Gold prices ended Thursday’s session down $1.57, pressured by the dollar’s bounce on better-than-expected U.S. economic data. XAU/USD tested the support at $1255 after a report from the Commerce Department showed demand for durable goods jumped 6.5% in July. Investors will be looking ahead to the U.S. Q2 advance gross domestic product report due out later today.

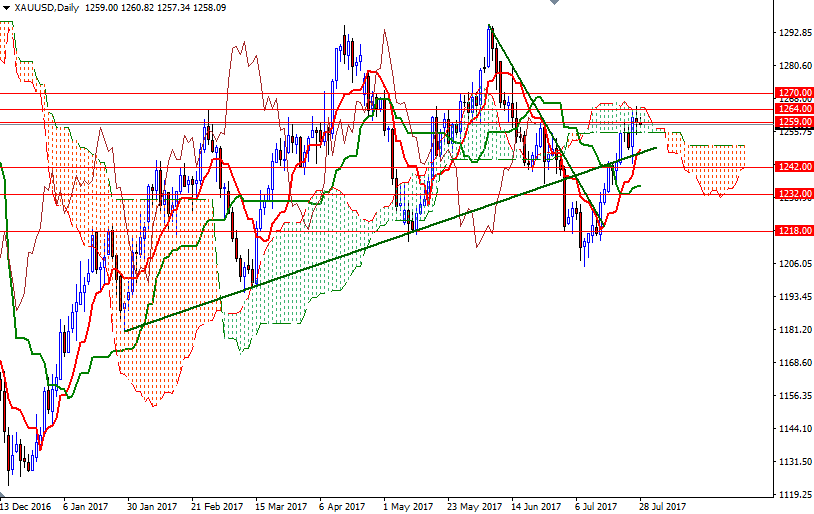

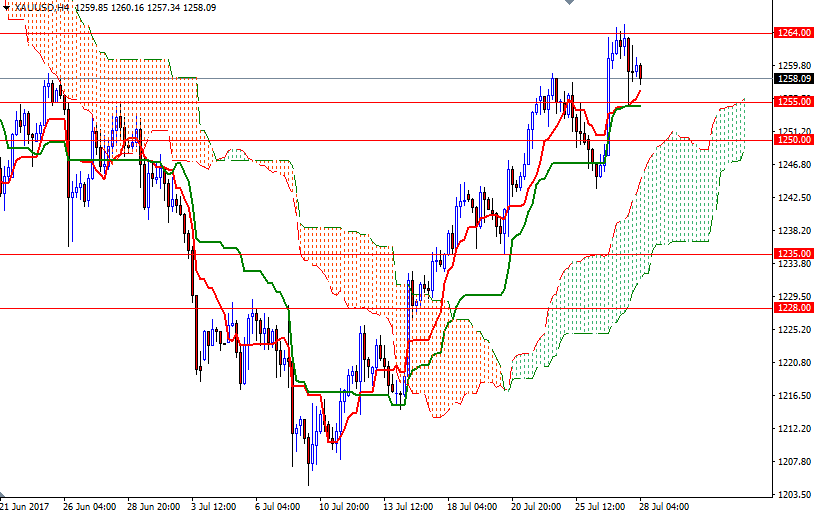

XAU/USD is trading above the Ichimoku clouds on the weekly and the 4-hourly charts. We have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on both the daily and 4-hourly charts, along with Chikou Span/Price crosses in the same direction. All these suggest that the bulls still have the near-term technical advantage. However, as I emphasized earlier in the week, the upside potential will be limited until the market breaches the 1264 level, the top of the Ichimoku cloud.

If this resistance is broken, then 1270 will be the next stop. The bulls will have to push the market convincingly beyond 1270 to gather momentum for 1282-1277.50. On the other hand, if the bears increase pressure and prices break down below 1255 (and take out yesterday’s low), we will probably revisit the support at 1250, the top of the 4-hurly cloud. A decline below 1250 could trigger further weakness and open a path to 1246.