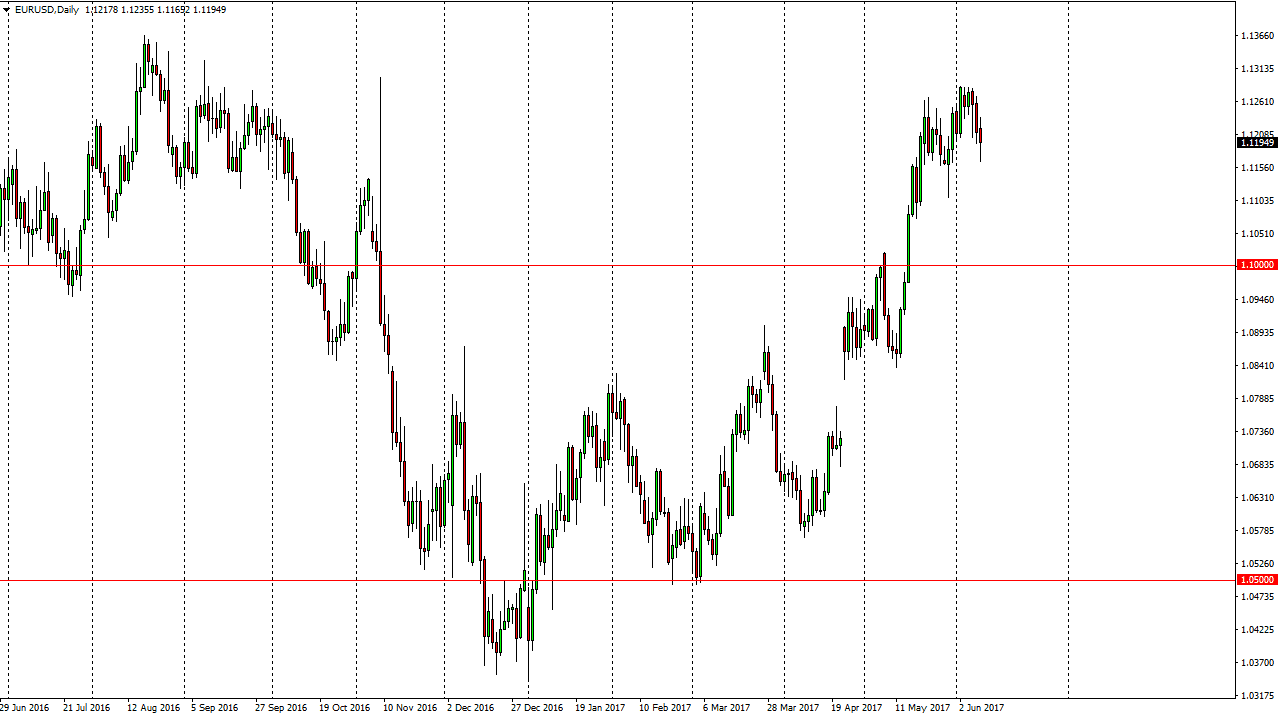

EUR/USD

The EUR/USD pair had a very volatile session during the day on Friday as the EUR was a beneficiary of the surprise elections in the United Kingdom. That being the case, we went back and forth during the day, but ultimately what I found interesting is that we broke down significantly, but turned around to show signs of support at the 1.12 handle. The hammer that formed for the day suggests that we are going to continue to see buying opportunities going forward, reaching towards the 1.13 level. A break above there should send this market towards the 1.15 level over the longer term. Having said that, we have been very bullish lately, so having said that it’s likely that the market should continue to see buyers jump into the market on pullbacks, but we may need to build up enough momentum to finally go higher.

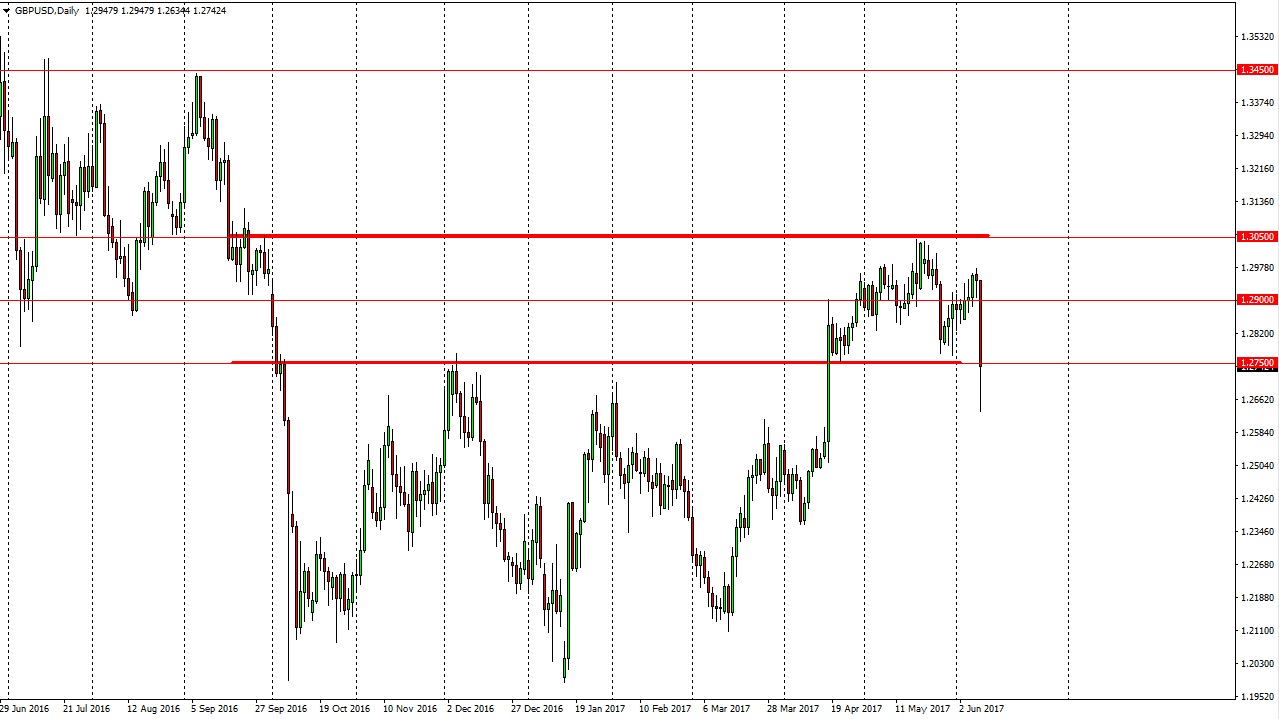

GBP/USD

The British pound fell significantly after the UK parliamentary elections, breaking down almost immediately. The 1.2750 level underneath has been significant support as of late, just as it was massively resistive in the past. Now that we have broken down below there and then bounced back towards the level, I think if we can possibly bounce and show signs of strength from that point. I would wait until we get a supportive daily candle though, because quite frankly it would not take much to freak this market out again. If we break down below the bottom of the range for the session on Friday, the market should then go much lower, perhaps reaching towards the 1.2350 level after that and then the 1.21 level below there. Regardless what happens, you can anticipate quite a bit of volatility. Because of this, smaller positions will probably be favorable, building upon winning trades.