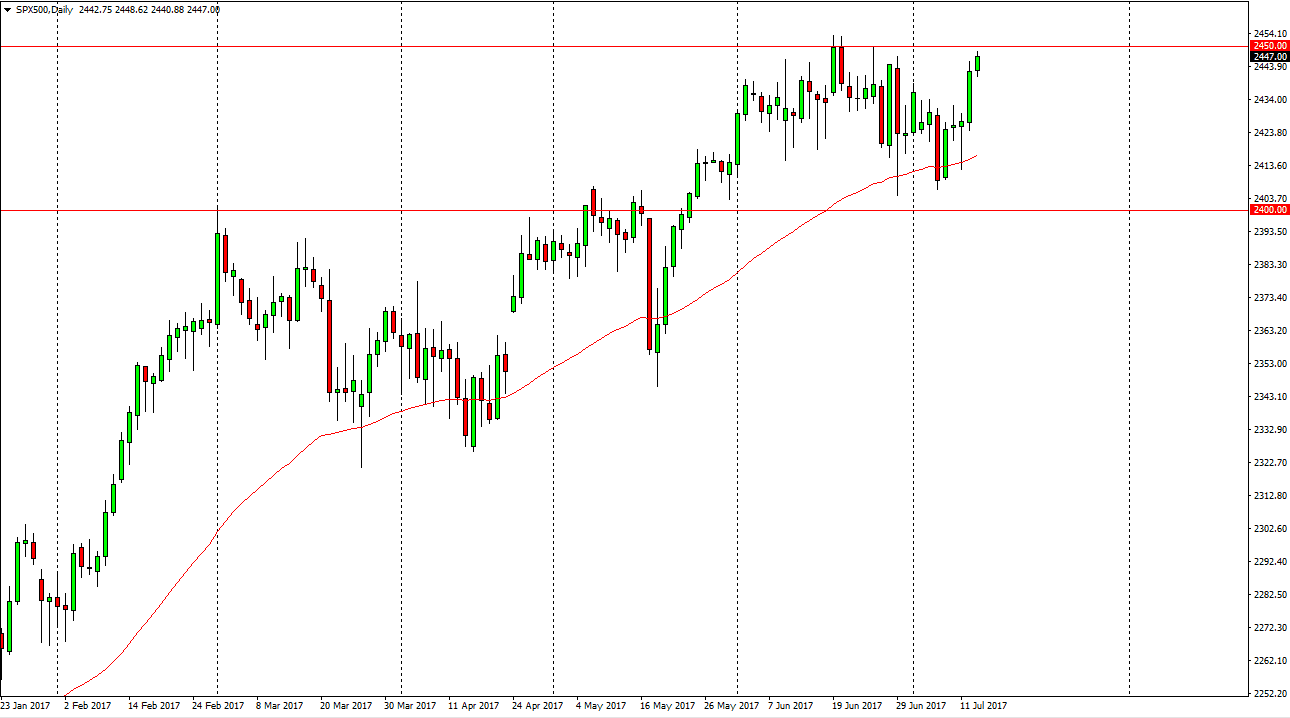

S&P 500

The S&P 500 rallied slightly during the day on Thursday, testing the 2450 handle. The 2450 handle is massively resistive as it was the previous high in the market, and as a result I think if we can break above there the market will continue to go much higher. Pullbacks will be supported dynamically by the 50-day exponential moving average, marked in red on the chart. I believe that the bottom of the uptrend is at the 2400 level at the very least, so if we can stay above there I am a buyer of this market. However, what I would prefer to see is a break above the 2450 handle, that should signal that the market is ready to go towards the 2500 level above. Ultimately, this market remains a “buy on the dips” situation, as we continue to see volatility, but most certainly a significant amount of bullish pressure.

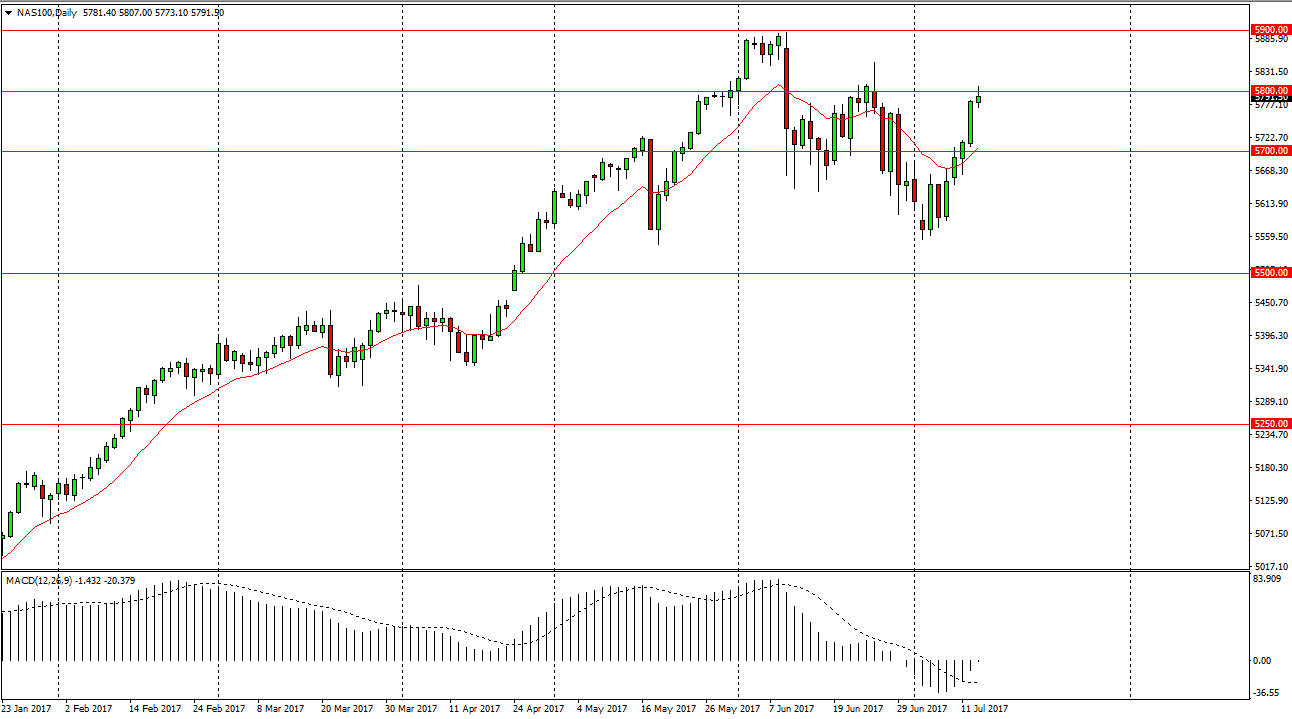

NASDAQ 100

The NASDAQ 100 struggle a bit during the day on Thursday as we went higher, but could not close above the 5800 level. Because of this, we could get a short term pull back but I think there is plenty of support below, especially near the 5700 level. A break above the top of the daily range for the Thursday session would also be a buying opportunity, as the market should then go to the 5900 level. The NASDAQ 100 has been bullish for months, and this reason pullback could be thought of as a value opportunity. The 5900 level above is the target short-term as far as I can see, and then I think once we break above there the market could then go to the 6000 level. I believe that the 5700 level below is massively supportive.