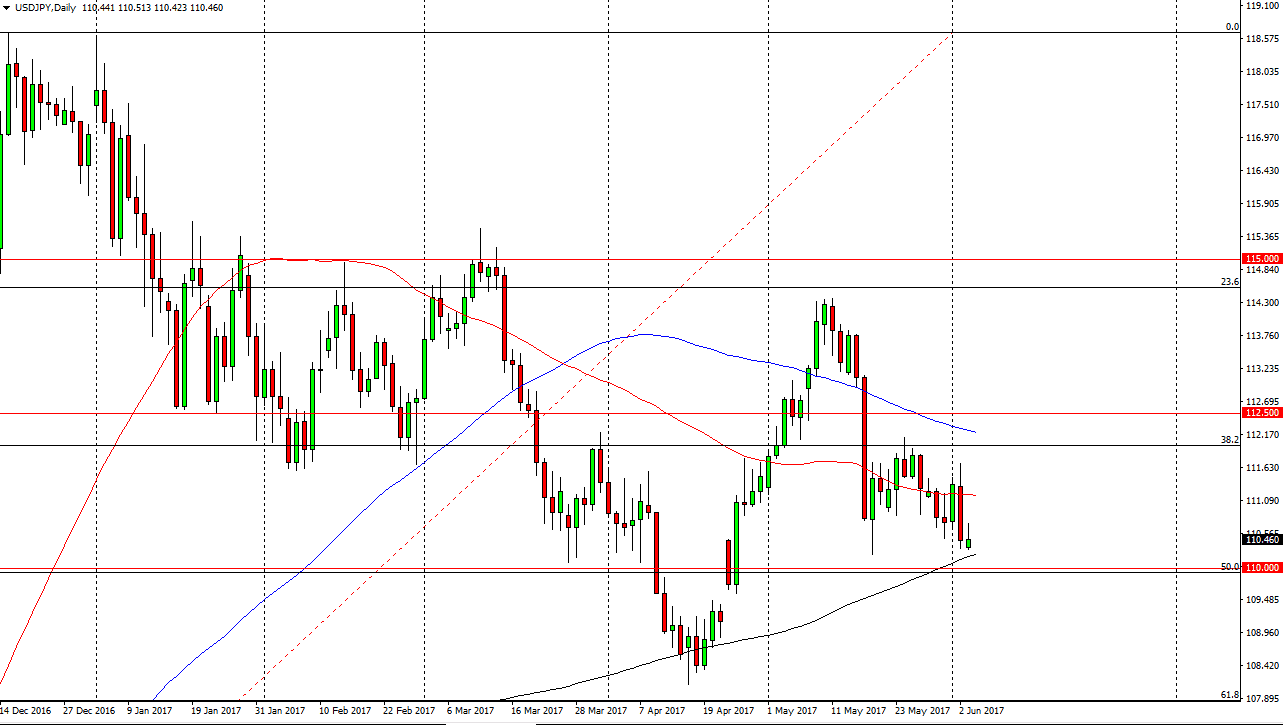

USD/JPY

The USD/JPY pair tried to rally initially during the day on Monday, but turned around to form a less than impressive candle. The candle is a bit of a shooting star, and it is at the bottom of a move lower. Because of this, it looks as if the market is going to continue to test the 110-level underneath. That is the 50% Fibonacci retracement level, and I think will offer quite a bit of support. Also, we have the 200-day exponential moving average, pictured in black, that is just below current pricing as well. Because of this, even though the market looks very weak currently, I still believe that it’s probably easier to buy this market on some type of bounce. Having said this, if we breakdown below the 110 level on a daily close, at that point I would probably start selling and aiming for the 61.8% Fibonacci retracement level, which is the 180 handle.

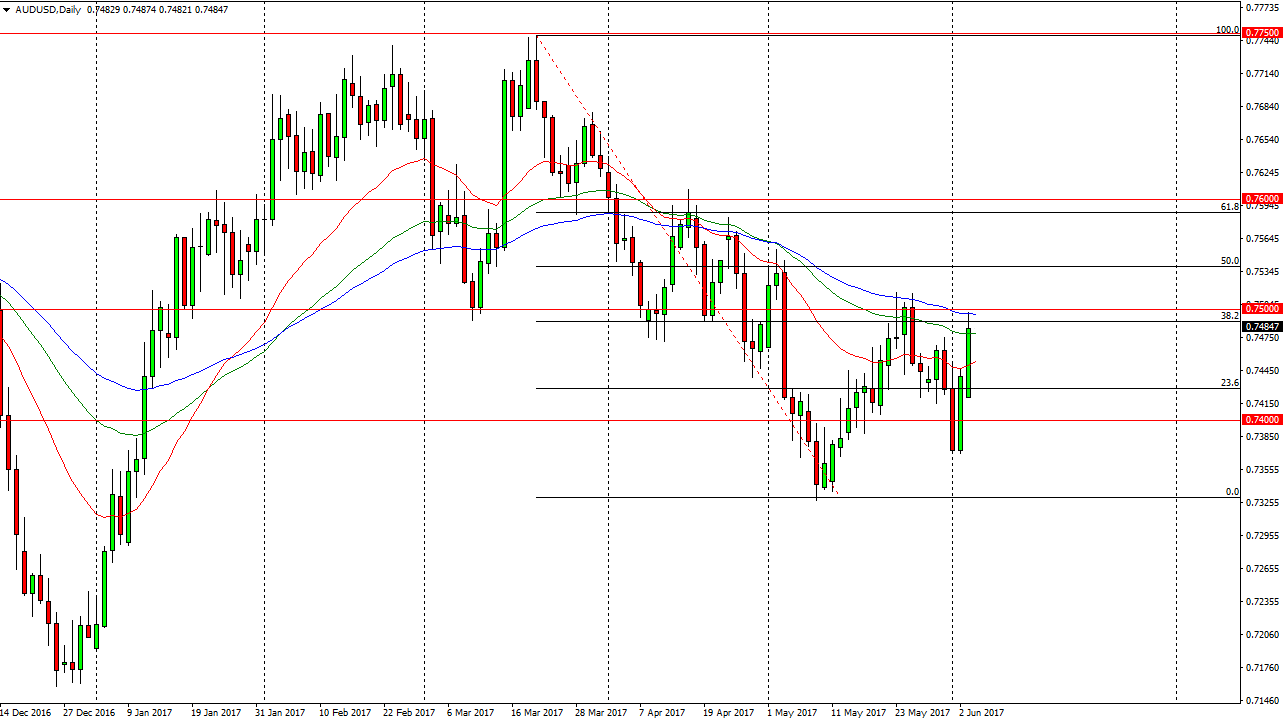

AUD/USD

The AUD/USD pair had a very strong day on Monday, testing the 0.75 handle. To break above there is a very bullish sign, and should send this market towards the 50% Fibonacci retracement level which is of 0.7550 level. I don’t have any interest in selling, but I need to see this market hang above the 0.75 level for more than at least an hour to go long. Keep in mind, we have an RBA interest rate statement coming out, and that will influence where this pair goes next. I believe that traders are looking for some type of hockey statement, and if it ends up being a bit of a disappointment, that will more than likely send this pair right back down. Because of this, expect volatility but I do think that it’s only a matter of time before the buyers take over again as we have made a lower low on the daily chart.