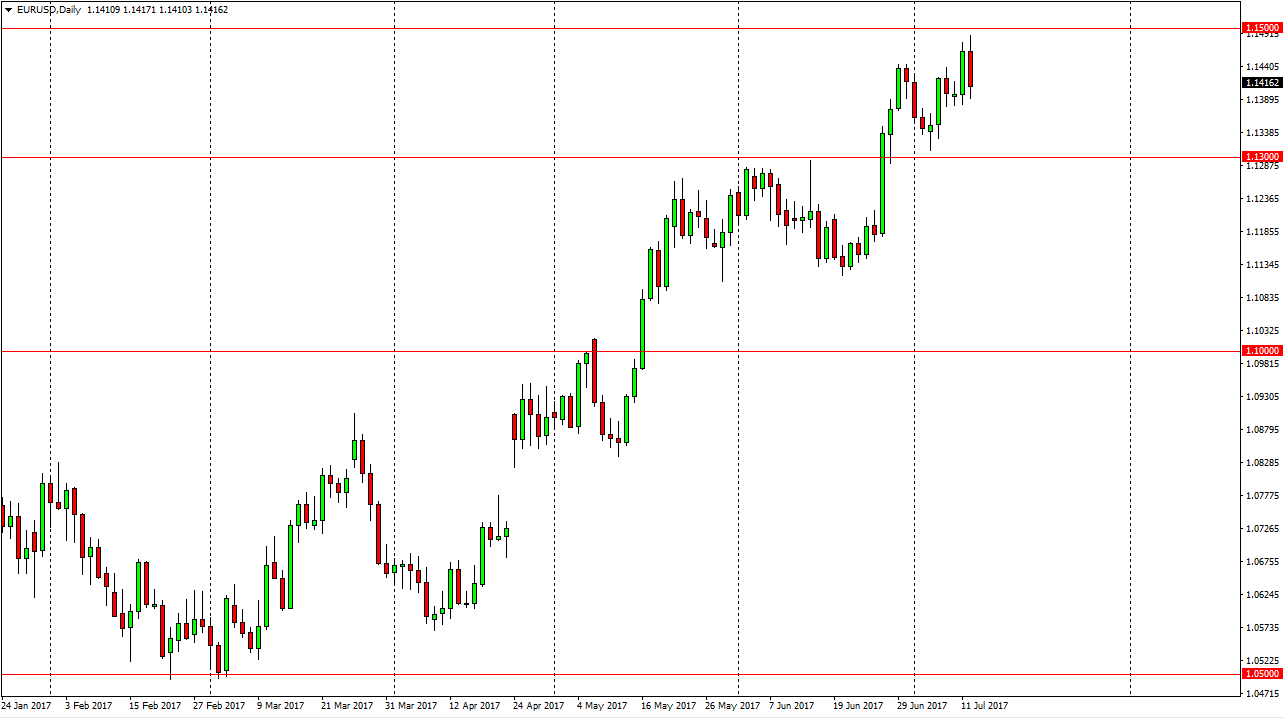

EUR/USD

The EUR/USD pair initially tried to reach at the 1.15 level, but failed. Janet Yellen’s speech in front of Congress was a little less hawkish than expected, although it certainly seems as if the Federal Reserve will raise interest rates. This bit of uncertainty could hamper risk appetite, and with that being the case this pair fell. I think that we are getting a little bit rich in valuation when it comes to the Euro, but the most support think pay attention to in this chart is that the 1.15 level is the top of a three-year consolidation range. I suspect that there is probably more downside risk of an up, but I am the first to admit that if we clear the 1.1550 level, we will have broken out and started reaching towards the 1.18 level. I think that the next couple of trading sessions are going to be crucial in this market.

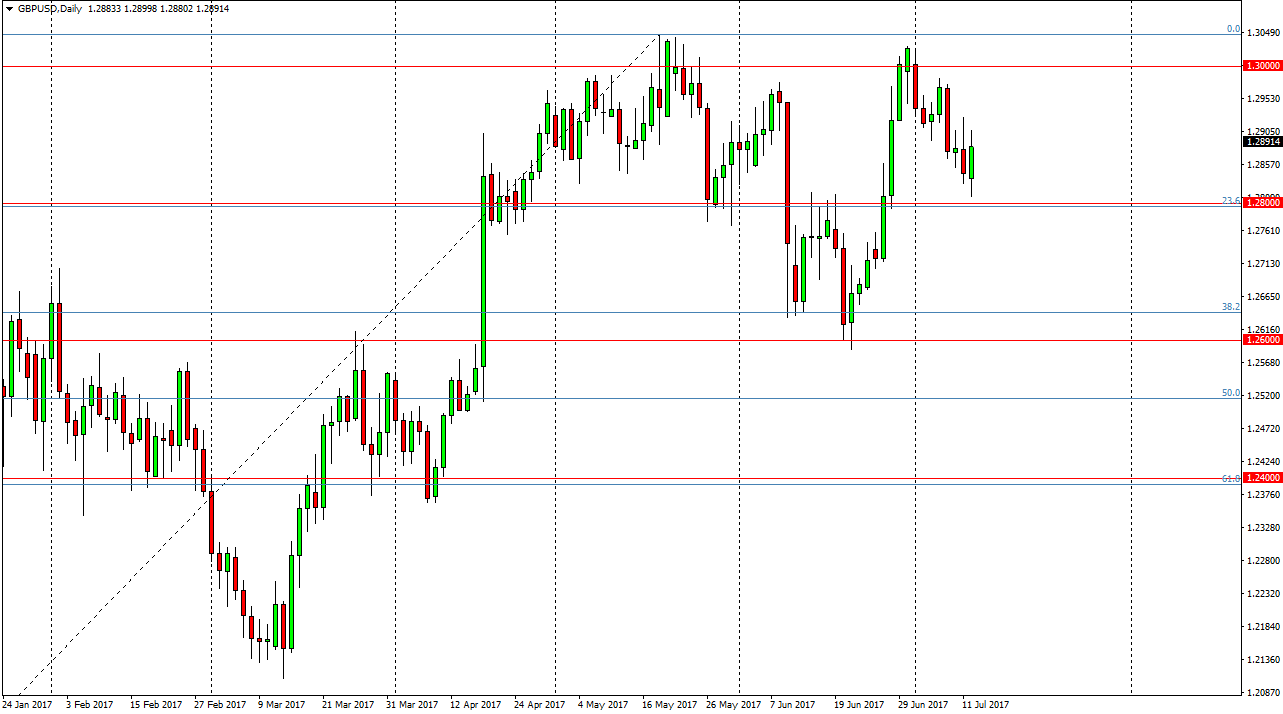

GBP/USD

The British pound fell initially during the day but found enough support at the 1.28 level to turn around and rally. The 1.29 level offered resistance, so essentially the market looks as if it is going to continue to grind overall, and I think at this point we may be entering a new consolidation area. The 1.28 level could be the sport, while the 1.30 level above could be resistance. If that’s the case, expect a lot of back and forth trading and what would be a relatively quiet summer interrupted by sudden bounce of volatility due to comments coming from politicians from both London and Brussels. Remember, there is that whole “Brexit” thing going on at the same time, so that can always enter the market and cause bits of trouble. I believe that we are going to see short-term back and forth range bound trading over the next several sessions.