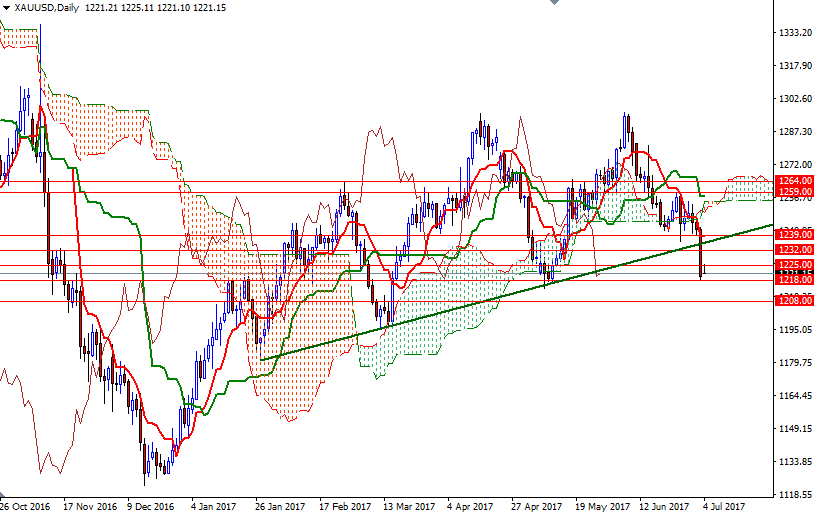

Gold prices dropped nearly 1.8% on Monday to settle at their lowest level since May 10 as the dollar firmed after stronger-than-expected manufacturing data bolstered confidence in the US economy. The XAU/USD pair fell sharply and retreated to the 1218 leve as expected after breaking below the key 1232/0 area generated extra pressure and triggered a sell-off. The market is trying to get back above the 1225 level, but it appears that sellers are stepping in again.

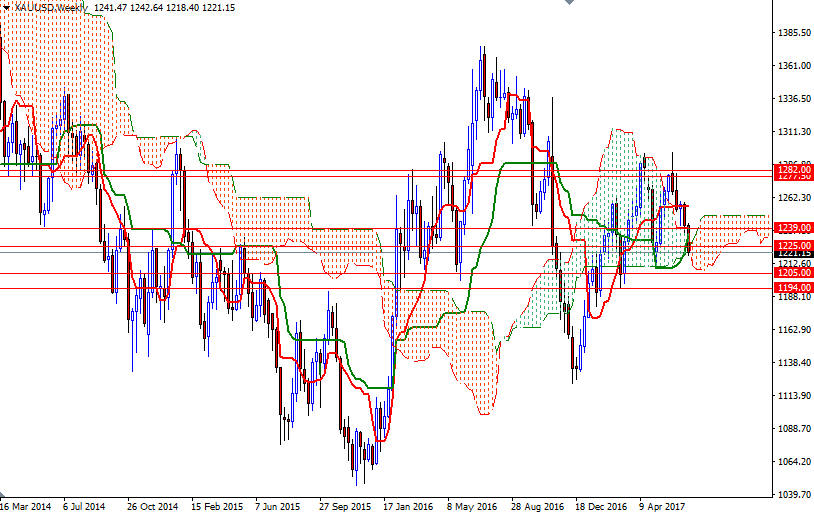

Investors will be looking ahead to key data later this week on jobs and the minutes from the Federal Reserve’s June 13-14 meeting. From a chart perspective, invalidating the medium term line that the market was following is a negative sign as it opens up the risk of a move to the bottom of the weekly Ichimoku cloud. The market is trading below the daily and 4-hourly clouds and we have negatively aligned Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) crosses. The daily Chikou span (closing price plotted 26 periods behind, brown line), which dropped below the cloud last week, also indicates there is further downside risk.

However, it would not be surprising if we have made short-term bottom above 1218 for a rebound to the 1232/0 zone or the broken trend line. Beyond there the first solid resistance is located in 1240/39. If the bearishness continues and the bears defend their camp around 1227/5, keep an eye on the 1218/5 support. Breaking below 1215 would indicate that the 1208/5 area might be the next port of call. A daily close beyond 1205 would prolong the bearish momentum and open a path to 1196/4.