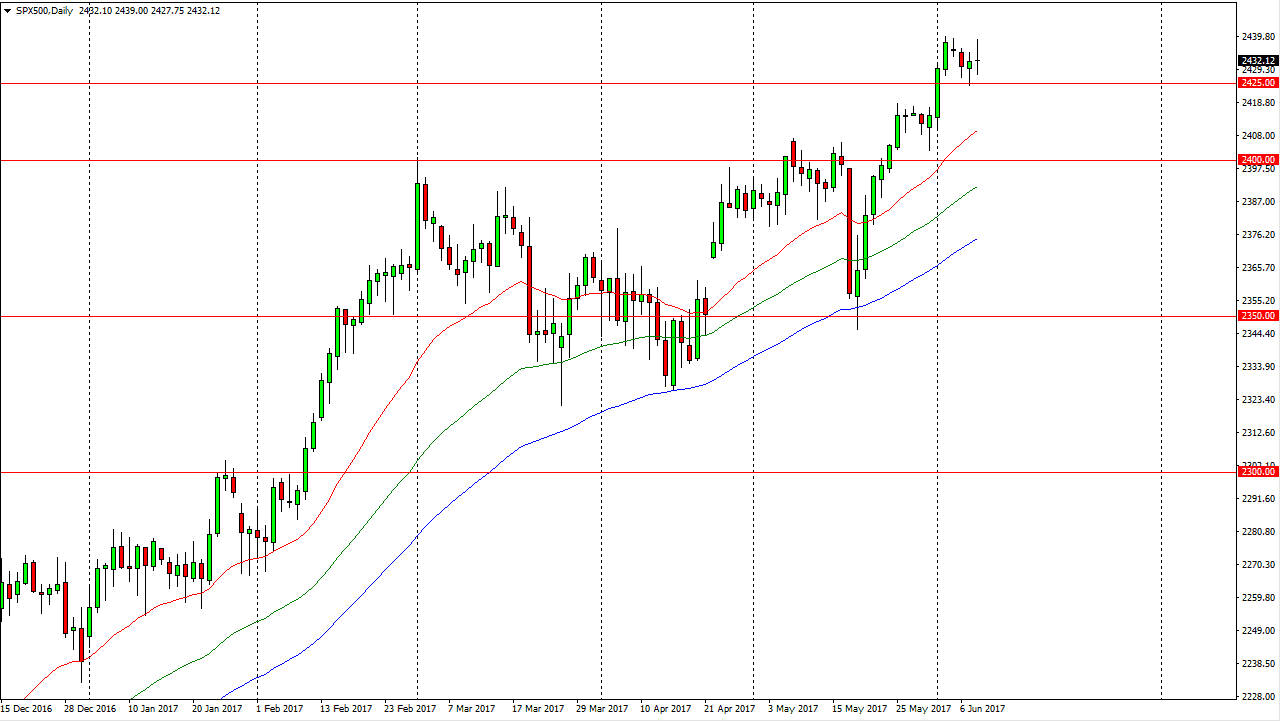

S&P 500

The S&P 500 was volatile during the session on Thursday, as we had congressional hearings, the UK election, and of course the ECB press conference. Quite frankly, it was far too much drama to be involved in the market during, and if you’re smart, you are on the sidelines. However, when you look at the longer-term charts there’s a clear and obvious uptrend so I certainly don’t have any interest in shorting this market although I recognize it could pull back. Pullback is probably going to end of being a nice value play for someone out there, and I plan to take advantage of it once I see a pullback and a supportive candle on the daily charts. In the meantime, I think it’s probably best to either trade individual stocks, or simply stay away from the index itself.

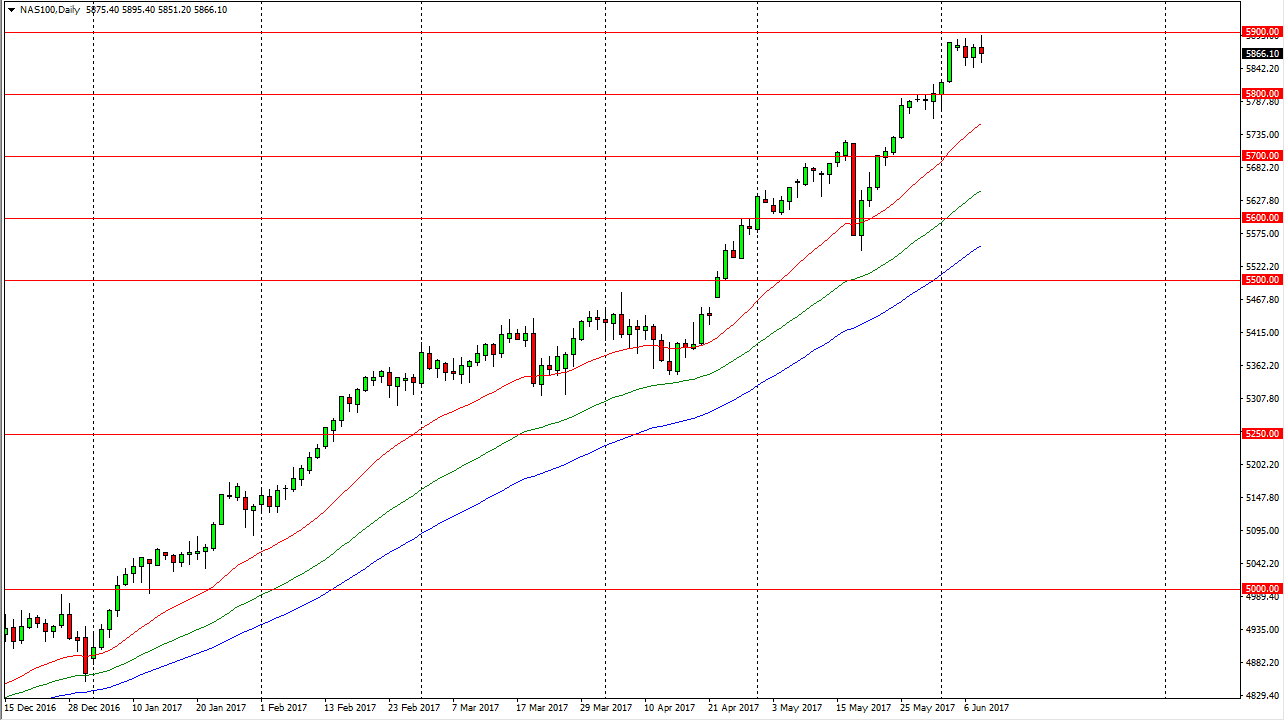

NASDAQ 100

The NASDAQ 100 also went back and forth during the day, as we simply cannot pick up enough traction to go any higher after the significant move, and of course all the nonsense going on around the world. Pullbacks offer buying opportunities, and a supportive daily candle is exactly what I would like to see after a dip to start taking advantage of the longer-term uptrend when it comes to the NASDAQ 100. This index has lead the way for most other indices out there, and I think that will continue to be the case going forward. I don’t have any interest in trying to fight the uptrend, so certainly selling is all but impossible as the market has been so decidedly bullish over the last several months. That’s not to say we can’t pull back, and quite frankly I wish we would, but rather that those pullbacks will continue to be attractive to longer-term investors who will try to take advantage of the overall trend.