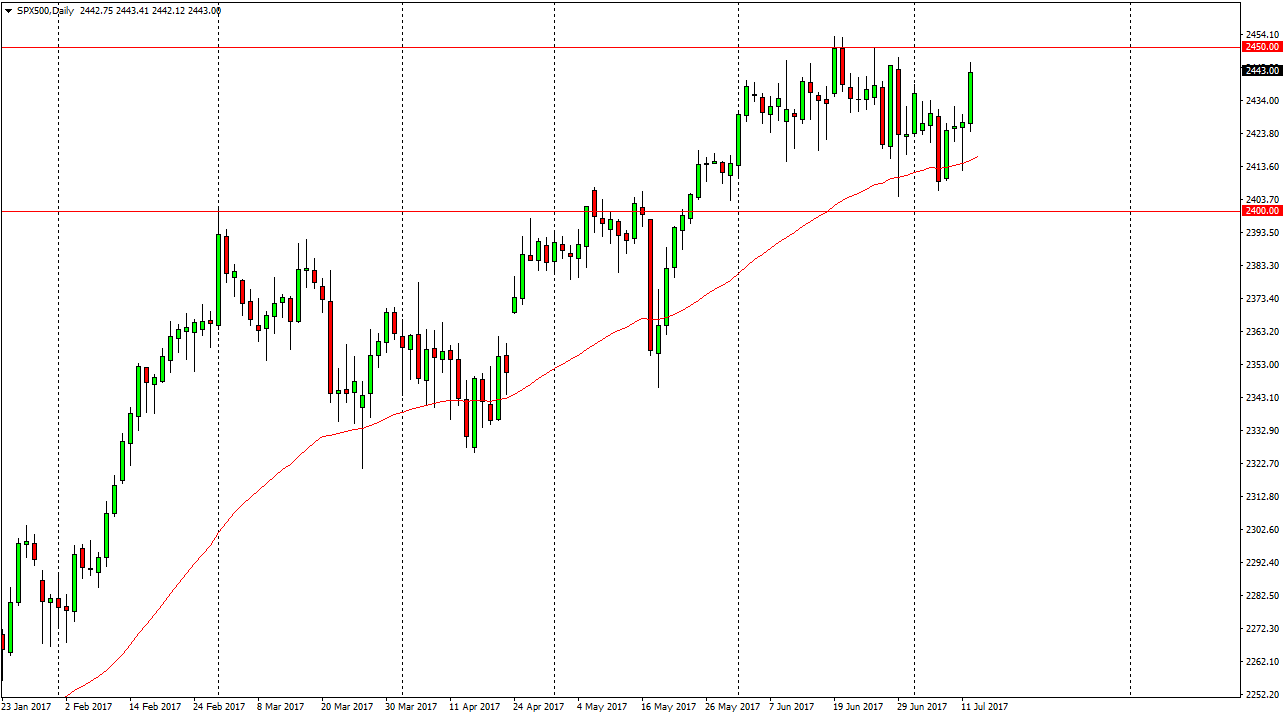

S&P 500

The S&P 500 had a strong showing on Wednesday as the Congressional testimony of Janet Yellen assured traders that although there will be interest rate hikes in the near future, they will be gradual and data dependent, which of course means that the Federal Reserve is very cognizant of how fragile the markets could be. Because of this, it looks as if the S&P 500 is trying to break out, and I believe that the market will look for reasons to try to overcome the 2450 handle. Once we do, the market should then go looking towards the 2500 level which has been my longer-term target for quite some time. When you look at this chart, the 50-day exponential moving average has offered significant support, and at the same time you can make an argument for an uptrend in channel, both of which are very bullish.

NASDAQ 100

The NASDAQ 100 also broke higher during the Wednesday session, and for very similar reasons. Ultimately, this is a market that I think is going to go looking for the 5800 level immediately, and then the 5900 level which was massive resistance in the past. I think once we break above there, the market then goes looking for 6000. Pullbacks continue to be an opportunity to pick up value, and I think that people will continue to look at it as such. With this in mind, I am a buyer of dips until we break below the 5560 handle. Until then, I suspect that the buyers are going to continue to jump on this market every time it pulls back as I think that the longer-term lead that the NASDAQ 100 has had in the US indices should continue. Ultimately, I have no interest in shorting until the breakdown happens.