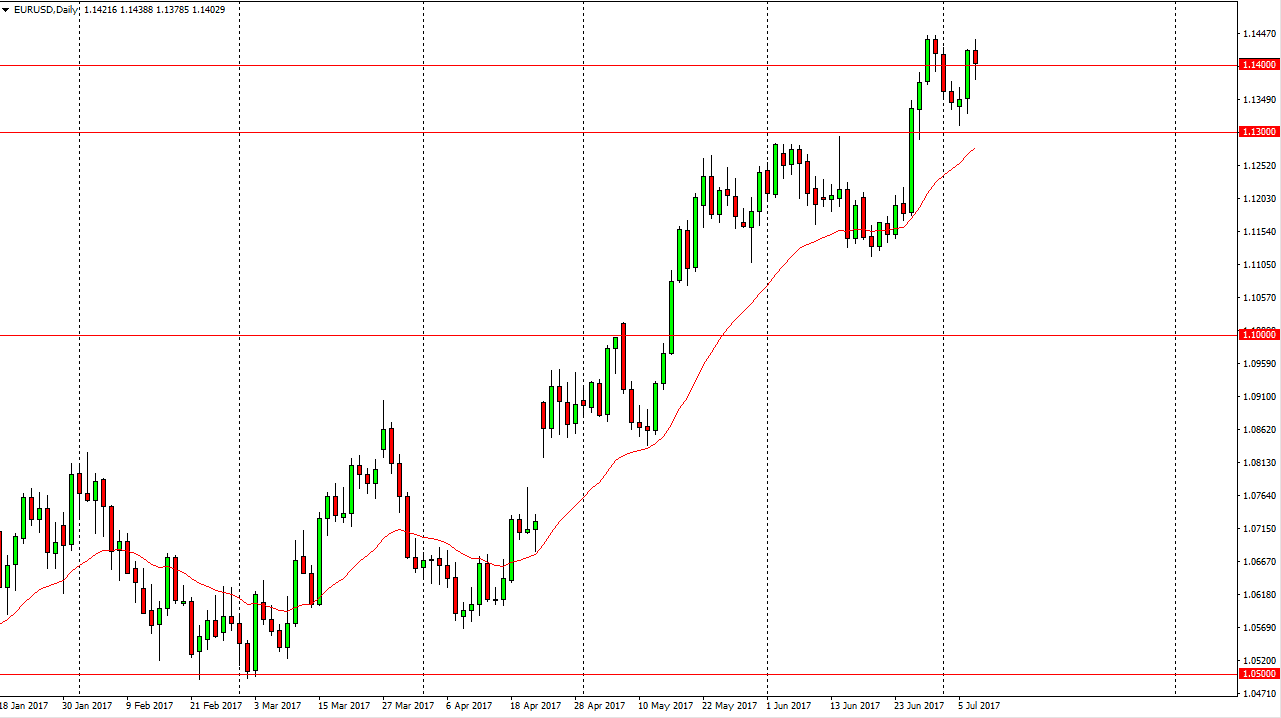

EUR/USD

The EUR/USD pair spent most of the day chopping around as the job numbers came out of America, much better than expected. We did bounce from below the 1.14 handle, so that’s a very bullish sign. The candle looks as if the buyers are getting ready to come back in and try to push towards the 1.15 handle, and more importantly the weekly candle is a hammer as well. Because of this, I think the dips will continue to be buying opportunities but I recognize that the 1.15 level above is massive resistance as it has been the top of consolidation for the last 3 years. Ultimately, I believe that the buyers are in control and it’s only a matter of time before we break out. I don’t know if it’s going to happen this week, but it should happen relatively soon. Alternately, if we break down below the 1.13 level, the market probably goes down to the 1.11 handle.

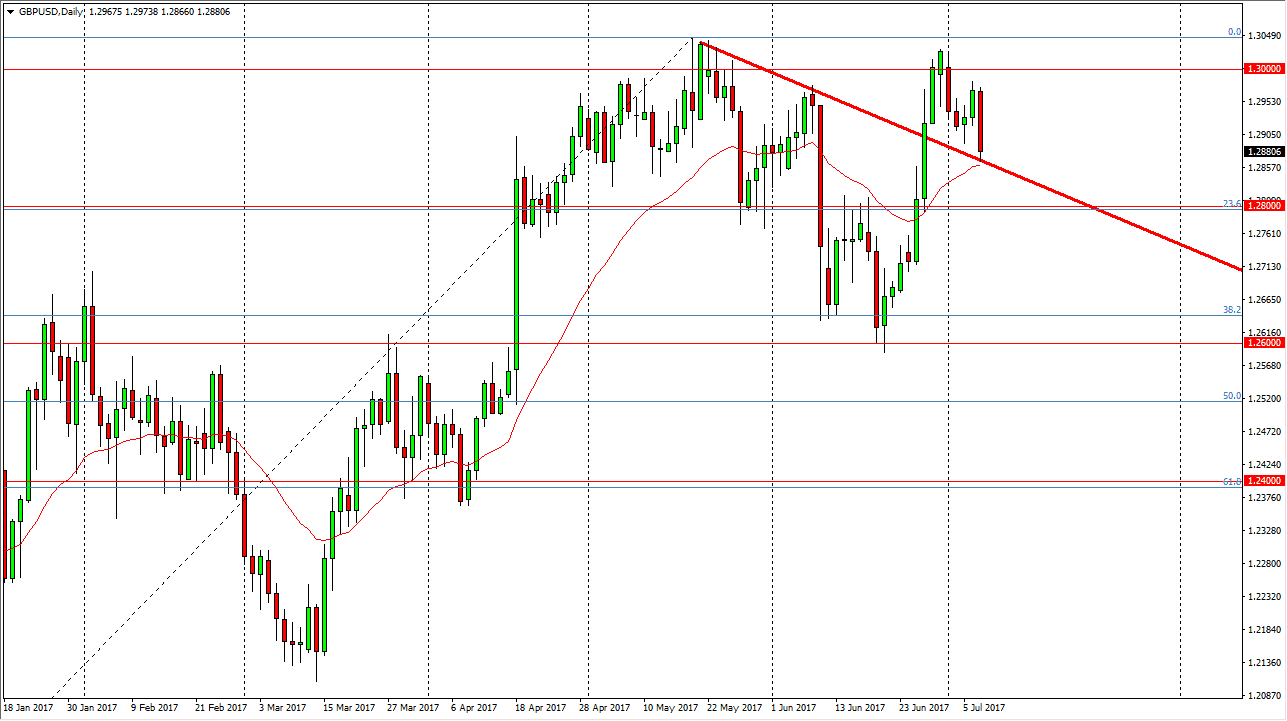

GBP/USD

The British pound fell significantly during the day as the jobs number in America surprised, and as you can see we are testing the daily downtrend line from previous action. It looks likely that buyers could be in this area, but we need to see some type of bounce or supportive candle to be convinced. That bounce could send this market looking towards the 1.3050 level above, which is massive resistance. A break above there is a very strong sign and send this market towards the 1.3450 level. If we do breakdown below the uptrend line on the daily chart, then I think that this pair goes looking for the 1.28 level which should also be supported. A breakdown below there send this market down to the 1.26 handle after that. I believe that we are going to see a lot of choppiness and volatility, so it’s likely that the next 24 hours should be important.