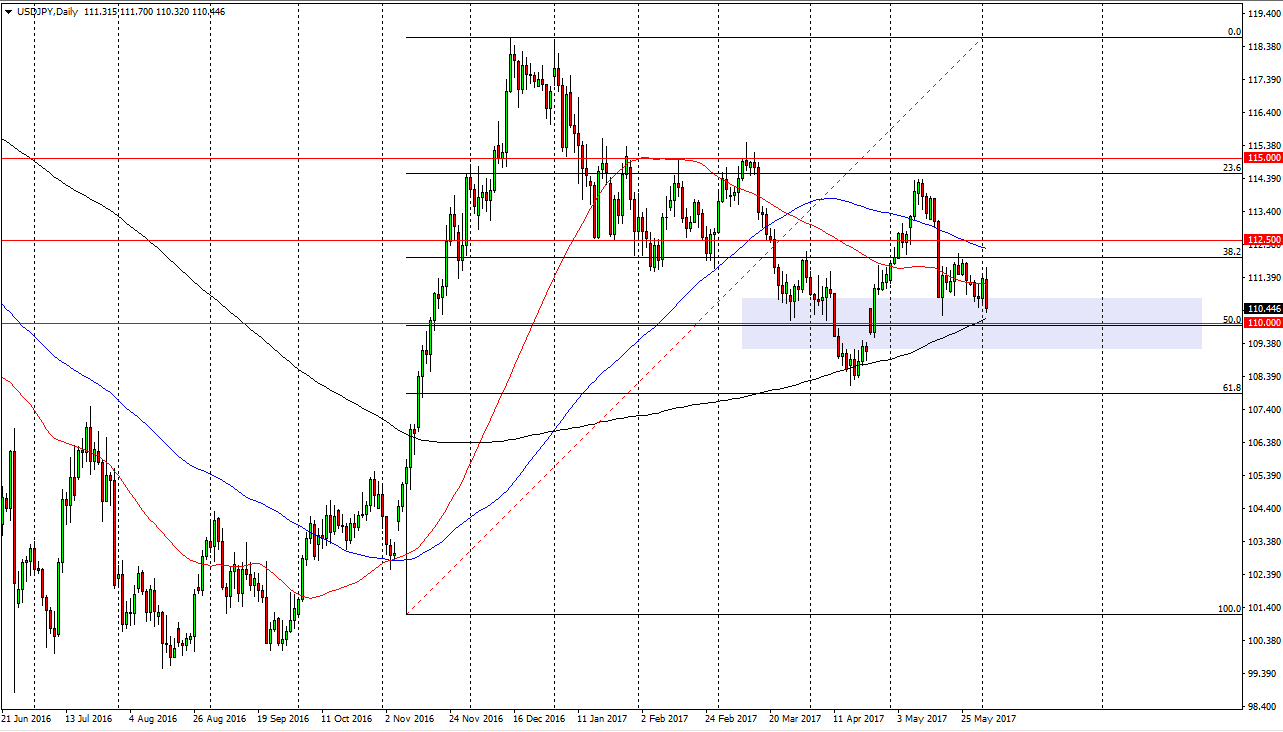

USD/JPY

The USD/JPY pair initially tried to rally on Friday but found enough resistance above at the 111.50 area to turn around and fall significantly. Obviously, the poor jobs number helped send the market lower, but I believe that there is enough support at the 110 level that the buyers could return rather quickly. On top of that, we have the 200-exponential moving average just below that area as well. If we did breakdown below the 110 level, we have a gap just below that could be support, and most certainly the 61.8% Fibonacci retracement level at the 108 level will be as well. I think it’s only a matter of time before the buyers return, but we could see little bit of negativity in the short run. Regardless, expect quite a bit of volatility.

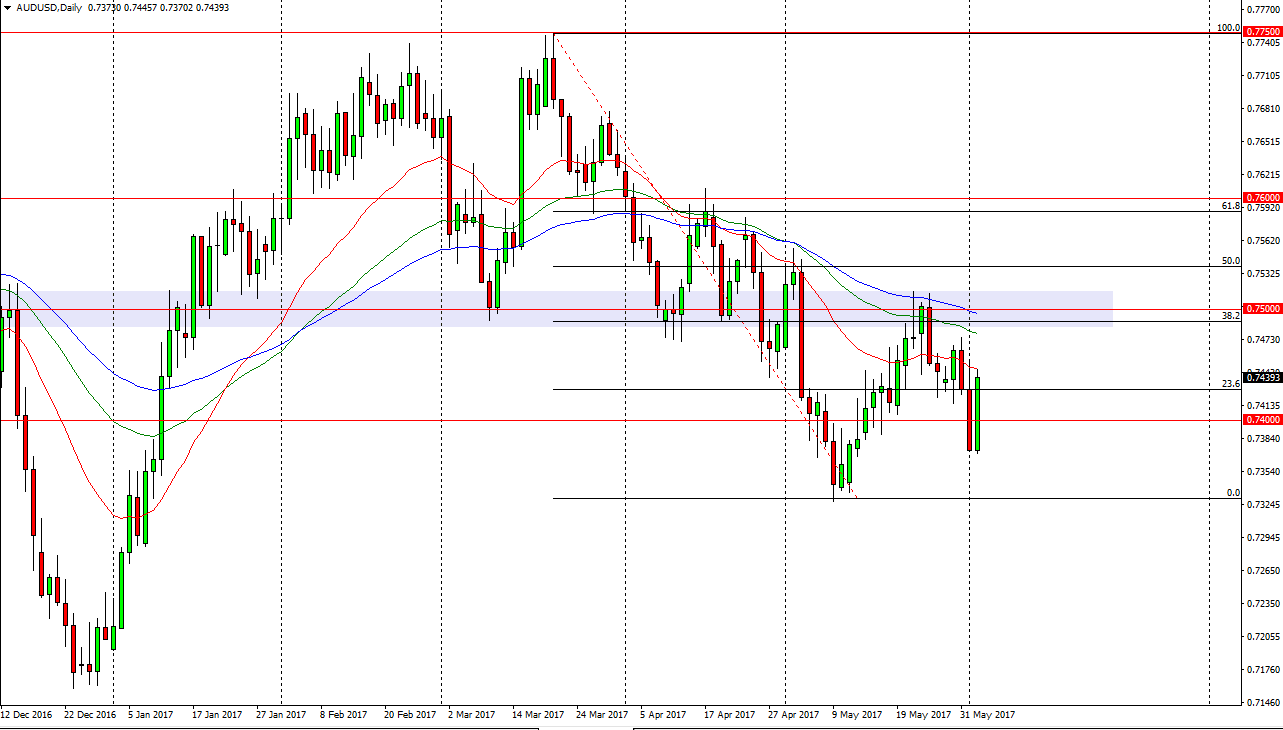

AUD/USD

The Australian dollar had a very explosive day on Friday, wiping out all of the losses from the previous session and breaking above the 0.7425 handle. However, I think there is still a significant fight above at the 0.75 handle, and with that being the case I believe that the buying pressure may abate relatively soon. If we did break above there, then I have to reassess the entire situation. Gold markets have not help the Aussie as of late, but Friday started to pull the market to the upside. Perhaps we are starting to see the correlation come back, but my overall attitude on this market is to stand on the sidelines and wait to see what happens at the 0.75 handle. If we were to close above the 0.7525 level on a daily close I might be talked into buying. I would be much more comfortable shorting a negative candle if we get it on the daily timeframe. Otherwise, I expect massive volatility.