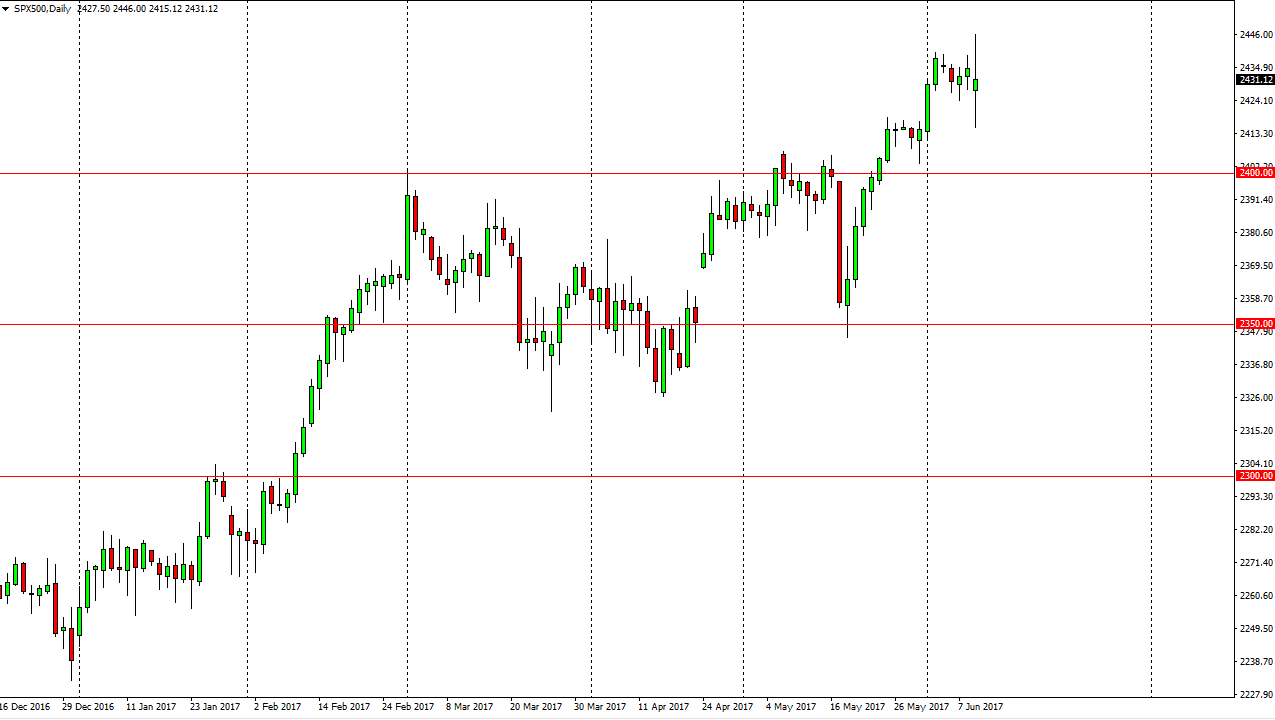

S&P 500

The S&P 500 had a very volatile session on Friday, initially going higher and reaching towards the 2450 handle, but then turning around and breaking down rather significantly. A lot of this would’ve had to do with sector rotation in the stock market, as the technology sector had gotten far too ahead of itself. This was seen in the NASDAQ 100, and of course fell in the S&P 500. It looks as if the 2400 level below continues to offer significant support, so I think the dips will continue to offer buying opportunities in what is a very strong uptrend. Remember, stocks tend to “climb a wall of worry”, and that means that sudden selling can compound itself as we saw during the Friday session. I still believe in the uptrend, I think it’s only a matter of time before we go even higher. I believe that the market is still going to target the 2500 level above.

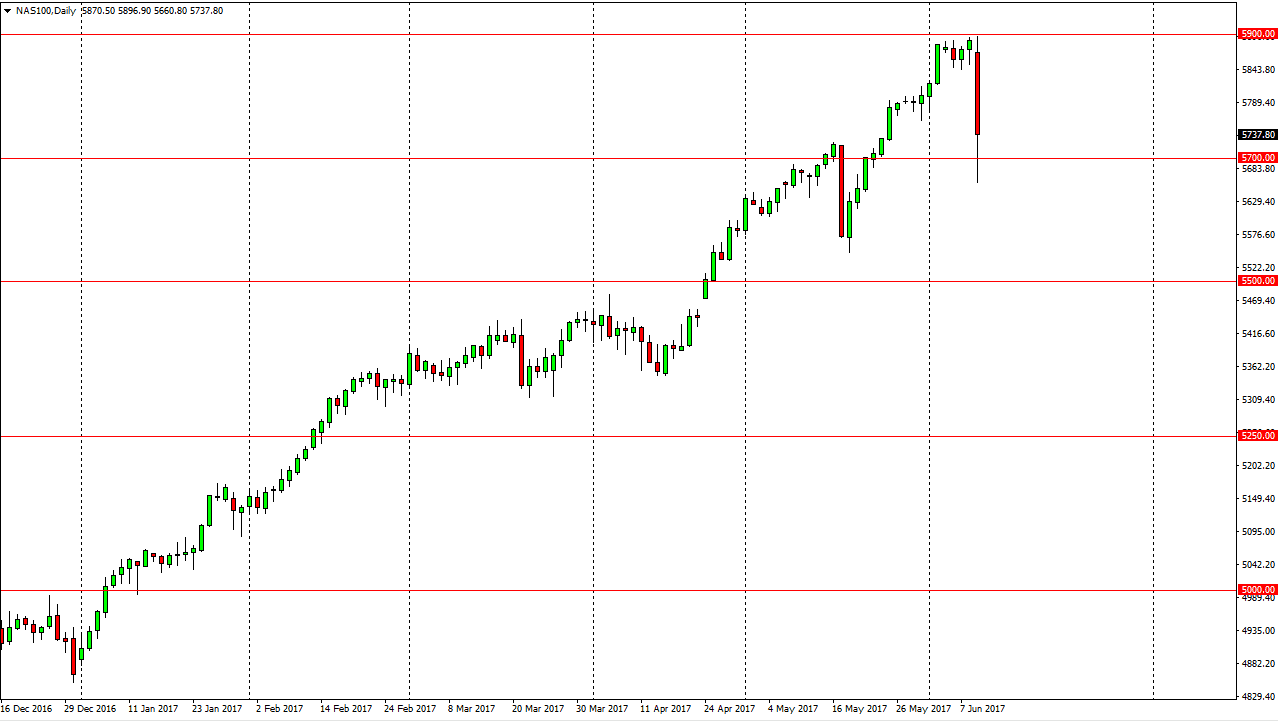

NASDAQ 100

The NASDAQ 100 broke down precipitously during the day on Friday, and even broke down below the 5700 level one point. Having said that, we did find support just below there, and the NASDAQ 100 is showing signs of life. I’m not ready to buy this market yet, I would rather see a full day of stability, but quite frankly the selloff was probably overdue and it was due to just a few stocks such as Alphabet, (Google) and Apple. This being the case, I do think that eventually traders will come back into this market and quite frankly I think that the farther we drop, the more interesting it becomes. I believe the market will still continue to go towards the 6000 handle above there. Wait for the market to calm down a bit, then look to pick up value as the NASDAQ 100 look so healthy.