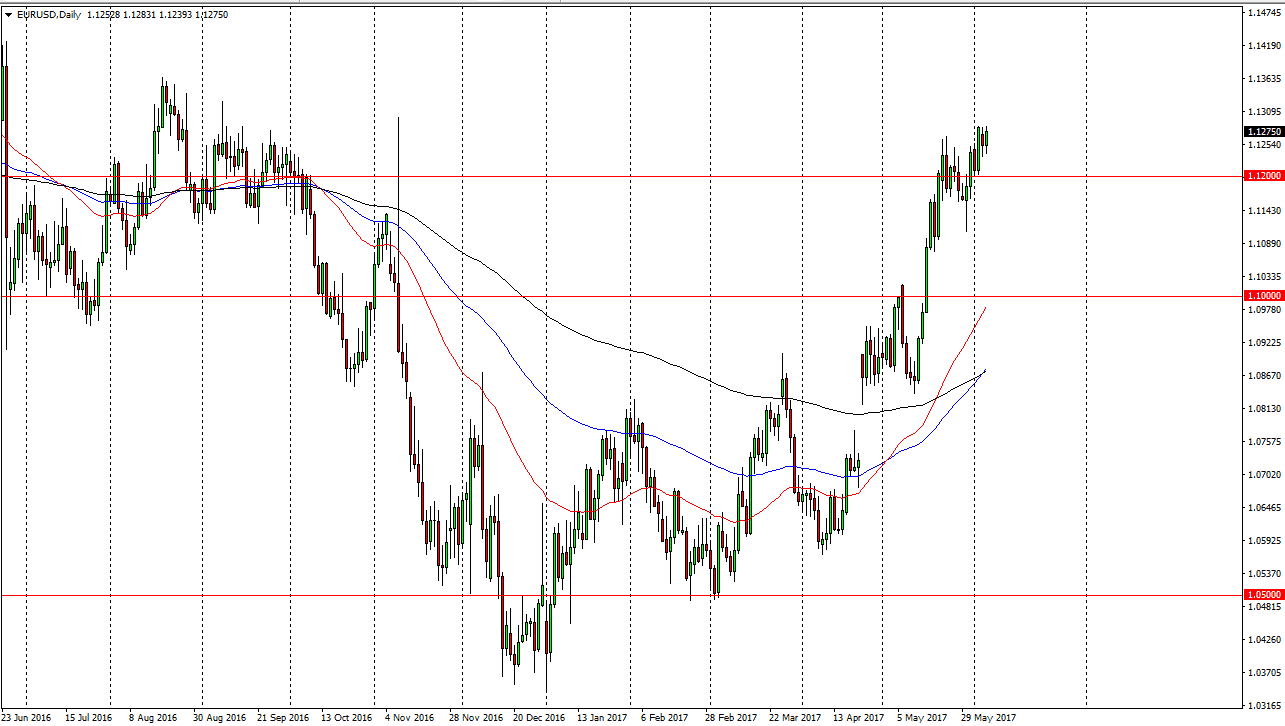

EUR/USD

The EUR/USD pair initially fell during the day on Tuesday but turned around to show bullish pressure. Ultimately, I believe that the market should continue to go higher, but we have the ECB Monetary Policy Statement coming out tomorrow will of course keep the market a bit quiet. I think pullbacks will continue to be supported between now and then, and that the 1.12 level should be a floor in the market. If we can stay above there, I think the market will continue to grind higher, and reach towards the top of the longer-term consolidation that we have seen over the last 3 years. Between now and then, it’s difficult for a lot of money into the market because there is so much riding on what happens on Thursday. The 1.15 level above is my longer-term target, so I believe that an impulsive candle to the upside is a buying opportunity just as a supportive candle is.

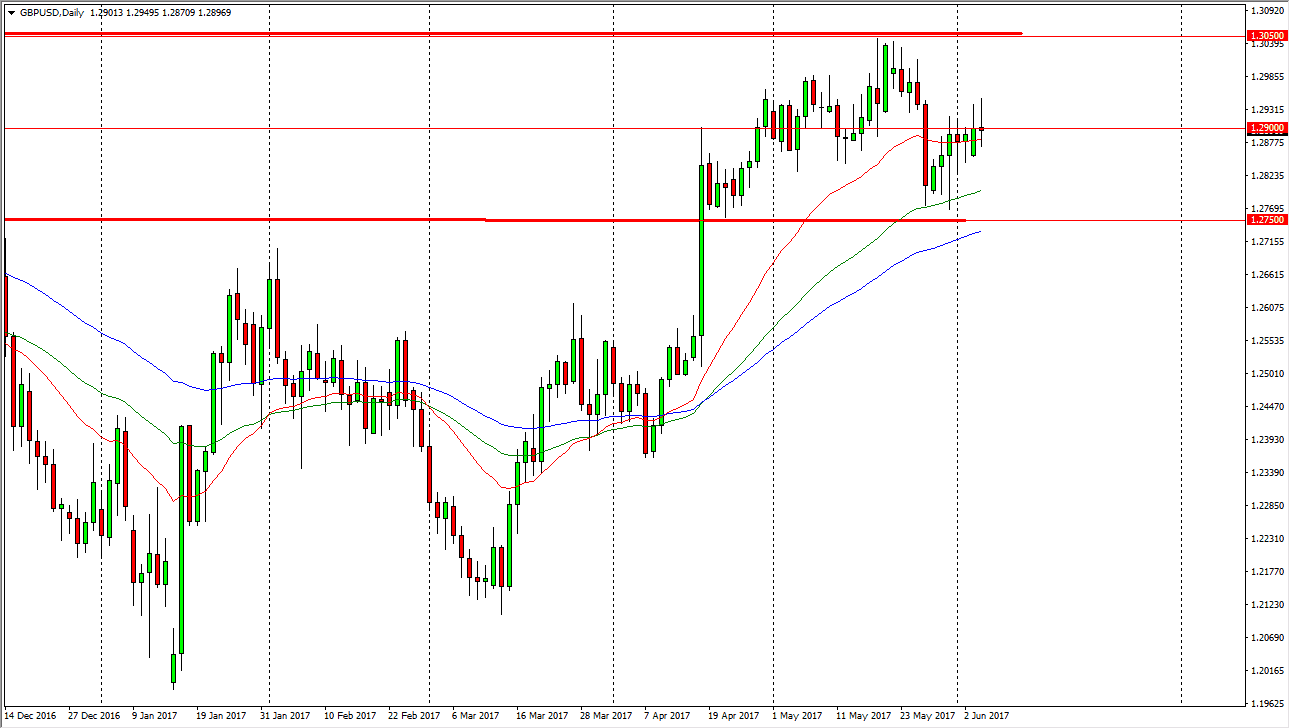

GBP/USD

The British pound had a volatile session on Tuesday, as we continue to hover around the 1.29 handle. With the UK elections coming up tomorrow, is very likely that the market will be hesitant to move very rapidly, unless of course we get some type of sign that the conservative party and the United Kingdom takes complete control. Since it doesn’t seem to be that way right now, I believe that we are going to continue to consolidate in a very tight range between now and then. Because of this, I am out of this market. However, I recognize that a break above the 1.3050 level is a very bullish sign, just as a breakdown below the 1.2750 level would be a very bearish sign. Ultimately, we should get some type of signal to trade for a longer-term move, but it probably isn’t going to comment until either late Thursday or early Friday.