Like the case in the previous technical analysis, we still expect that any gains for the pound will be a new sell opportunity. This time it is going to be from the unexpected announcement of a pullback in UK inflation rates, which threatens the Bank of England efforts to tighten its monetary policies.

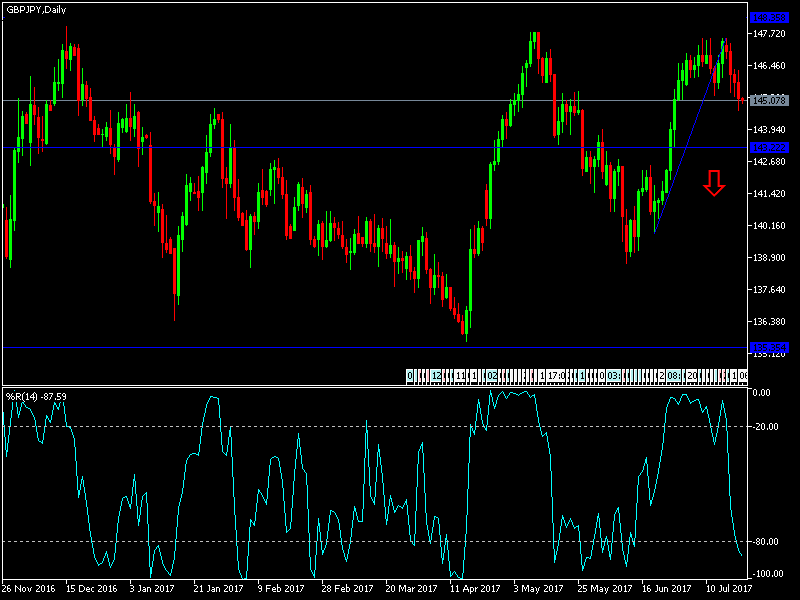

Despite the positive Retail Sales data from the UK, which came stronger than expected, the markets ignored that and focused on the negativity of the UK inflation. The GBP/JPY fell down to the support at 144.70 level during yesterday’s trading session before settling around 145.10 in the beginning of Friday’s trades.

The GBP/JPY pair has been trying for three sessions in a row to break through the resistance at 147.60, to have a stronger chance of making more gains to guarantee reaching the psychologically important peak at 150.00. These expectations will be facing the risk appetite tendencies as well as the worry of expectations of tough negotiations between the UK and the EU on the BREXIT issue, in light of the EU taking advantage of the political worries in the UK to come out with a deal giving them stronger gains. On the H4 chart, the GBP/JPY is still in need of more push to avoid fears facing the pound of the consequences of the political worries in the UK, and the expectations of a harder BREXIT negotiations.

The pair will not strongly supported by anything aside from the increased risk appetite, as well as better expectations of closer monetary tightening from Bank of England, and the ease on BREXIT negotiation fears. If the pair successfully managed to move towards the 150 peak, then it will confirm the power of the upward bounce, but reaching that peak is going to face challenges of trust in the performance and future of the pound itself, as well as the renewed global geopolitical fears at any time. The variance job data from the UK reduced the trust in the pound.

Technically: If the GBP/JPY managed to move below 146 level, then the pressure will mount on the pair towards stronger bearish areas like 145.30, 144.60 and 144.00 in a raw. On the bullish side, if the pair managed to settle above the resistance at the 147.00 level, then it could move again towards peaks like 147.77 and 148.50 after that, and then the psychologically important 150 peak.

On the economic data today: This pair is not expecting any Japanese or British data today, and with the conclusion of this week’s trades. The pair’s moves are going to be dominated by the market sentiments towards the Bank of Japan policies and the latest British Economic Data. Save Heaven assets led by the Japanese Yen will monitor any negative reactions in case of renewed global geopolitical fears.