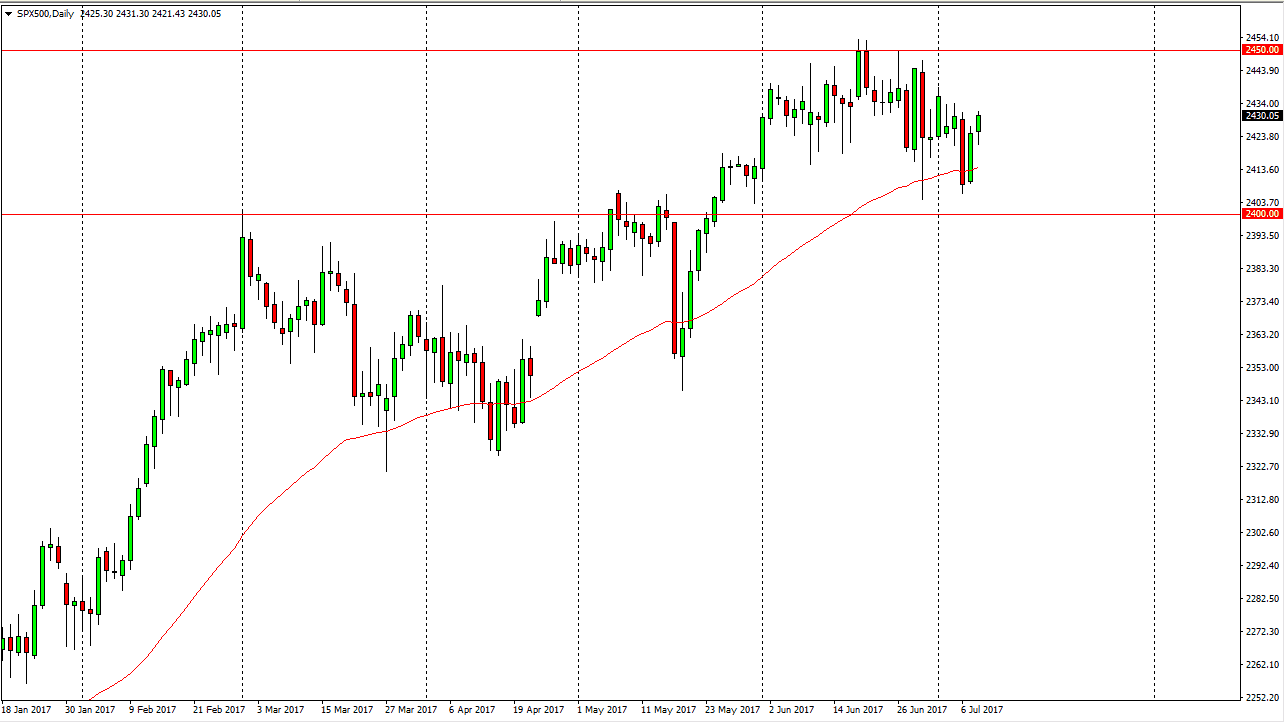

S&P 500

The S&P 500 initially fell on Monday, but found enough support underneath to bounce and reach towards the 2430 level. The market looks likely to continue to grind to the upside, perhaps trying to reach towards the 2450 handle above. A break above that level would send this market to the 2500 level, which is my longer-term target. This market continues to be one that find support every time it falls, so with this being the case it’s likely that buyers will return repeatedly. Because of this, the market will probably be very volatile, but I still believe that the upward momentum and bullish pressure will continue. The 2400 level should be massively supportive and essentially a “floor” in the market.

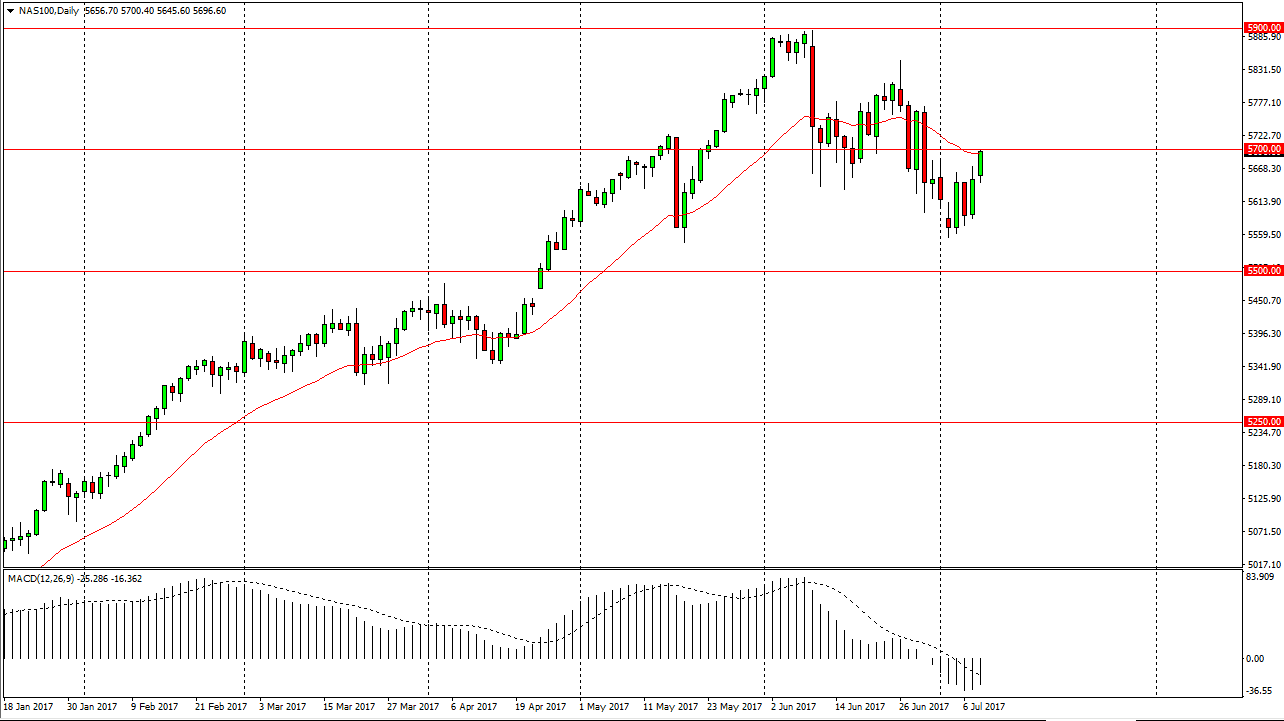

NASDAQ 100

The NASDAQ 100 rallied on Monday, testing the 5700 level. If we can break above there, the market should continue to go much higher, as we have had a nice pullback. The NASDAQ 100 has been very bullish, and I believe that we will eventually go to 5900 if we can get the break out. Otherwise, we may pull back in and continue to grind lower in slow motion. The 5500-level underneath is massively supportive, and I believe that the uptrend is still very much intact if we can stay above that level. If we don’t, things will get very bad for the NASDAQ 100, and it could send the rest the US stock markets lower as well. My longer-term target has been 6000 for some time, but I don’t think we will get there anytime soon, the volatility and of course the fact that we are in the middle of summer, should continue to work against momentum overall, as it is traditionally a very quiet time of year.