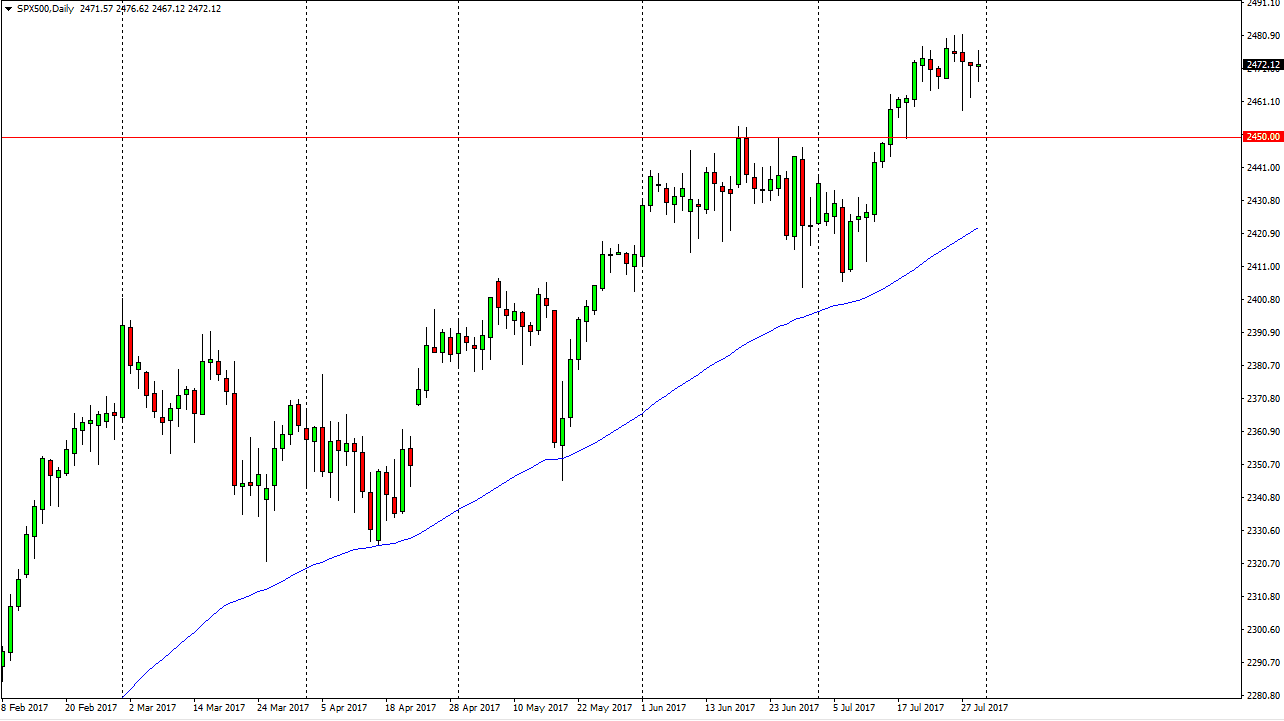

S&P 500

The S&P 500 had a volatile and choppy session on Monday as we essentially went nowhere. The back and forth action shows a marketplace that is going through earnings season, and of course may be trying to catch his breath after we initially had seen so much bullish pressure over the course of the month. I believe the pullbacks continue to find buyers though, and I also think that the 2450 handle below is the “floor.” Eventually, I expect to see this market go looking for the 2500 level above, which should be a bit of a target and ceiling. I like this market, but I recognize that we need to calm down, and perhaps catch our collective breath in this general vicinity.

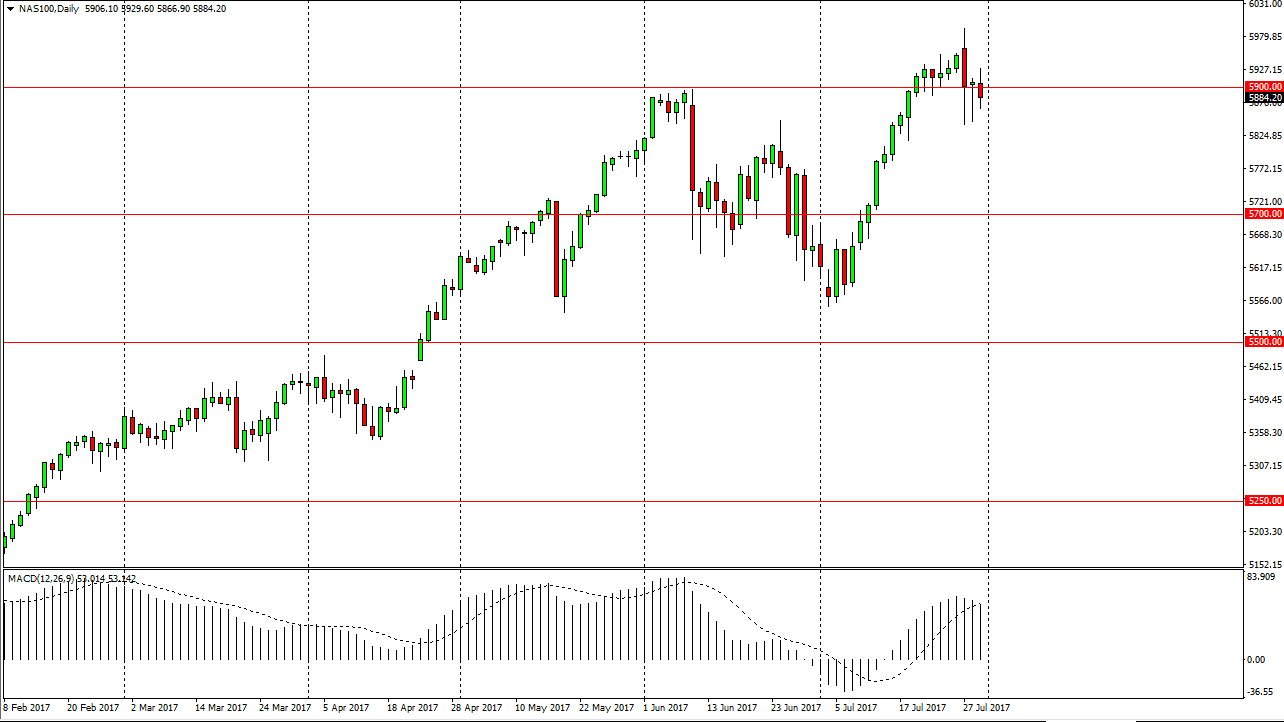

NASDAQ 100

The NASDAQ 100 initially tried to rally, but then fell through the 5900 level. I think there is more than enough support underneath to keep the market going higher though, especially after the most recent significant bounce that we have seen. I think that pullbacks offer buying opportunities, just as a break above the top of the candle from the Monday session would be. I still believe there were going to try to get towards the 6000 handle, which would be a significant barrier and target. A break above there census market more to a “buy-and-hold” stance again. I believe that buying dips continues to be the best way to play this market, as we have seen so much in the way of bullish pressure. The 5700 level below should be the absolute “floor” in the market, and I would be stunned to see this market break down below there. In the meantime, patiently waiting for dips that offer value will probably be the best way to play this market.