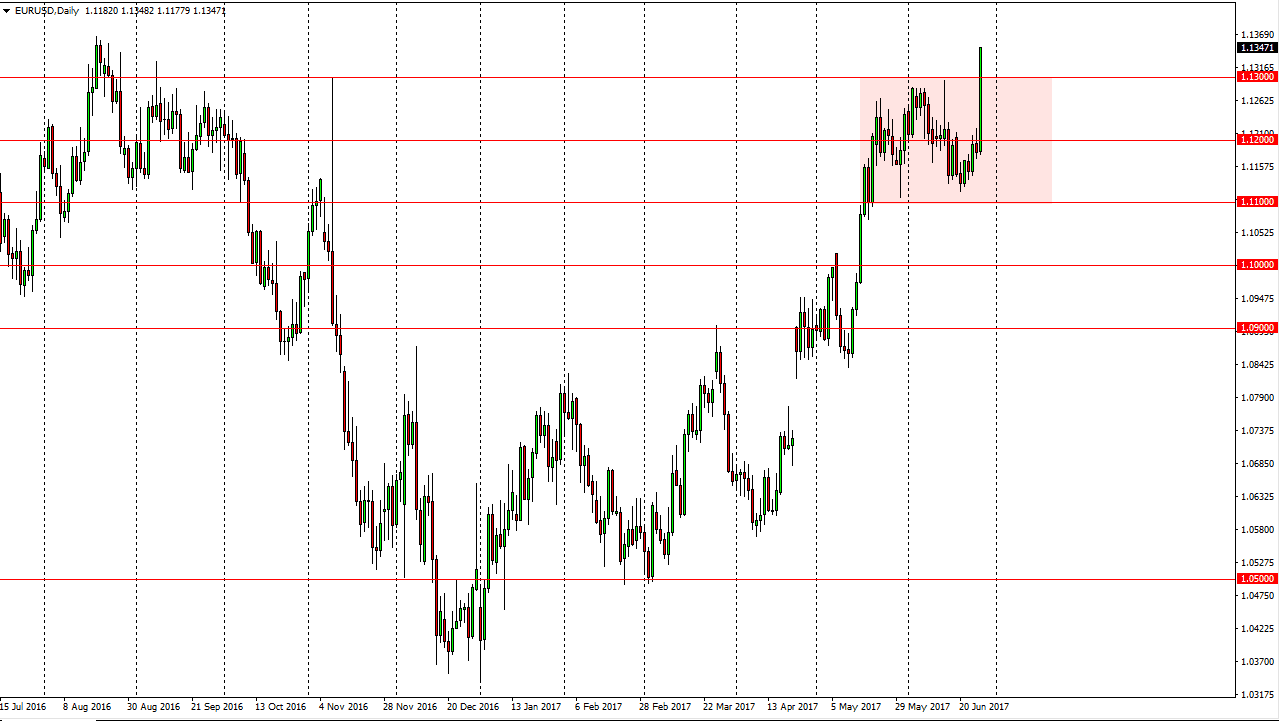

EUR/USD

The EUR/USD pair broke out to the upside during the day on Tuesday, slicing through the 1.13 level as ECB President Mario Draghi suggested that interest rates could be tightened sooner than the market thought. That being the case, I think the pullbacks continue to offer buying opportunities as we will go looking for the top of the three-year consolidation area. That would have the market looking for the 1.15 level, where there would be a significant amount of resistance. That being the case, the market looks as if it will go higher in the short term, so therefore I am a buyer of the EUR as we pull back and offer value. I would have no interest in selling this market anytime soon, as the bullish pressure has most certainly picked up.

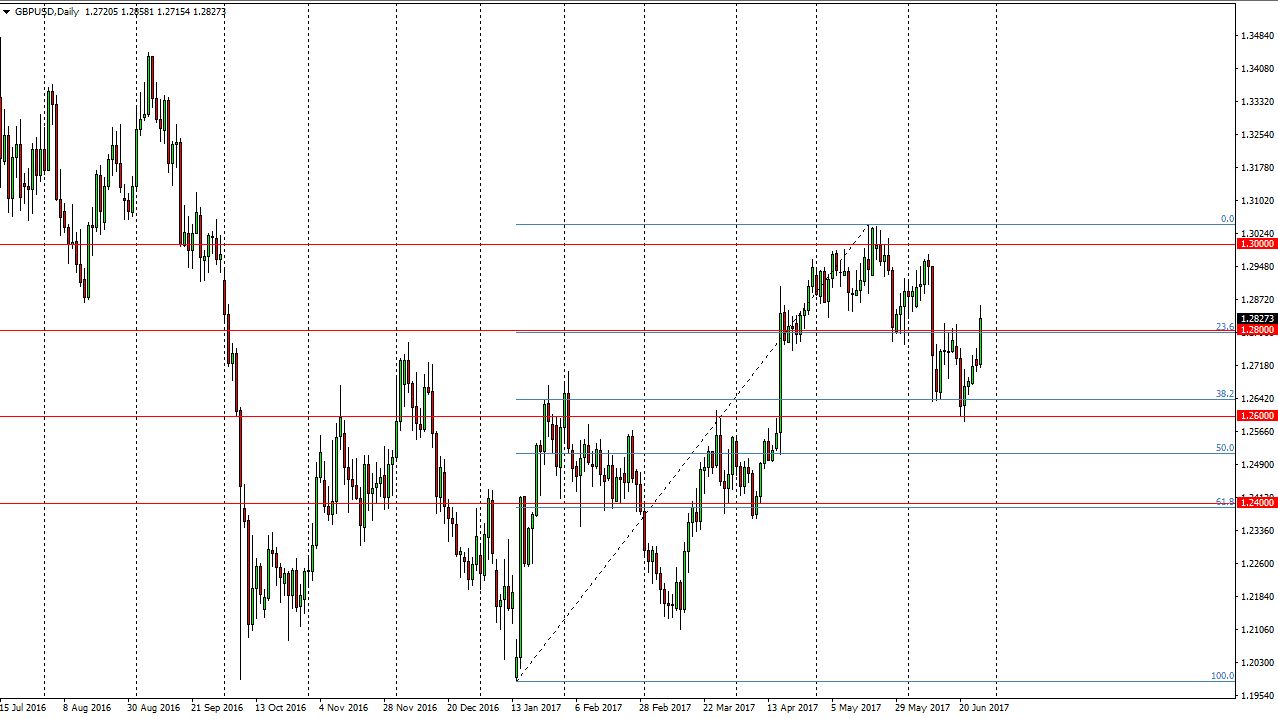

GBP/USD

The British pound broke out to the upside, breaking above the 1.28 level. Now that we’ve clear that area, looks as if the market is going to reach towards the 1.30 handle. I have no interest whatsoever in shorting this market, as it looks like the British pound is trying to turn around its overall attitude. Given enough time, we should go looking for the 1.3 handle as I mentioned, but in the end, it’s going to be very noisy all the way up to the level. A break above there should send the market even higher, perhaps reaching towards the 1.3450 level. Ultimately, this is a market that will continue to be volatile due to the headlines coming out of London and Brussels during the Brexit negotiations. However, I think that we are starting to see serious doubts about the Federal Reserve being able to raise interest rates, so they are starting to punish the US dollar. Given enough time, I believe that we are going to see this market change the overall trend, and go to the upside, especially once we get some type of clarity out of the negotiations.