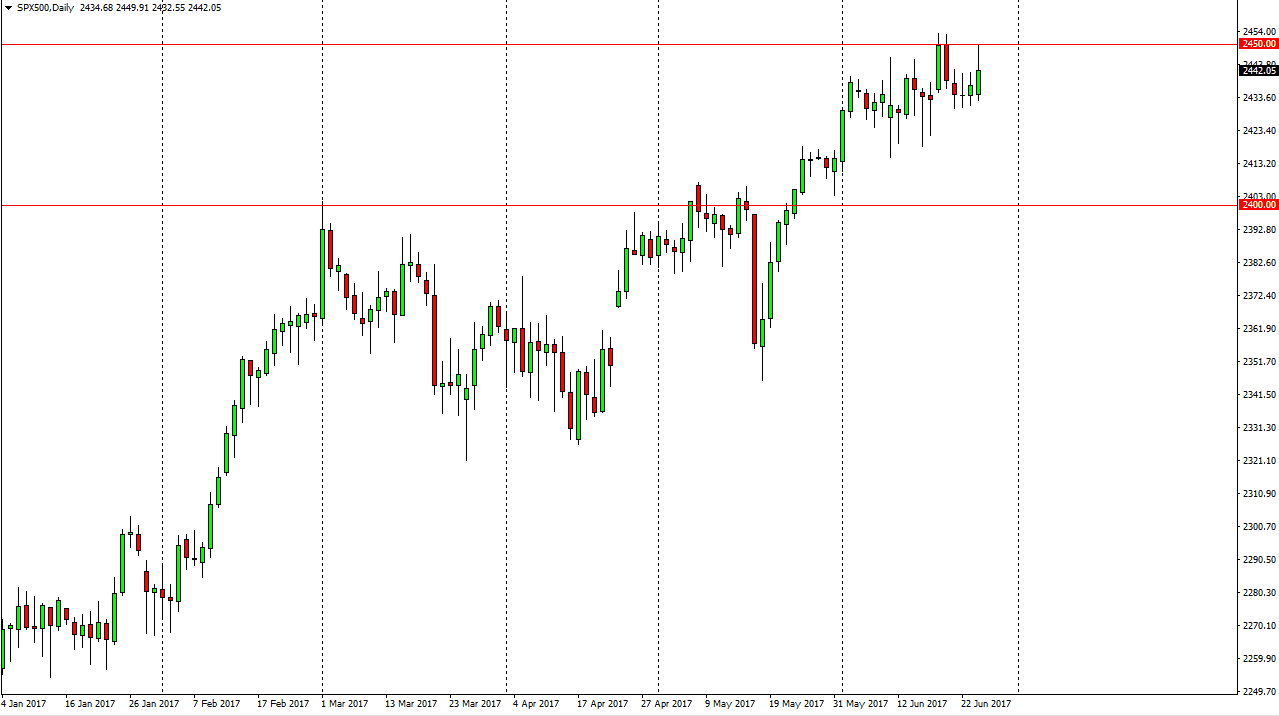

S&P 500

The S&P 500 rallied at the open on Monday, reaching towards the 2450 level. Because of this, we ran into resistance and a less than anticipated number for the Core Durable Goods Orders announcement out of America sent this market lower. By doing so, it looks as if we are trying to build up momentum, to break much higher, especially once we get above the 2450 handle. Once we get above there, the market should then go to the 2500 level above. That is a much more significant resistance barrier and that should send this market to much higher levels and perhaps into a buying frenzy. I believe that pullbacks continue to offer plenty of reason to go long, as this market has been so bullish over the last several months.

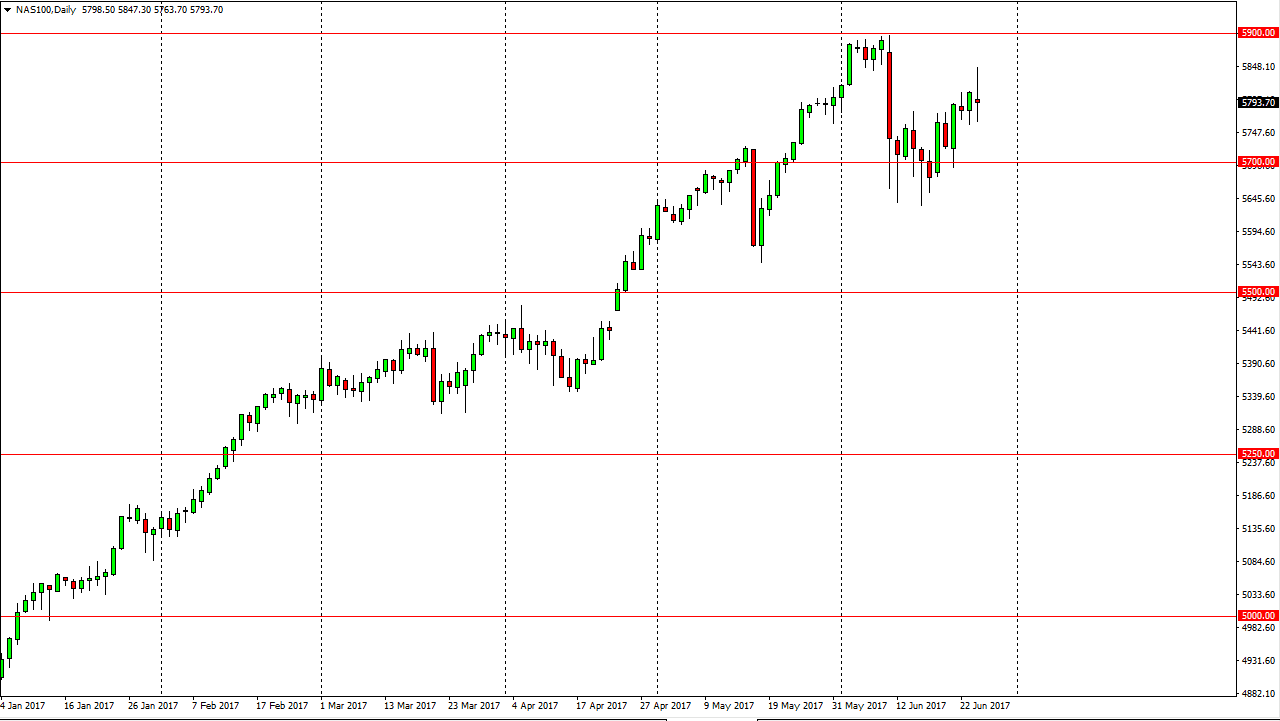

NASDAQ 100

The NASDAQ 100 gave back quite a bit of the gains, and right now looks like we may get a little bit of a pullback. That pullbacks should give us an opportunity to go long, perhaps reaching towards the 5900 level above. That is an area that should offer significant resistance, but if we can break above there I think that the market then goes to the 6000 handle. That’s been my longer-term target for some time, and I believe that we are trying to build up enough momentum to finally reach that level. I believe that the NASDAQ 100 will continue to find buyers, as the biotech sector has been so strong, and with this being the case it’s likely that the buyers should continue to like this market quite a bit. I have no interest in selling this market least not until we break down below the 5650 handle, which looks very unlikely. I remain bullish.