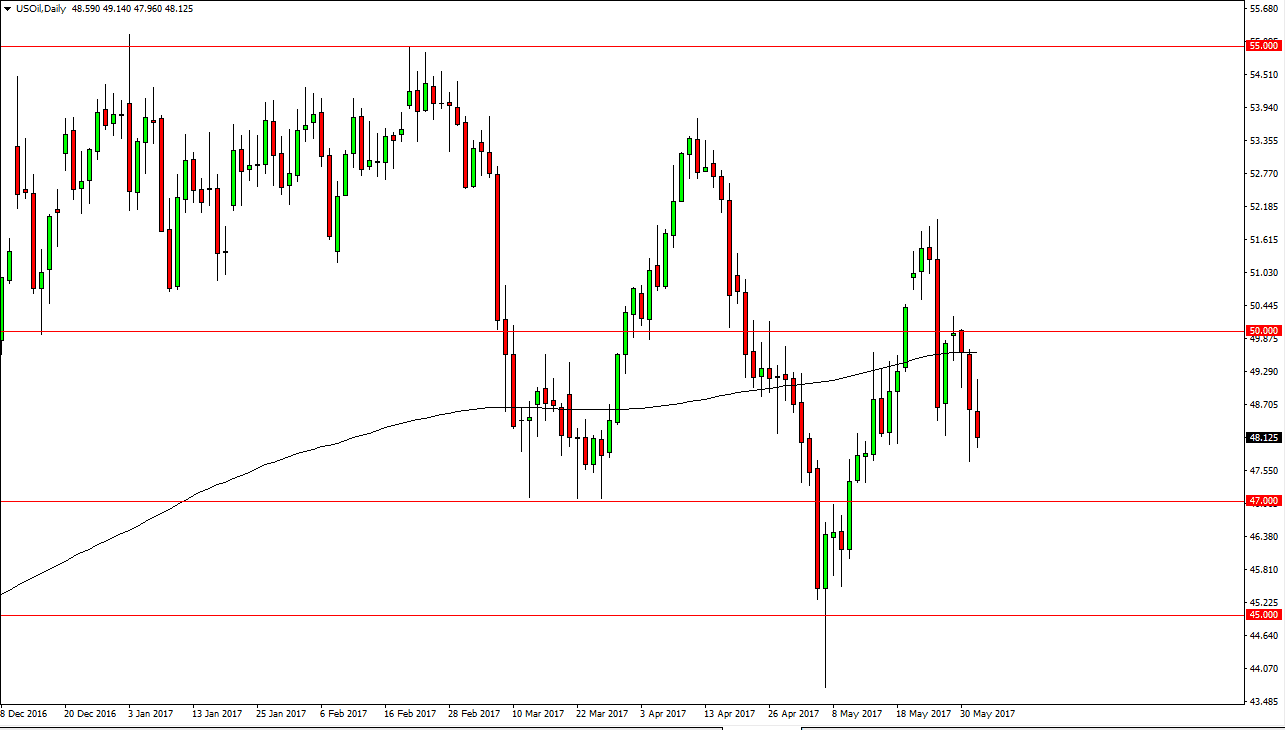

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Thursday, but found enough resistance near the $49.25 level to turn things around and form a very negative looking shooting star like candle. If we can break down below the current area, I believe that we will go looking for the $47 level underneath, and then possibly the $45 level after that. I believe that the market will continue to be one that you can sell as long as we stay below the $51 level. In the meantime, we have a jobs number coming out today which of course will cause volatility in all markets, but I believe that the WTI grade of crude oil continues to be very negative overall as OPEC has very little control on what happens with pricing. The market will continue to be volatile, but with an overall negative bias in my estimation.

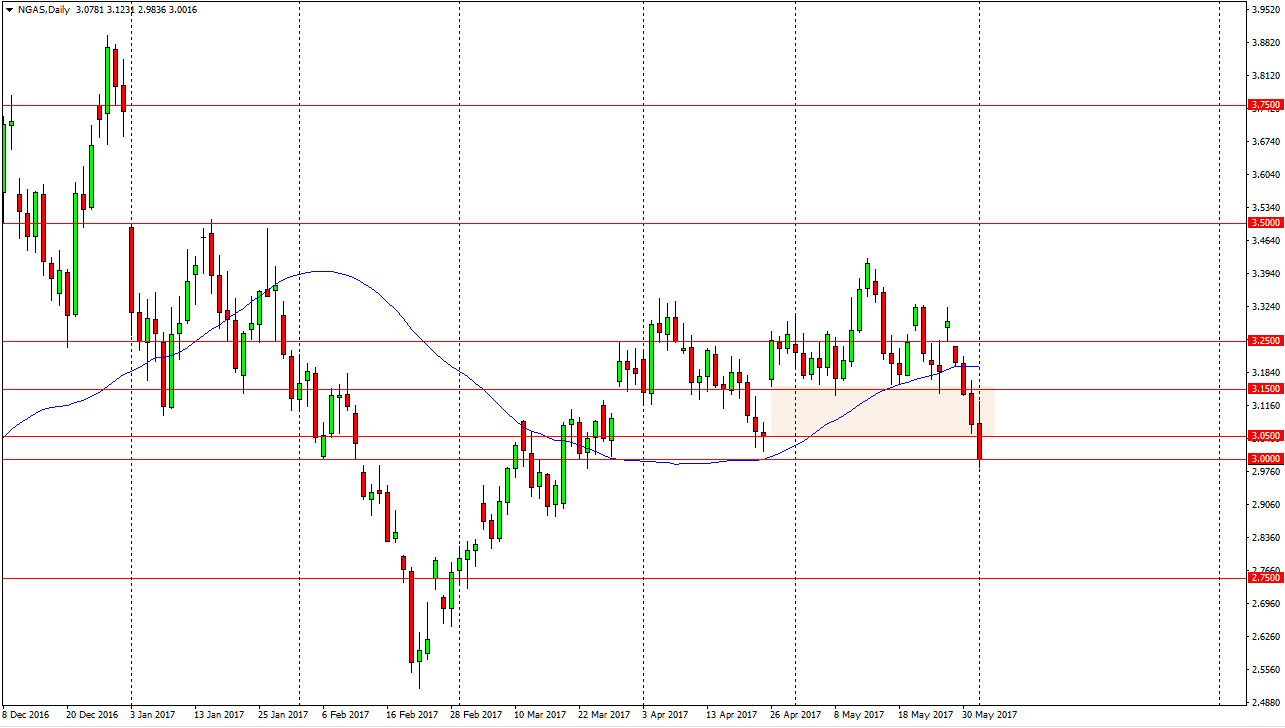

Natural Gas

Natural gas markets initially trying to bounce on Thursday, but found enough resistance near the $3.10 level to turn things around and start selling off again. The $3.05 level under that level gave way to the sellers, and then we found the market reaching towards the $3 handle because of that. With this in mind, the market should continue to find bearish pressure, especially if we can break down below the bottom of the range for the session on Thursday as it would be such a negative sign. At that point, I would anticipate that the natural gas markets will go looking for the $2.80 level rallies this point don’t interest me, least not until we get a daily close well above the $3.05 level, and even then, I would be a bit suspicious. Volatility continues to be very high in this market, and I don’t think that’s something that’s going to change anytime soon.