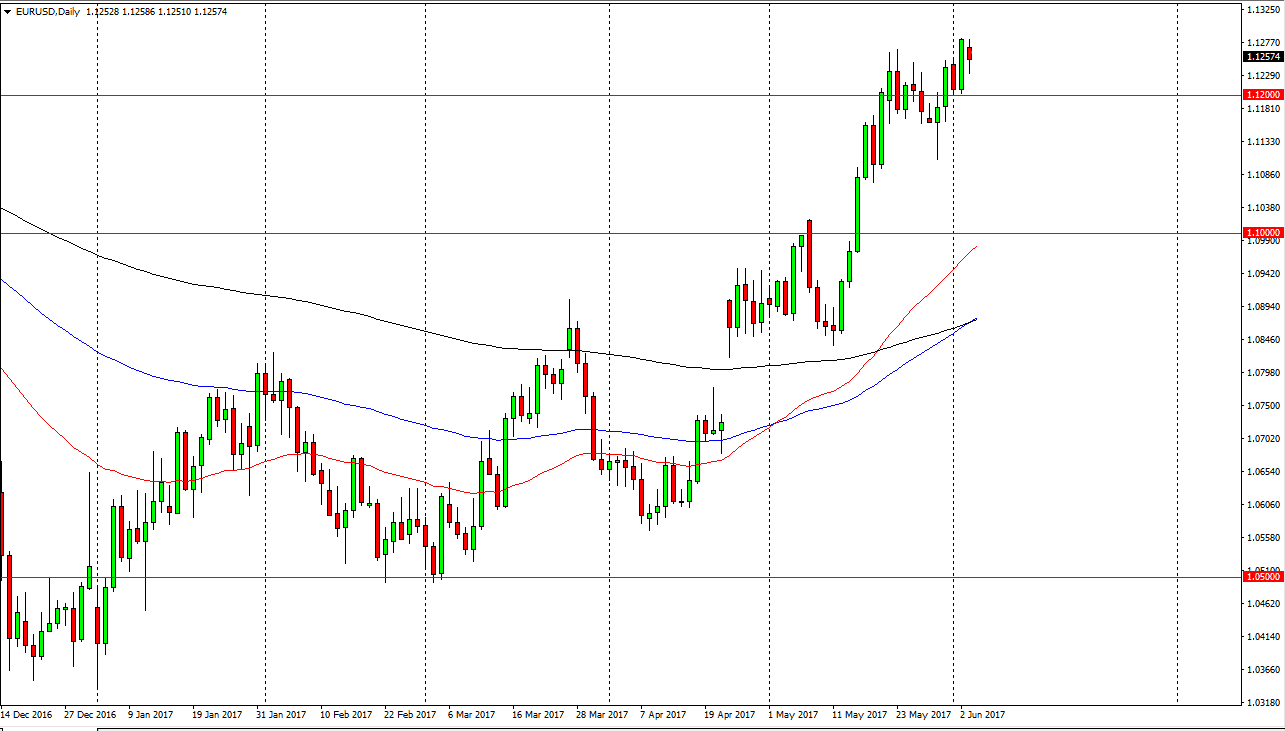

EUR/USD

The EUR/USD pair fell significantly during the day on Monday, but did find a bit of support underneath as the longer-term uptrend should continue. The 1.12 level underneath should continue to be supported as well, so I think pullbacks continue to be an opportunity to pick up this market on the cheap. The ECB has an interest rate statement later, and of course people will be looking for some type of opportunity to move the markets themselves. If they sound even remotely hawkish, this pair should continue to go to the upside. My best case is that we are trying to reach the top of the previous consolidation area for the last three years, which is the 1.15 level. Selling is all but impossible at this point.

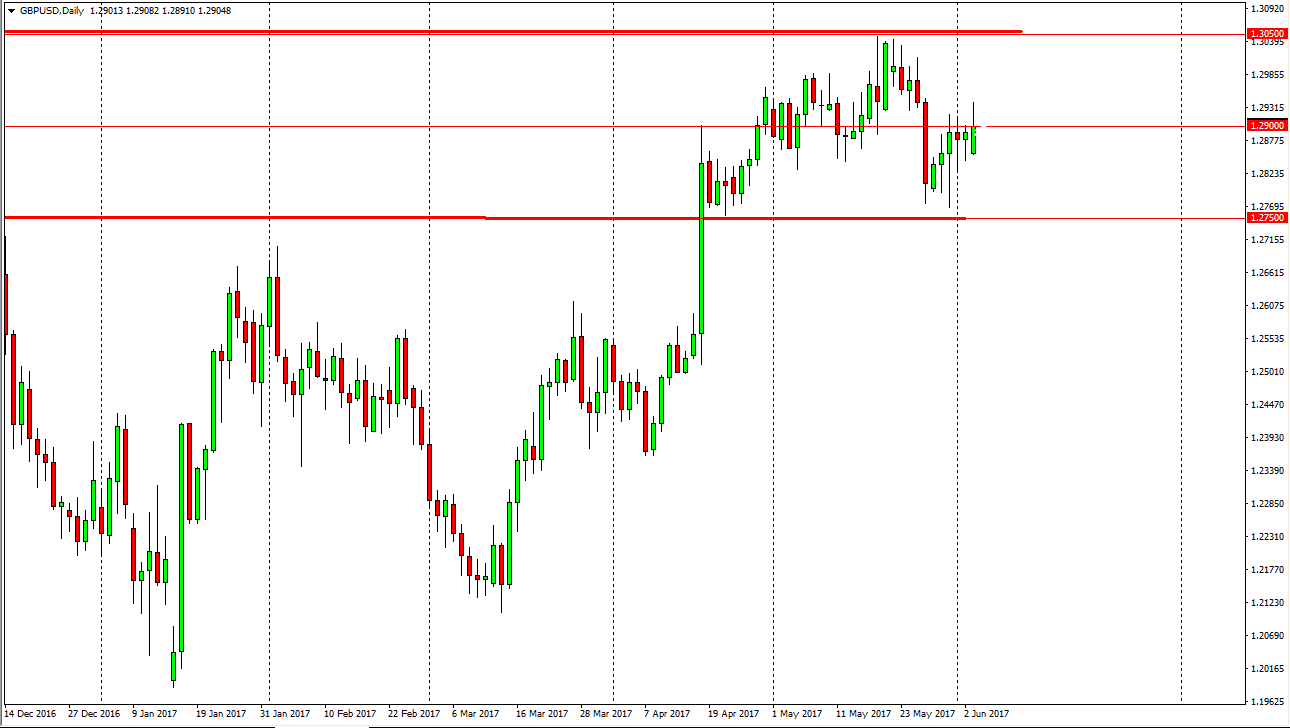

GBP/USD

The British pound rallied during the session on Monday, breaking above the 1.29 level. This market should continue to go higher though, and I believe that pullbacks are buying opportunities in what should be a longer-term move to the upside in my estimation. However, expect a lot of back-and-forth trading over the next several days as the British elections are coming out on Thursday. In fact, both of the pairs in this video will be a bit choppy over the next few sessions as we await the results of not only the British election, but the ECB interest rate decision as well, because of this I expect to see very little decided between now and then. This is why I would anticipate that the back and forth action will continue. I do have an upward bias in this pair though, and once we break above the 1.3050 level, the market could very well find its way towards the 1.3450 level longer-term. Alternately, if we were to break down below the 1.2750 level, that would be very negative.