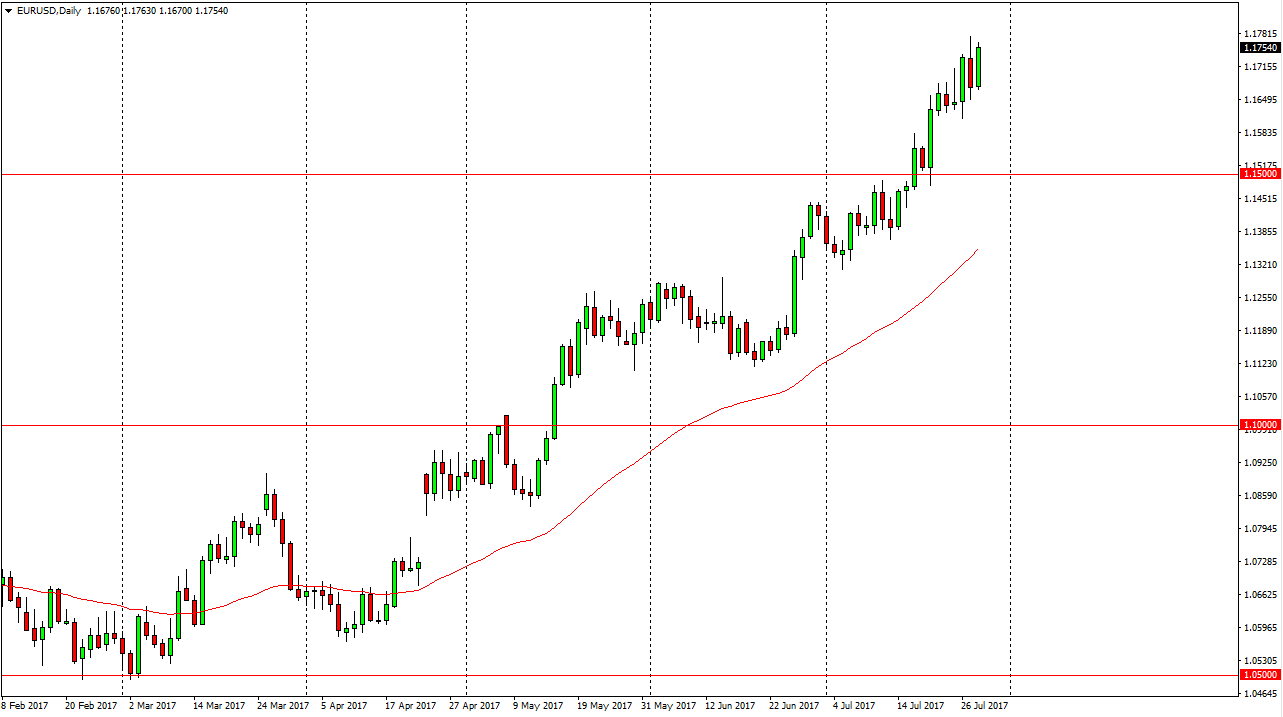

EUR/USD

The EUR/USD pair broke higher during the day on Friday, as we continue to see bullish pressure in the EUR. Ultimately, the market should continue to be bullish, but we are bit overextended. I look at pullbacks as potential buying opportunities, and as a result I think that it is only a matter of time before we reach towards the 1.1850 level above. I believe that the 1.15 level underneath should be essentially a “floor” in the market, and as long as we can stay above there I don’t see the reason to short this market. Every time we pull back, I think that it is only a matter of time before value hunters come back into the marketplace and take advantage of the dips as it has recently made a massive breakout from a 3-year consolidation range.

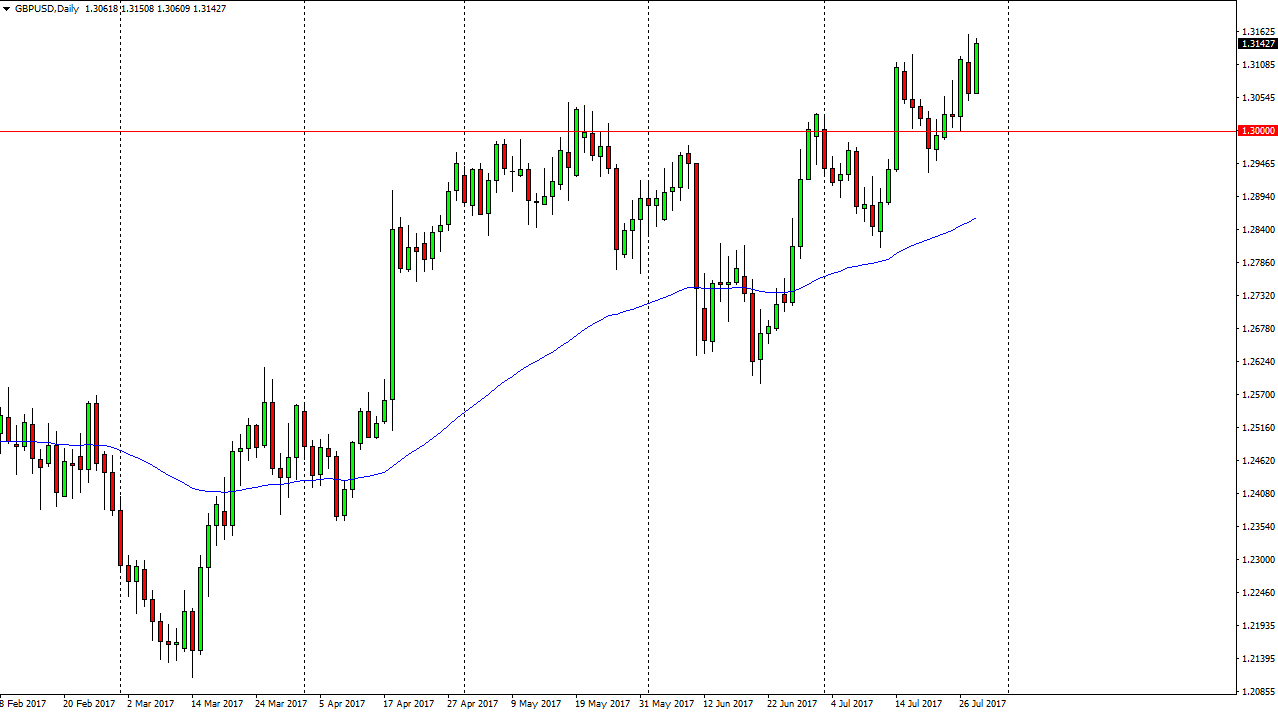

GBP/USD

GBP/USD traders send this market to the upside, reaching towards the 1.3150 level. I think that there is a significant amount of support below the 1.30 level though, so it’s probably only a matter of time before the buyers get involved on dips. I believe that the US dollar will continue to fall in value, due to the Federal Reserve being a bit dovish. Quite frankly, I think that the Federal Reserve will probably raise interest rates will more time this year, but they are going to do it in such a slow manner that they might as well have said interest rate hikes are off the table. I believe that the market should continue to go towards the 1.3450 level above, which is a significant barrier longer term. Pullbacks offer value, and it’s not until we break down below the 1.2850 level that I would consider selling. In the meantime, I think it remains a “buy on the dips” situation.