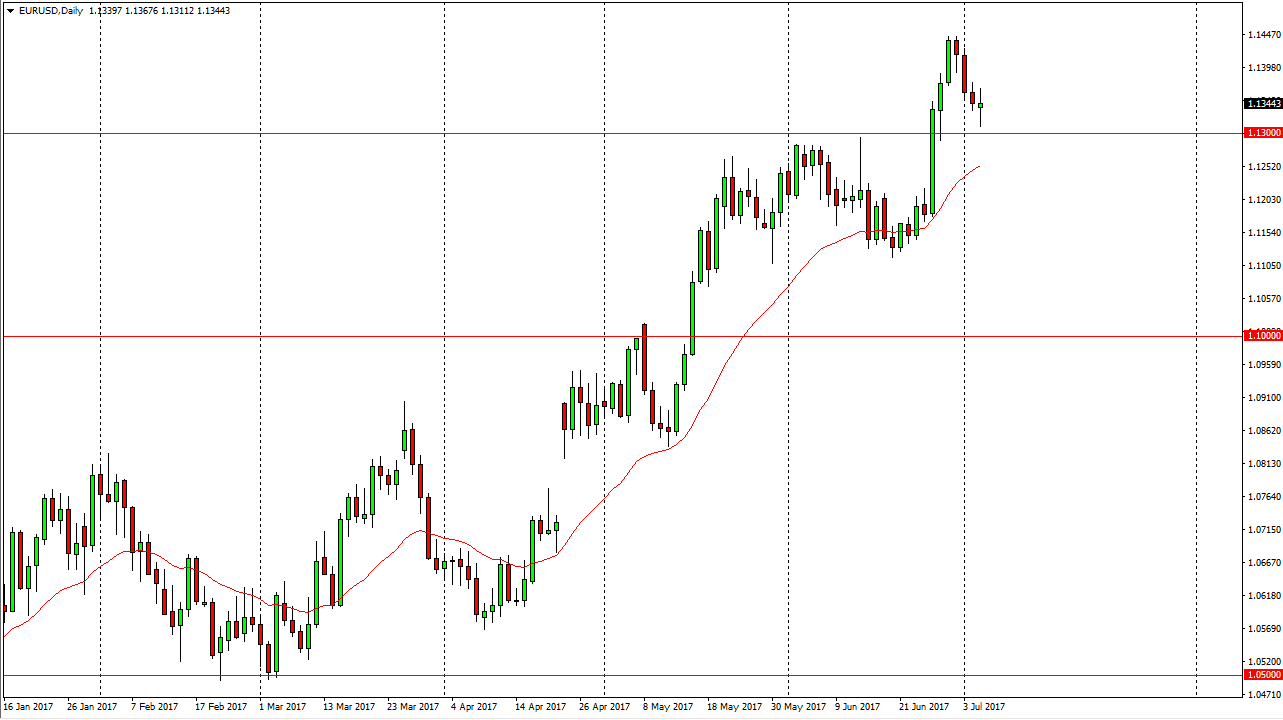

EUR/USD

The EUR/USD pair had a volatile session on Wednesday, as we awaited the FOMC Meeting Minutes. The 1.13 level has offered support, and it now looks as if the market is ready to turn around and go looking towards the 1.14 level above. I think if we can finally break above the 1.15 level, the EUR/USD pair will grind its way towards the 118 handle. A breakdown below the 1.13 level would be very negative, but I see a significant amount of support underneath, reaching down to the 1.1150 level. The market has been very bullish over the last several months, and I think this latest pullback is simply an opportunity to pick up value yet again.

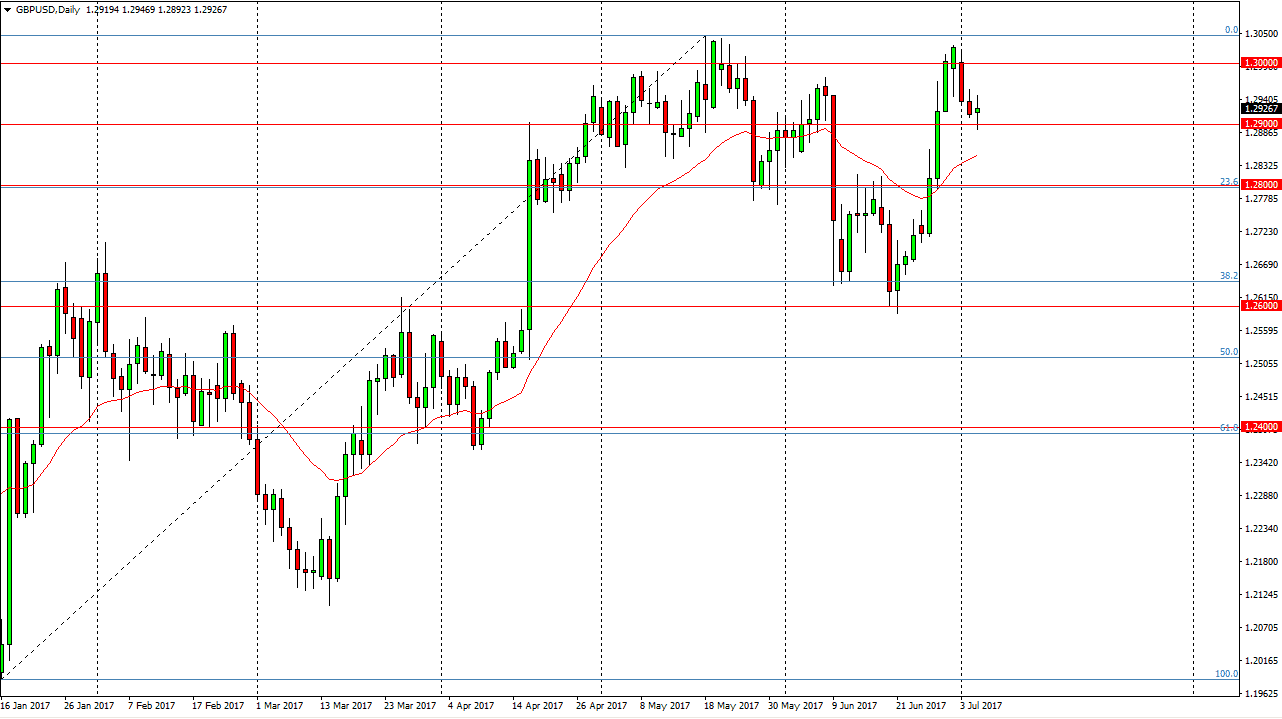

GBP/USD

The British pound went back and forth during the session as well, but found enough support at the 1.29 level to turn around and form a bit of a hammer. Because of this, I am bullish in this market and I recognize that we will probably go hunting the 1.3050 level above. Beyond that, we could go to the 1.3450 level, which would be a very bullish sign. I think that the market is trying to in the longer-term downtrend, but the problem with the British pound is there are so many possibilities as far as headlights crossing the wire that it is difficult to hang onto a large position. I think that short-term buying on the dips is probably the best way to go, eventually building a larger position as the market could take off to the upside. I have no interest in shorting this market, and I believe that the 1.28 level underneath is massively supportive, and keeps the uptrend intact. A breakdown below there since the market racing towards the 1.26 handle. Ultimately, the only thing I think you can truly count on is volatility.