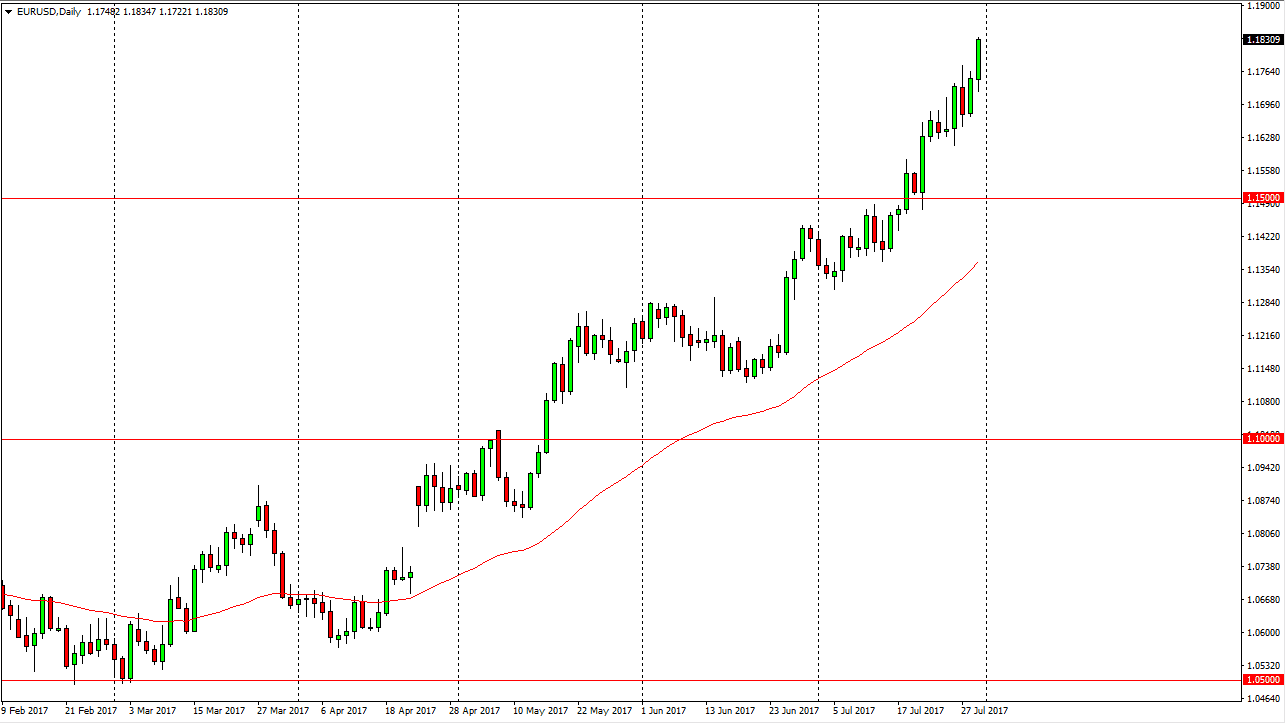

EUR/USD

The EUR/USD pair initially fell during the session on Monday, then broke above the 1.18 handle. The market is getting a bit overextended though, so I’m very cautious about buying right now. I’m looking for pullbacks to offer value in a market that should continue to the upside. In fact, I believe that the 1.15 level underneath should offer a “floor” in the market, and therefore I think that any type of supportive candle after a pullback is an opportunity to start going long. I am very cautious about buying up here, but certainly would not short this market at this overbought extreme. While I am bullish, I recognize that we need to find a bit of value in this market.

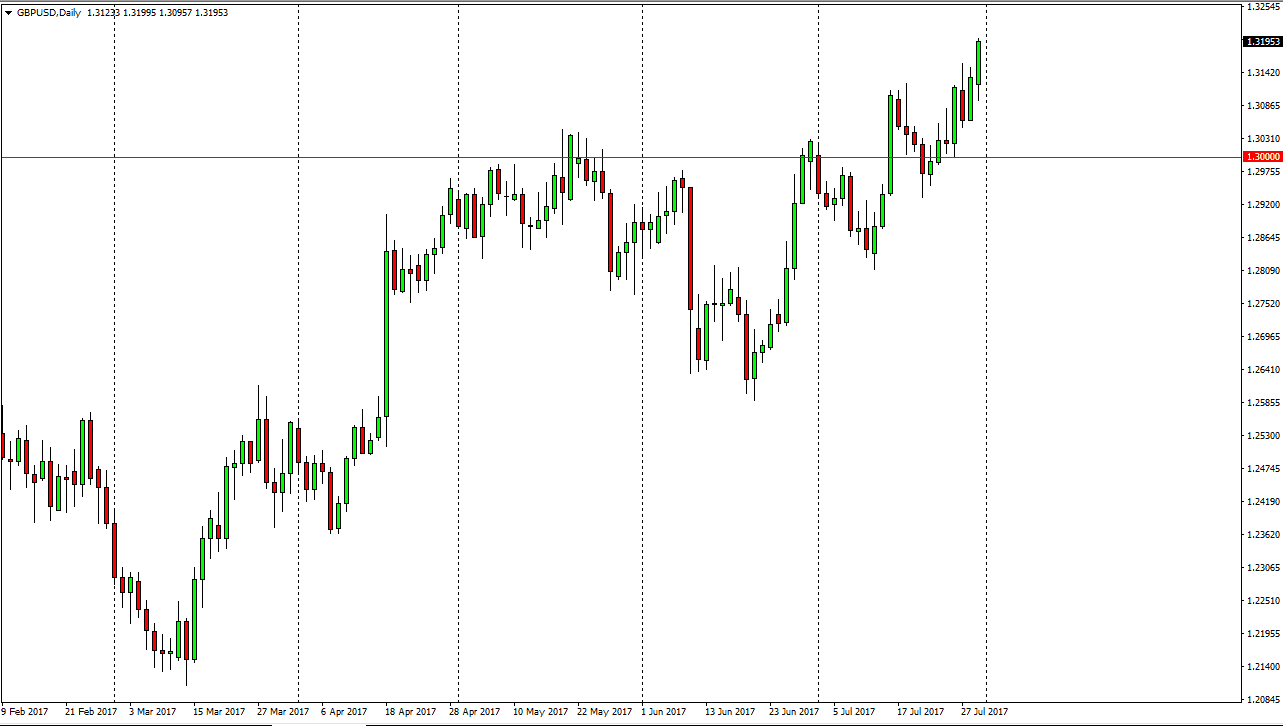

GBP/USD

The British pound also fell initially during the day on Monday, but found enough support near the 1.31 level to turn things around and form a bullish candle. A break above the top of the bullish candle, extensively the 1.32 handle, since this market looking for higher levels, namely the 1.3450 level above which is the top of the consolidation area that we have just entered. I think pullbacks continue to offer buying opportunities, and I also recognize that the 1.30 level should be essentially the “floor” in the market. A breakdown below there would be very negative, and I would have to rethink the entire situation. However, I don’t think that’s going to happen anytime soon, so I remain a buyer on dips as the British pound has shown some much resiliency. The US dollar is oversold against most currencies, so we could get a bit of a pullback and the short-term, but that should only offer a better entry for patient traders. I’m a buyer, and not interested in selling.