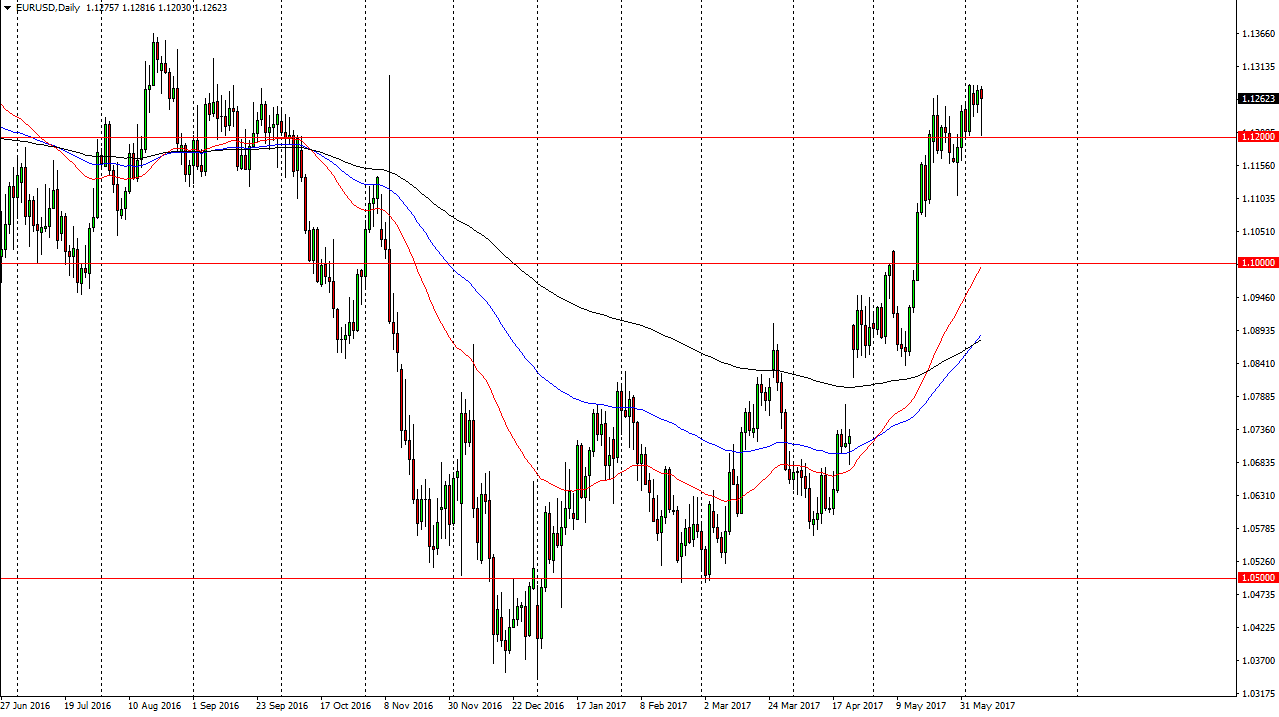

EUR/USD

The Euro initially fell during the trading session on Wednesday, and then bounced again, only to fall again and then bounced yet again. The 1.12 level has offered significant support both times it was challenged during the day. The resulting candle was a hammer, which is a very bullish sign. The fact that the 1.12 level continues to attract buyers suggests to me that the market is ready to go higher. If I did not know that there was an interest rate decision and more importantly a press conference later today, I would assume that the breakout is all but imminent. However, what I would think is that the market is certainly “leaning” to the upside, and I believe that buyers continued to push to higher levels, most notably at the 1.1350 level above.

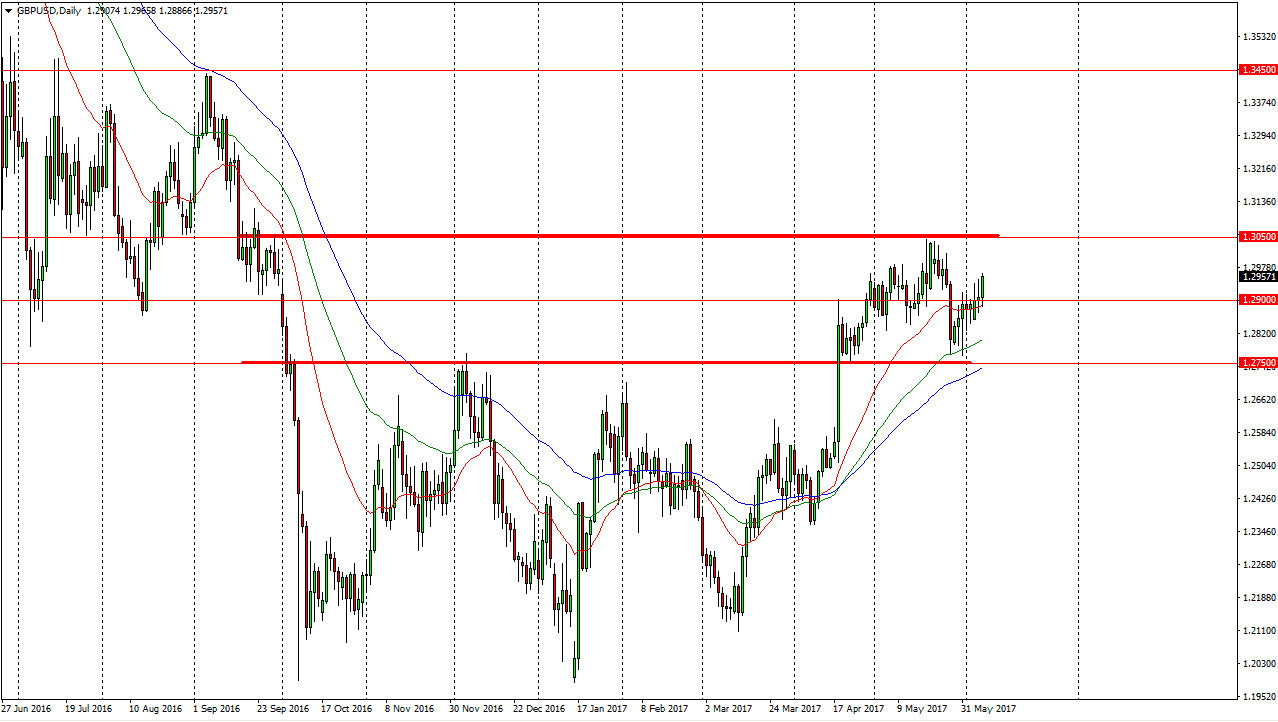

GBP/USD

The British parliamentary elections are today. This is without a doubt the biggest factor in this pair, but I would say that it looks as if the market is leaning to the upside as well, and that we will be challenging the 1.3050 level rather soon. If we can break above there, then I believe that the market goes to the 1.3450 level over the longer term. We’ve had a rough couple of weeks, but I think that unless there’s some type of major defeat for the Conservative party and the United Kingdom, the market should continue to grind higher. If they can sweep Labour, that would send this market much higher. I suspect that we are about to see a continuation of the grind higher as not much will have changed. Pullbacks of this point in time look to be supported at the 1.2750 level, and I would look at them as value as long as we can stay above that handle.