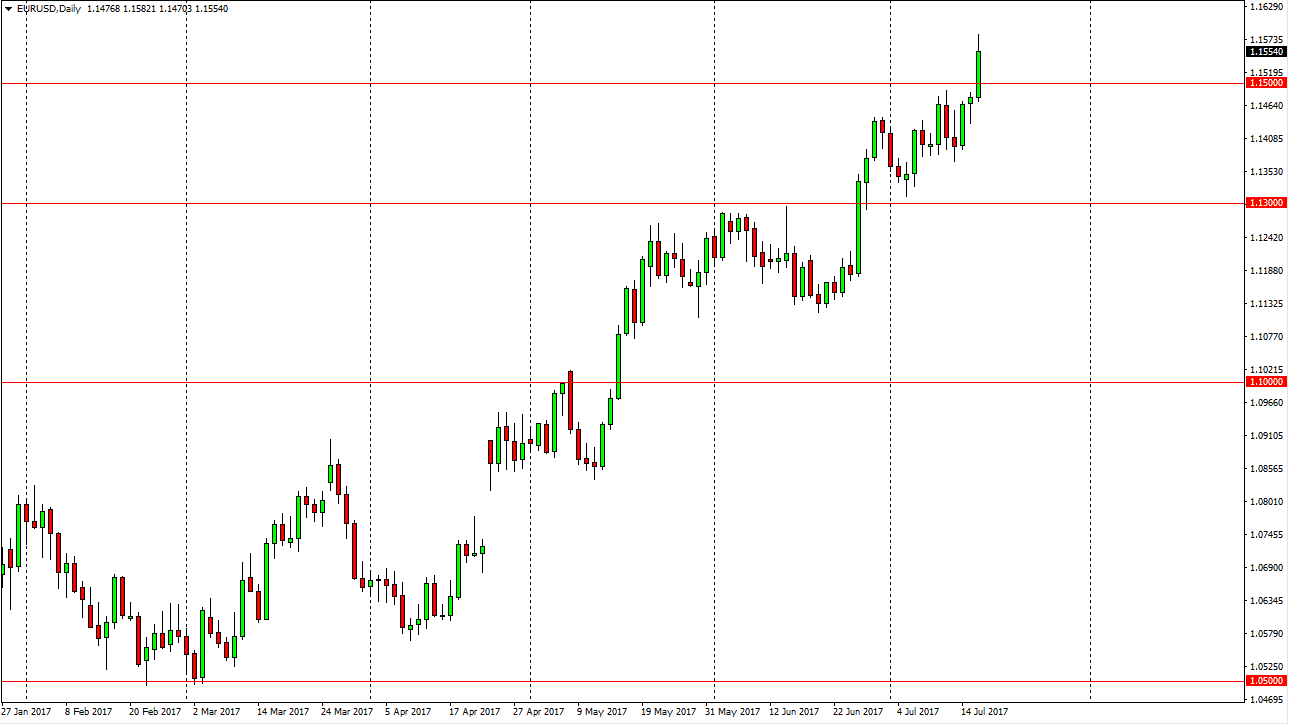

EUR/USD

The EUR/USD pair broke above the 1.15 handle finally, as we showed the market to be very bullish during the day on Tuesday. Because of this, we have broken above the consolidation area that has kept this market under control for over 2 and half years. With that being the case, I believe the pullbacks will continue to attract buyers, and that we will go much higher. If we were to break below the 1.14 level I would become concerned with the uptrend, but I don’t think that’s going to happen, and I believe that value hunters will return to jump into the market. Longer-term, we could be looking at a move to the 1.18 level above, and perhaps even higher than that. I think that the market continues to see upward viability and interest by traders around the world.

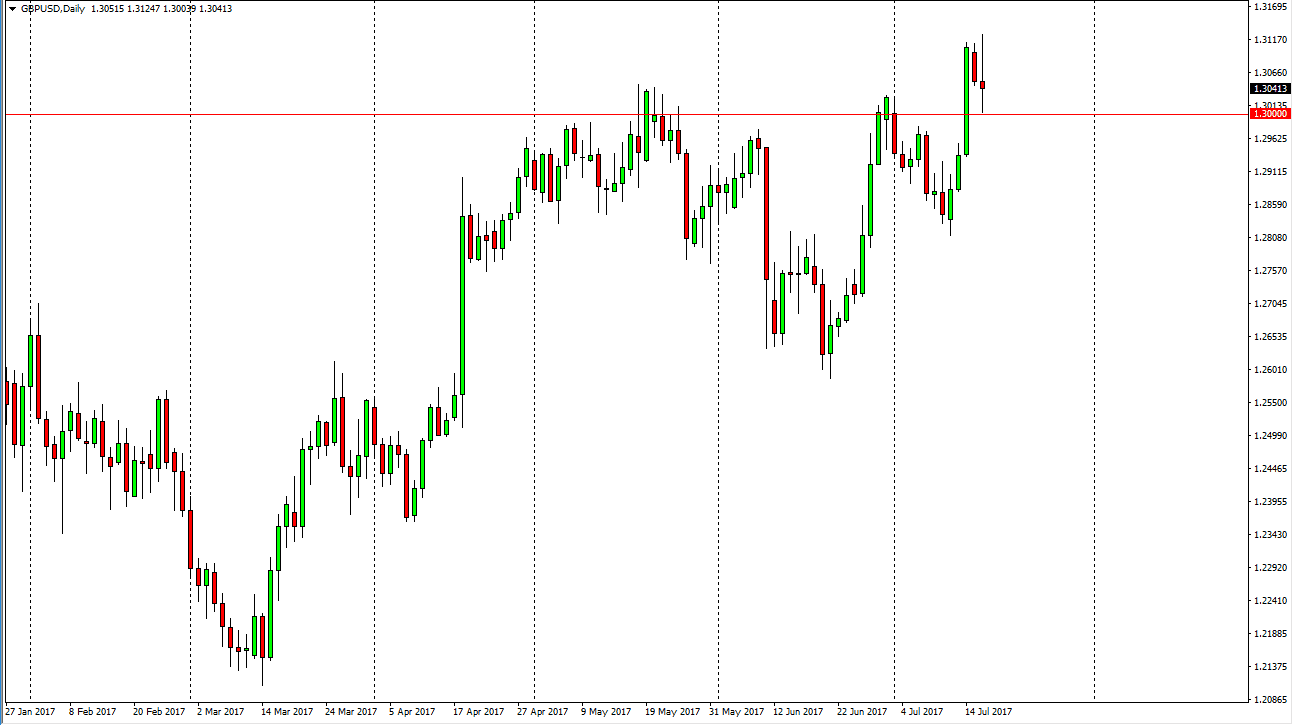

GBP/USD

The British pound went back and forth during the day on Tuesday, as CPI numbers come out much lower than anticipated. This of the market falling all the way to the 1.30 level underneath, but we have bounced significantly since then. Because of this, I believe that the British pound will probably continue to the upside, but we may need to consolidate and build up momentum in the meantime. Short-term pullbacks will probably offer pressure the buyers will be taken advantage of. I believe that the 1.30 level underneath should be massively supportive, so break down below there would have me looking at the market a little more skeptically, so I believe that the next 24 hours will be vital as to where we go next. A break above the top of the range for the session on Tuesday would be a continuation and a confirmation of the buying pressure that should send this market looking towards the 1.3450 level above.