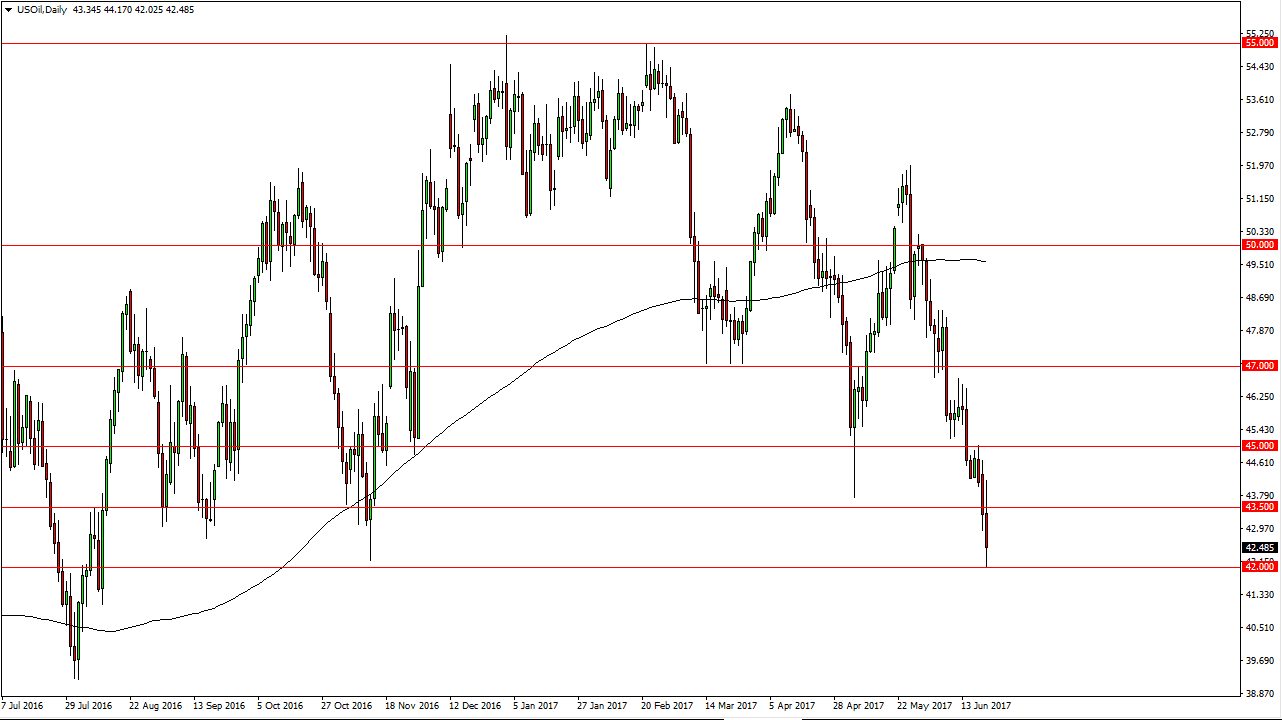

WTI Crude Oil

The WTI Crude Oil market tried to rally during the day on Wednesday, after a stronger than expected inventory number. However, we turned around to break down below the $43.50 level. Not only that, we broke down through significant support and even touched the $42 level under that. This is an area that’s been massively supportive, so if we can break down below their, the market will break down significantly and go looking for the $40 level. Oil simply cannot seem to get out of its own way, and that being the case I think it’s likely that every time we rally, it’s a selling opportunity as the market is certainly bearish, but we may have gotten a little bit of head of ourselves, so rallies can be looked at as nice opportunities going forward. I have no interest whatsoever and buying this market.

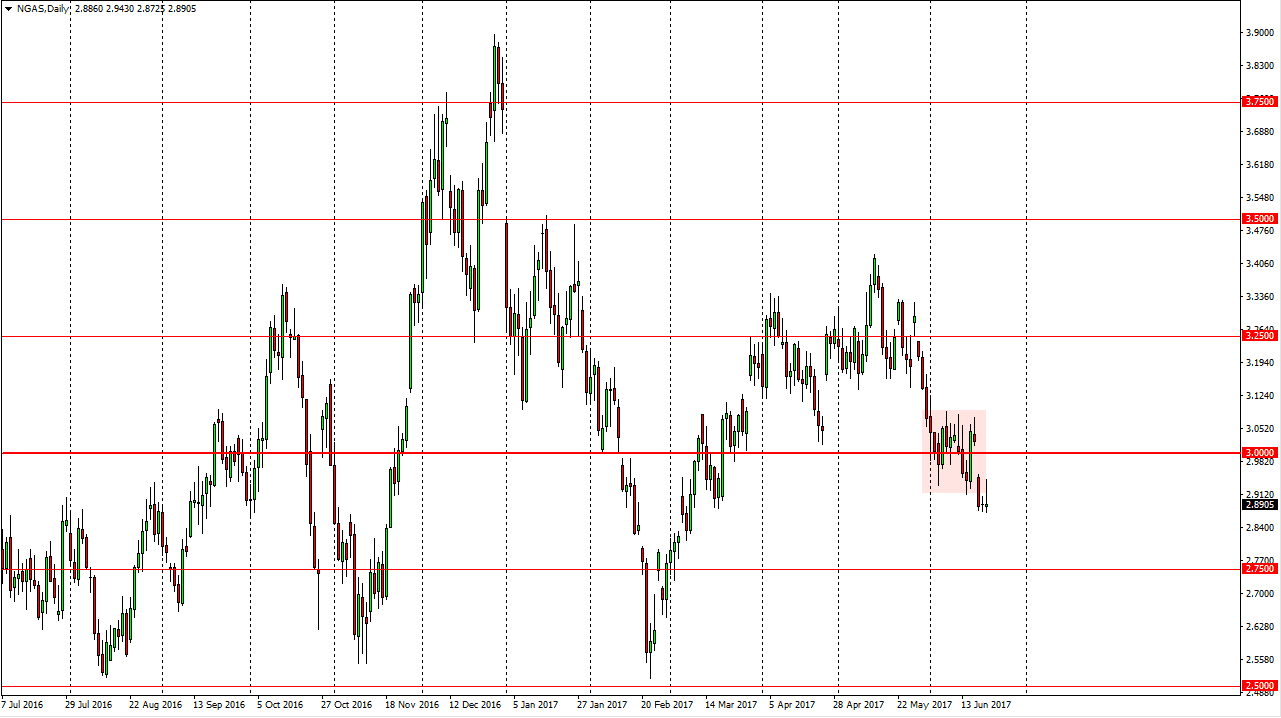

Natural Gas

The natural gas markets tried to rally during the day, but turned around to form a shooting star. The shooting star suggests that we are going to continue to see bearish pressure, reaching to lower levels, perhaps even the $2.75 level. The shooting star suggests that the gap above is going to continue to cause quite a bit of bearish pressure, so I believe that the $3.00 level is essentially the “ceiling” in the market. The oversupply in the natural gas market continues, and I do not believe that we are anywhere near seeing some type of turnaround in the overall trend and a massive pickup in demand.

Longer-term, we could go as well as the $2.50 level, which has been a major base in this market for some time. A breakdown below their turns the entire last year or so into a massive head and shoulders that could send the markets tumbling rather rapidly.