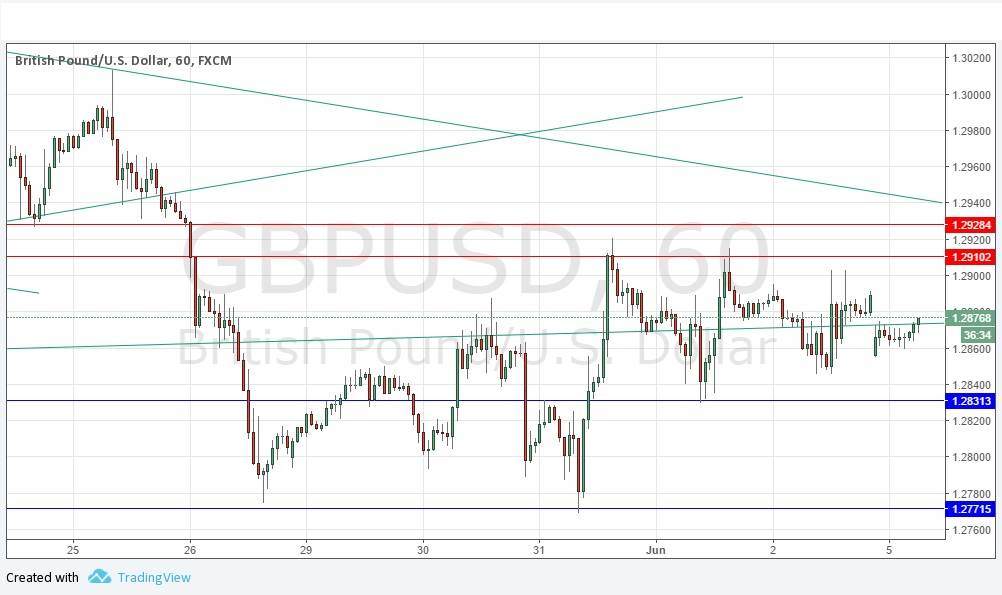

Last Thursday’s signals produced profitable trades off both 1.2831 (long) and 1.2910 (short).

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may be entered between 8am and 5pm London time today only.

Long Trades

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2831 or 1.2772.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Short Trade 1

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 1.2910 and 1.2928.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

There is continuing uncertainty over Britain’s political future, with opinion polls continuing to show a tightening of the contest leading into Thursday’s General Election. The weekend’s terror attack in London has contributed to the mood of uncertainty. Should the Government fail to secure a workable majority in the election, this pair is likely to fall strongly, and if it looks as if the opposition Labour Party could form the next Government, we are likely to see a huge fall of more than 10%, similar to the drop which occurred after Brexit.

Meanwhile, the pair is likely to continue to range predictably between the key support and resistance levels shown in the chart below, which could provide some small but significant opportunities.

Concerning the GBP, there will be a release of Services PMI data at 9:30am London time. Regarding the USD, there will be a release of ISM Non-Manufacturing PMI at 3pm.