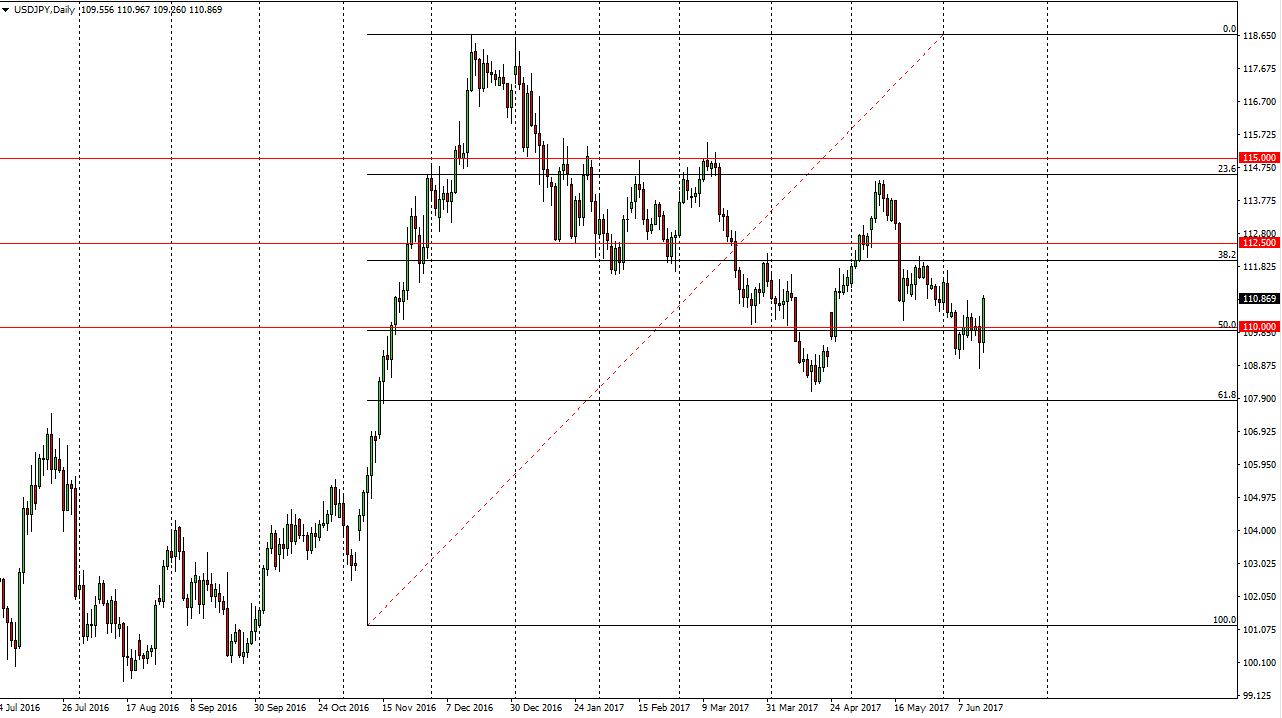

USD/JPY

The US dollar rose against the Japanese yen during the day on Thursday, breaking above the 110 level again. This is in reaction to the Federal Reserve being much more hawkish than originally thought. Because of this, the US dollar should continue to climb, and I think that the US dollar will reach towards the 112 level against the Japanese yen, and then the 112.50 level after that. Once we break above their, we could be looking towards the 115 handle. I think short-term pullbacks will continue to be buying opportunities, and that the market volatility will give you plenty of opportunities in the future. Longer-term, you can see that the market pulled back to the 61.8% Fibonacci retracement level, and then saw that the market was getting ready to go higher.

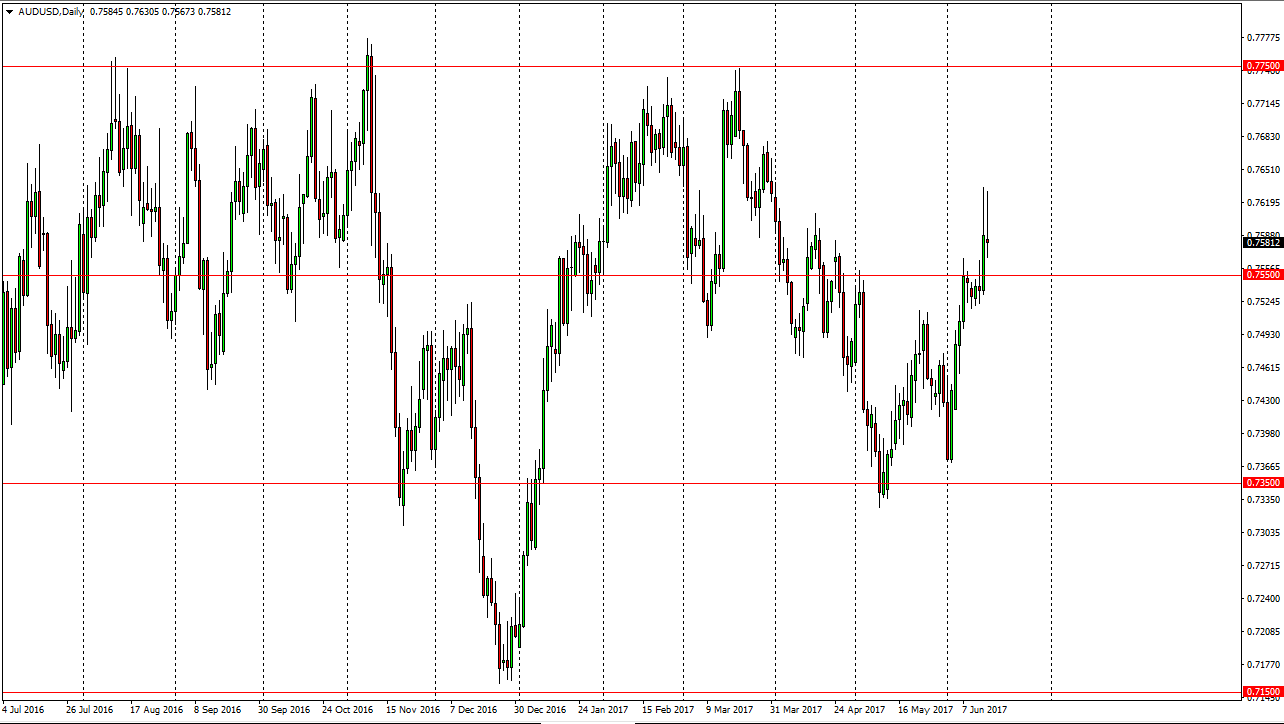

AUD/USD

The Australian dollar initially tried to take off to the upside during the day on Thursday, as we continue to see volatility, but the market turned around to form a shooting star. The shooting star offered a negative sign, but it would not be until we breakdown below the 0.7525 level that I would be comfortable selling. I think that there should be a significant amount of support just below, so given enough time I would anticipate that the buyers return. Because of this, I suspect that the Australian dollar will go looking for the 0.7750 level above, but it is obviously going to take some time to get there. Gold markets have been extraordinarily volatile, so it’s difficult to imagine that trading the Aussie is going to be easy but I do expect to see interest near the 0.7550 level. Either way, the market should continue to be difficult, so keep in mind that the volatility could shake out short-term traders. Options may be the best way to play if you have the ability.