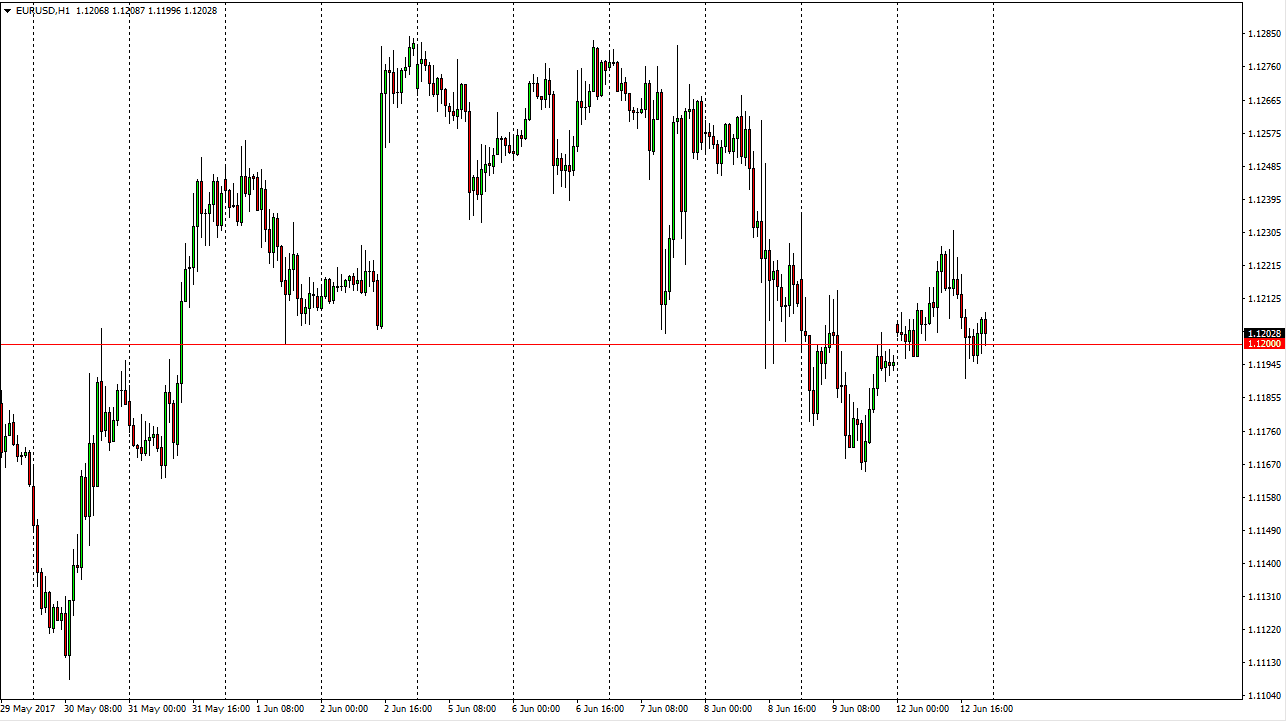

EUR/USD

The EUR/USD pair initially tried to rally during the day on Monday, but found enough resistance above to turn around and fall significantly and reach towards the 1.12 level. The market had formed a hammer during the Friday session though, and there is a hammer from several sessions ago just below there. Because of this, I think that eventually the buyers will continue to jump back into this market, perhaps trying to reach towards the 1.13 level. The Federal Reserve has the meeting on Wednesday that will move the market of course, but quite frankly I feel that this is a situation where the market will probably be relatively quiet between now and then. Because of this, you may be better served to stay away from this pair until we get those announcements.

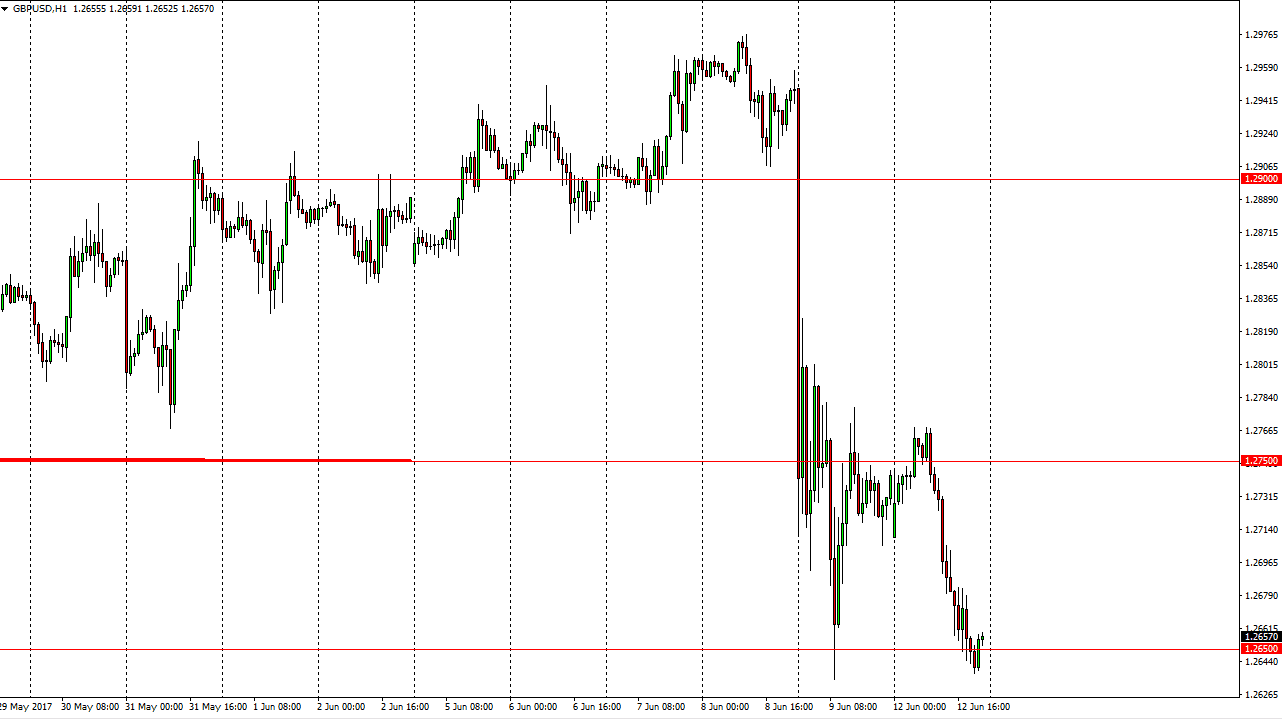

GBP/USD

The British pound continues to struggle, as we had initially rally during the session on Monday, but found sellers yet again. We find the market down at the 1.2650 level, and that could lead to much lower levels. I believe the market will below there could really put some serious pressure on the British pound. Ultimately, the market will be volatile regardless, because quite frankly there are a lot of headlines that could move the British pound due to the election results. If we did break above the 1.2750 level however, I would be a buyer as it would be a very strong sign that the markets are starting to show a bit of faith in the British pound, and perhaps at the very least are starting to shed some fear. On that move, I would anticipate that we will go looking for the 1.3050 level over the longer term. Either way, this is can be a rocky market, but as I look at the close on Monday, I suspect that the downward pressure is more likely than not.