The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 30th July 2017

Last week, I saw the best possible trades for the coming week as long EUR/USD and NZD/USD, and short USD/CAD. Each of these components were profitable: the EUR/USD rose by 0.74%, the NZD/USD rose by 0.79%, and the USD/CAD fell by 0.84%, producing an overall positive averaged winning result of 0.79%.

The Forex market remains in a settled mood, with a re-emergence of clear trends, and breakouts into multi-month or even multi-year highs in several Forex pairs, all against the U.S. Dollar. This comes as sentiment continues to be sour on the U.S. Dollar following more dovish than expected testimony from the FOMC on U.S. inflation prospects, making rate hikes less likely, and weak U.S. economic data releases, as well as the increasingly shaky position politically of the U.S. Presidency.

This week I forecast that the highest probability trades will be long of the Dow Jones 30 Index, the British Pound, and the Canadian and Australian Dollars, and short of the U.S. Dollar. These are currently the best-performing assets against the weak U.S. Dollar.

Fundamental Analysis & Market Sentiment

The major element affecting market sentiment at present is the view that almost all major central banks have now indicated they are on courses of tightening monetary policy, but with much more pessimism concerning the U.S. Dollar as the Federal Reserve has now signaled a slower pace of monetary tightening. This has left the U.S. Dollar with clear weakness in the Forex market, which has been reinforced by recent weak economic data which boosted the dovish case. Crucially, this week we will see key Non-Farm Payrolls data, which should affect sentiment concerning the greenback. As the Dollar is in a clear and strong bearish trend, it could be wise to expect that an “accident happens along the line of least resistance”, justifying a short USD position in advance.

The Canadian Dollar has been particularly strong this week following a quarter-point rate hike by the Bank of Canada three weeks ago, while the Down Jones 30 Index, the Euro, and the New Zealand and Australian Dollars have all printed new multi-year highs over the past week.

It should also be noted that the British Pound is increasingly strong, and has almost recovered its entire decline over the past year.

Technical Analysis

U.S. Dollar Index

This pair printed another strongly bearish candlestick, closing not far from its low and making a new 10-month low price. There is a clear long-term bearish trend and the price has carved out new resistance above, while closely following a dominant bearish trend line. Furthermore, the former key support level at 12012 has been decisively broken, and there are no obvious support levels anywhere nearby.

Dow Jones 30 Index

This pair printed a strongly bullish candlestick, closing extremely close to its high and making a new all-time high price. There is a clear long-term bullish trend and the price is trading in “blue sky”. There are no obvious obstacles ahead to a further advance whatsoever.

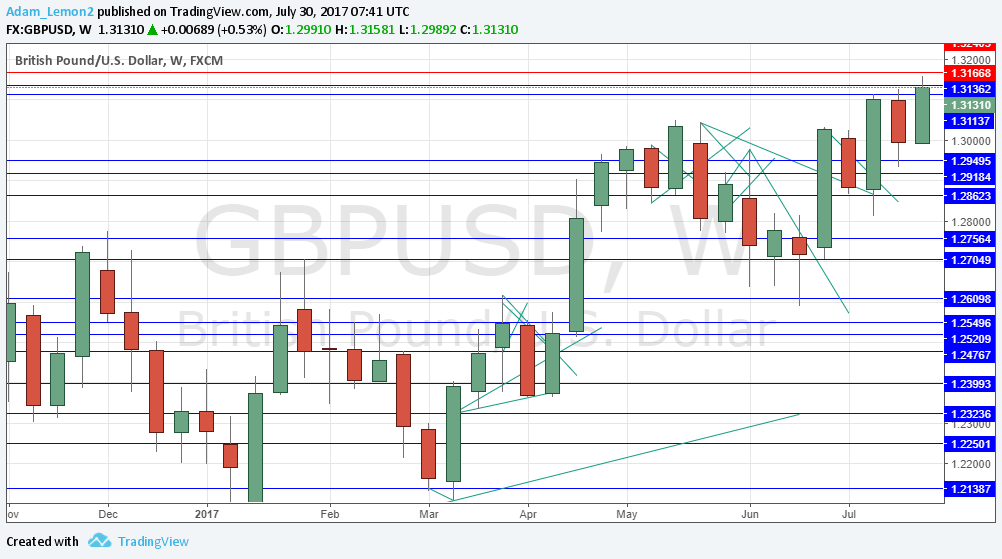

GBP/USD

This pair printed a strong bullish engulfing candlestick, closing near its high and making a new 10-month high price. There is a long-term bullish trend and the price is trading in “blue sky”. However, there is a key resistance level just ahead at 1.3169 which may act as resistance and prevent the price from rising much further, at least over the short-term. Additionally, the long-term trend, while bullish, is slow with many pull-backs.

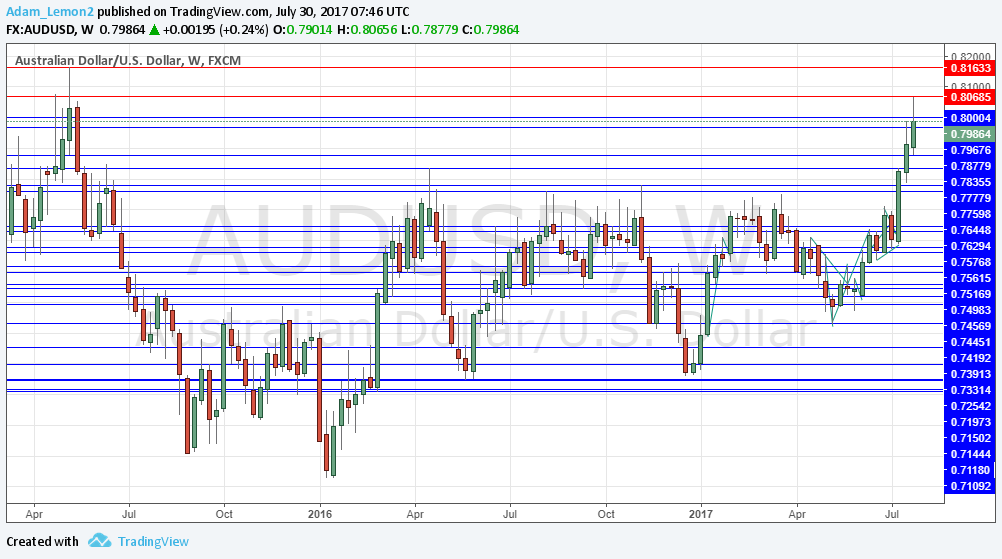

AUD/USD

This pair printed a bullish candlestick, although it made a noticeable wick at its high. A new 2-year high price was made. There is a long-term bullish trend and the price is trading in “blue sky”. There is no obvious resistance ahead below the 0.8069 area, so this upwards movement looks as if it has further to run in the near term.

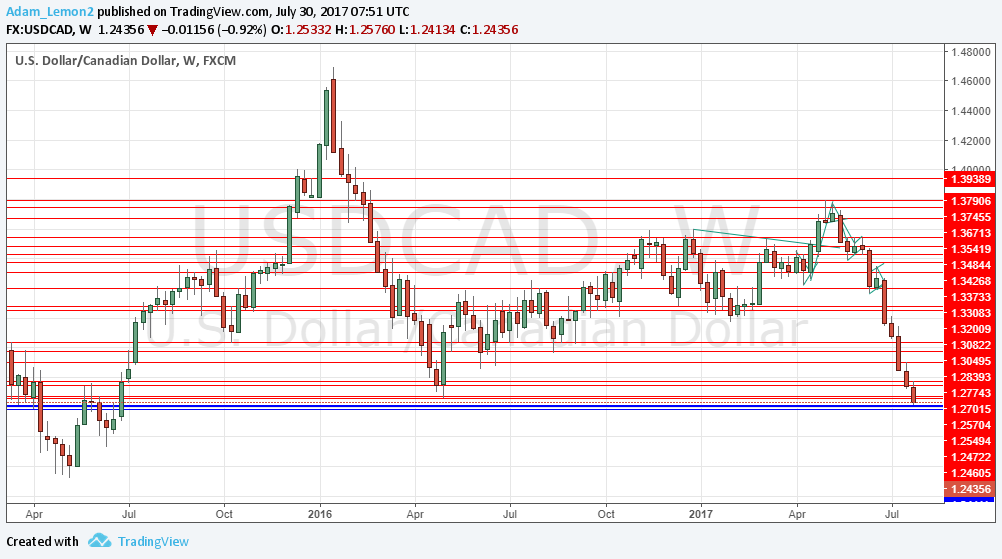

USD/CAD

This pair printed another strong bearish candlestick, closing right on its low and making a new 2-year low price. There is a clear long-term bearish trend with the movement of the past few weeks being of good bearish quality. The price is trading in “blue sky”. However, there are some support levels not far away which may act as support and prevent the price from falling much further, at least over the short-term. Despite these, it looks as if 1.2250 could be reached in the foreseeable future.

Conclusion

Bullish on the Dow Jones 30 Index, the British Pound, Australian and Canadian Dollars; bearish on the U.S. Dollar.