The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 9th July 2017

Last week, I saw the best possible trades for the coming week as long EUR/USD and long GBP/USD. The results here would have been negative overall, with the EUR/USD falling slightly, by 0.15%, and the GBP/USD falling by more, at 1.09%. This would have produced an overall average negative result of -0.62%.

The Forex market is now in a more settled mood, with a re-emergence of clear trends, although the U.S. Dollar gained some ground on Friday following the release of a reasonably strong Non-Farm Payrolls number. There is more important input expected this week from major central banks, most notably the Federal Reserve with Janet Yellen’s testimony before the Senate Banking committee, as well as the Bank of Canada’s monthly report. I forecast that the best trade this week will be long EUR/JPY and CAD/JPY.

Fundamental Analysis & Market Sentiment

The major element affecting market sentiment at present are a view that almost all major central banks have now indicated they are on courses of tightening monetary policy, with the notable exception of the Bank of Japan. Although the Federal Reserve was the first major central bank to turn towards a tighter policy, its actions are now being overshadowed. There is a slightly more bullish outlook on the U.S. Dollar. The Canadian Dollar remains strong, with increased speculation that the Bank of Canada will raise its interest rate later this week, and the Japanese Yen weak. There is a report that the Bank of Japan will hold off on further monetary easing, but the market may take this as an admission of weakness rather than as a prompt to buy the Yen.

Technical Analysis

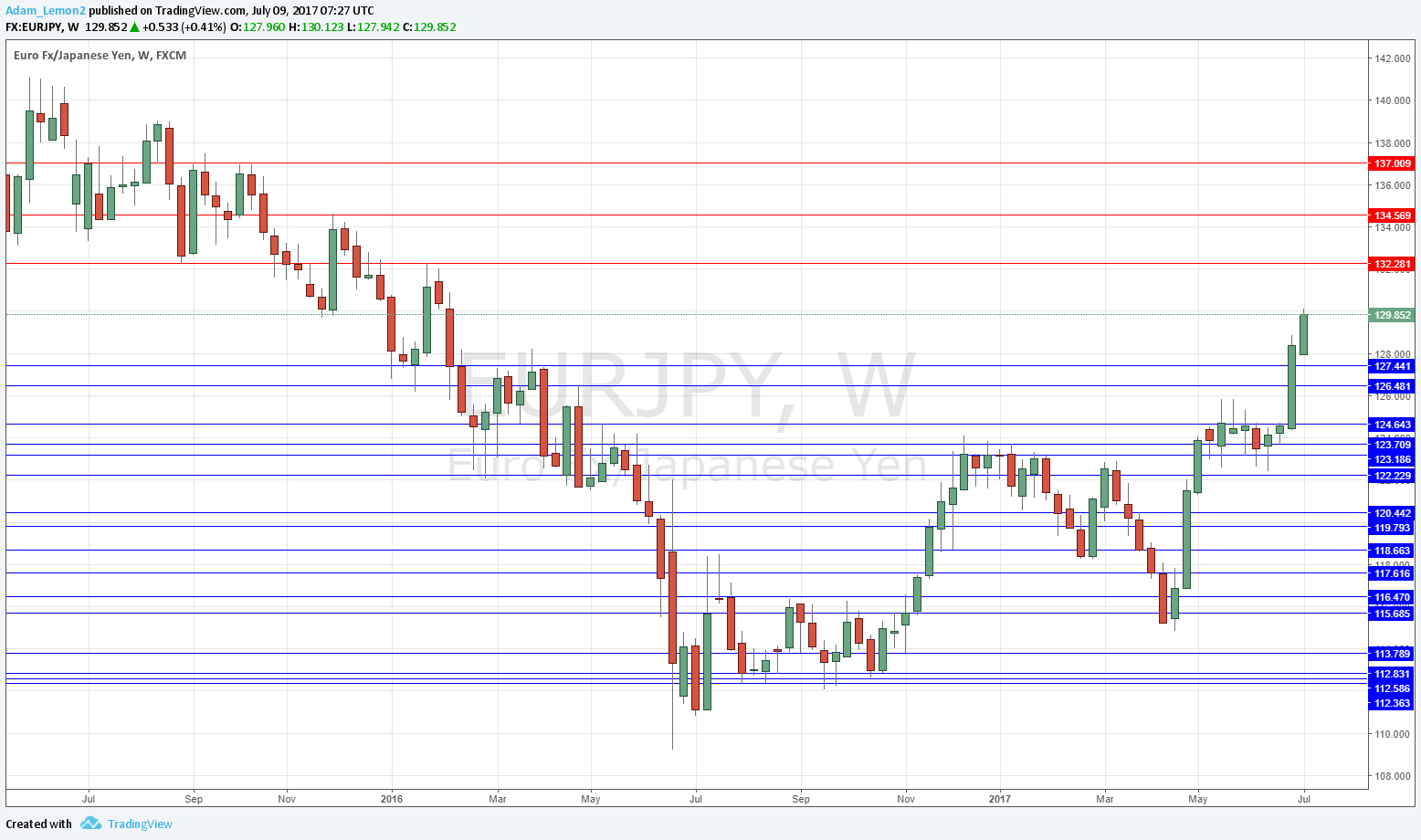

EUR/JPY

This pair printed a very strongly bullish candlestick, closing near its high and making a new 5-month high price. There is a clear long-term bullish trend and the price is trading in “blue sky”. There is no key resistance until 132.28 so the price has plenty of room to rise further. However, the price of the EUR/USD currency pair does face a key resistant trend line at 1.1440 which may prevent the EUR from advancing much further.

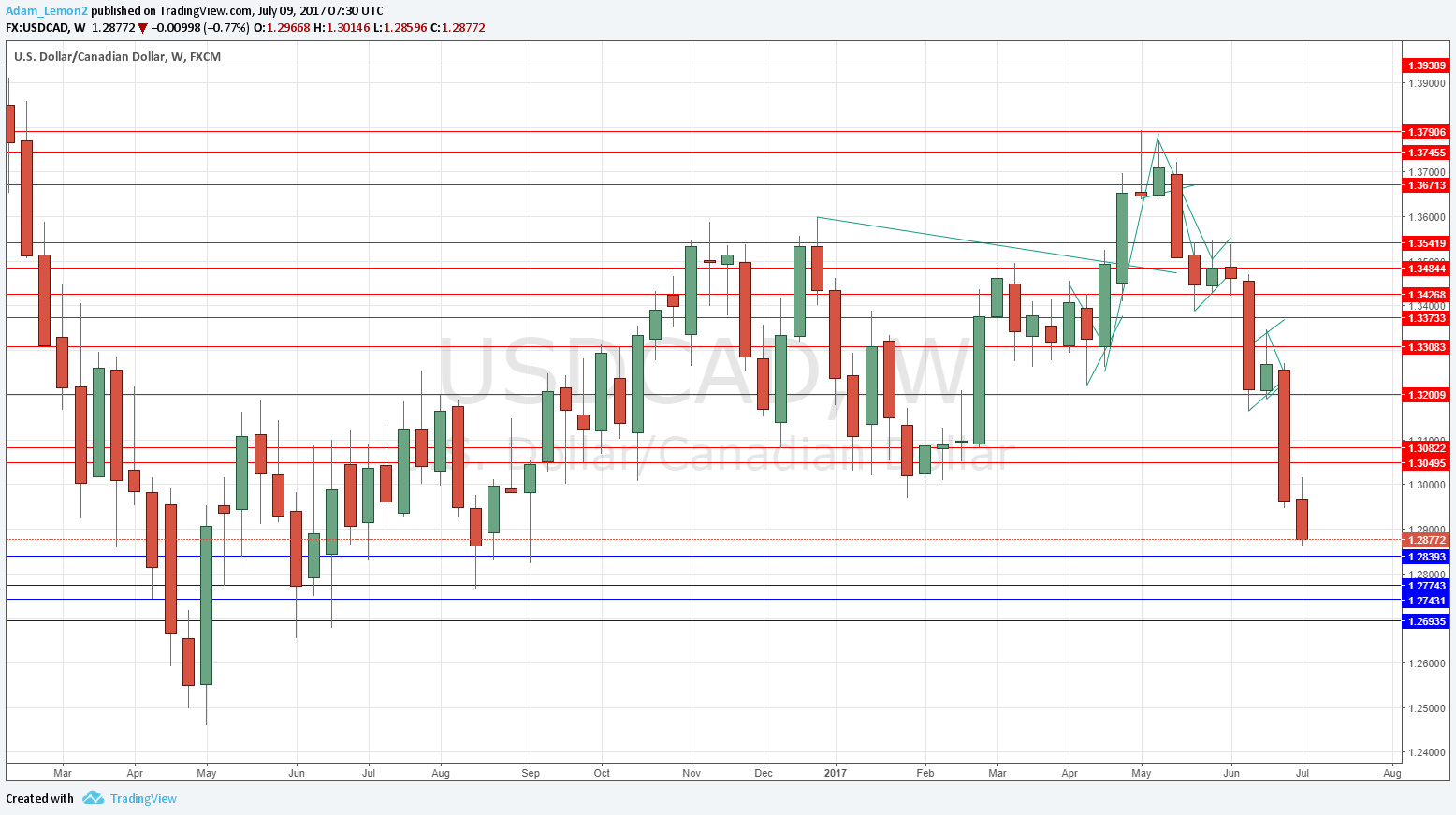

CAD/JPY

As this cross has little direct trade, it is preferable to analyze its components USD/CAD and USD/JPY. Let’s first examine the USD/CAD currency pair, with the chart presented below. This pair printed a very strongly bearish candlestick, closing near its high and making a new 10-low high price. There is a clear long-term bearish trend and the price is trading in “blue sky”. However, there is key resistance at 1.2839 so the pair may not have a great deal of room to fall further over the short term.

USD/JPY

The USD/JPY chart below shows that this pair printed a strongly bullish candlestick, closing near its high and breaking up past a long-term bearish trend line. There is now a bullish bias over the longer term. However, there is key resistance at 114.08 and above at the key psychological area of 115.00, so the pair may not have a great deal of room to rise further over the short term.

Conclusion

Bullish on the Euro and Canadian Dollar; bearish on the Japanese Yen.