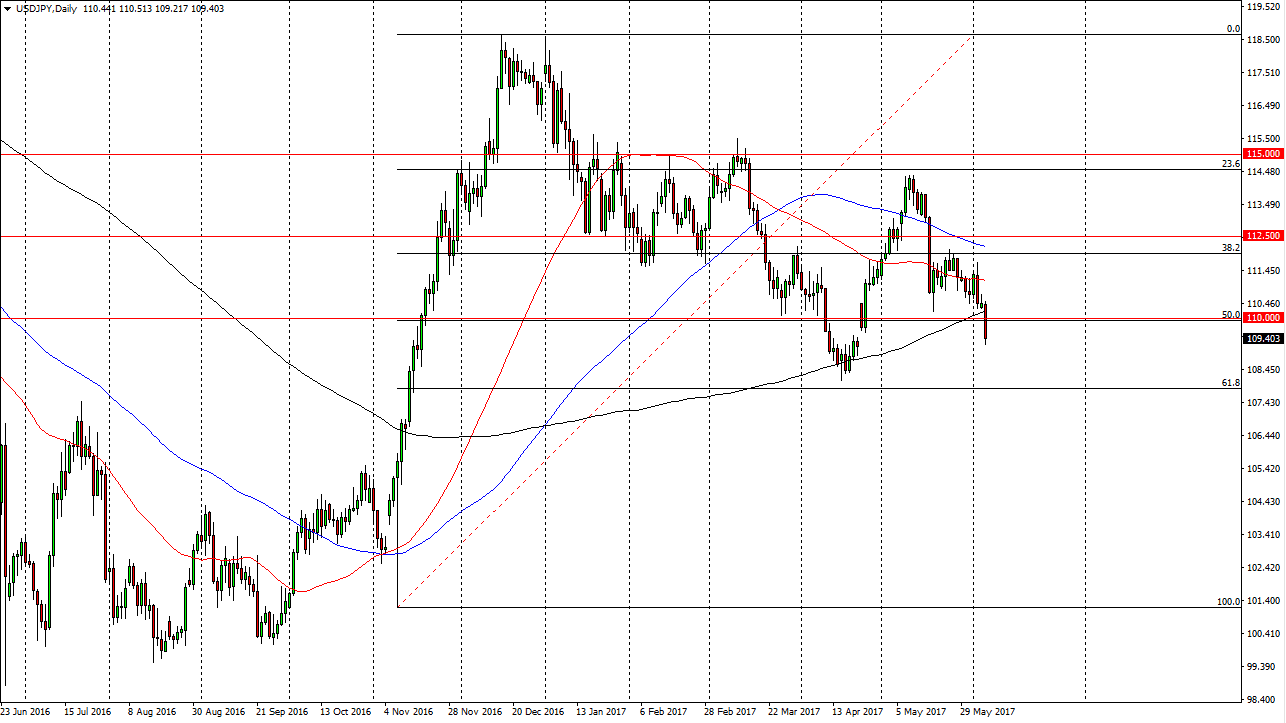

USD/JPY

The USD/JPY pair broke down during the day on Tuesday, slicing through the 110 handle. On top of that, we broke down below the 200-day moving average. With this being the case, looks as if we are starting to see another line of bearish pressure, and that should continue to send the market down to the 108 level, or the 61.8% Fibonacci retracement level. I believe that the market continues to find sellers in this pair, at least down to that area. If we can break down below the 108 handle, I think this market will probably fall apart. Alternately, if we can break back above the 110 level, that would be very bullish sign. One thing is for certain, it suddenly looks as if there is a lot of uncertainty and the markets.

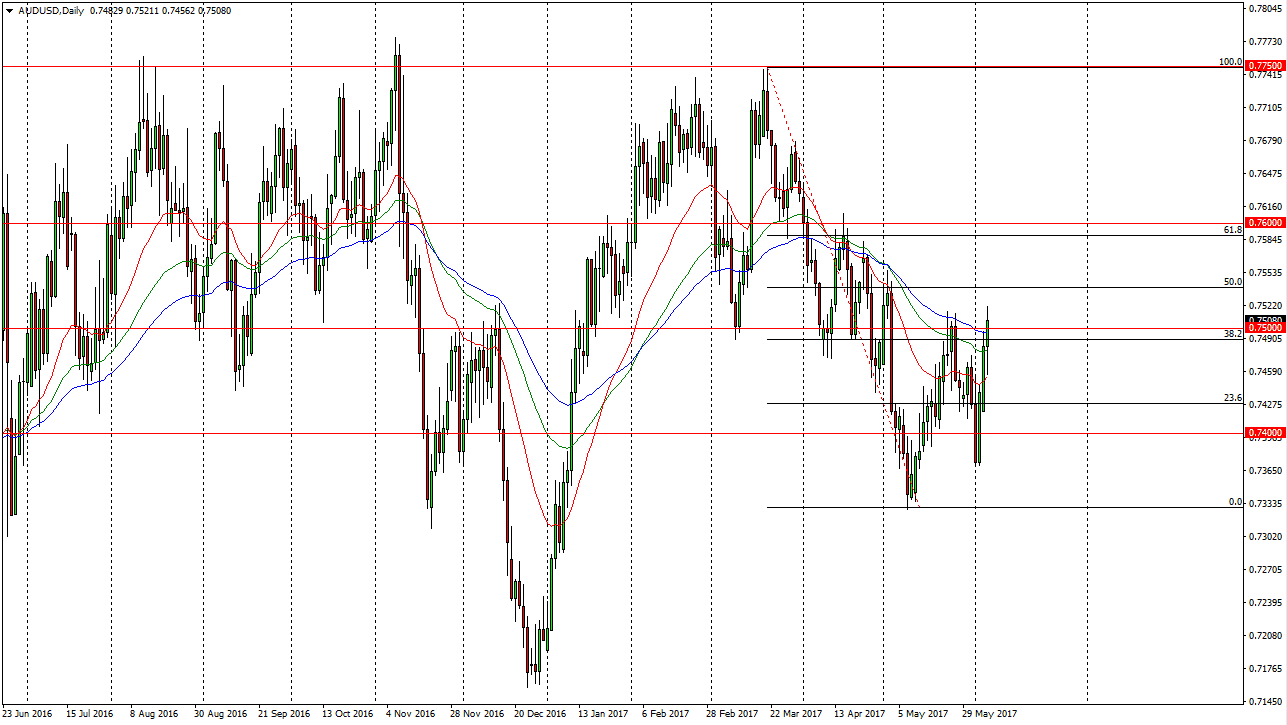

AUD/USD

The Australian dollar initially fell during the day on Tuesday, but found enough support at the 0.7450 level to turn around and break above the 0.75 handle. It looks as if the market is trying to go higher in general, and gold is getting close to making a breakout. We have the GDP numbers coming out of Australia early today, and that can cause a lot of volatility here as well. I think given enough time, the market could go to the 0.76 level, but I think it will be a difficult market and move to be had. Pullbacks that show support below could be a buying opportunity as the most recent low was higher than the one before it. I think if we can break above the 0.76 handle, the market should then go to the 0.7750 level above. I believe that the Australian dollar will continue to be very noisy. With that being the case, I would stick to very small positions, and perhaps add as you find yourself in profit.