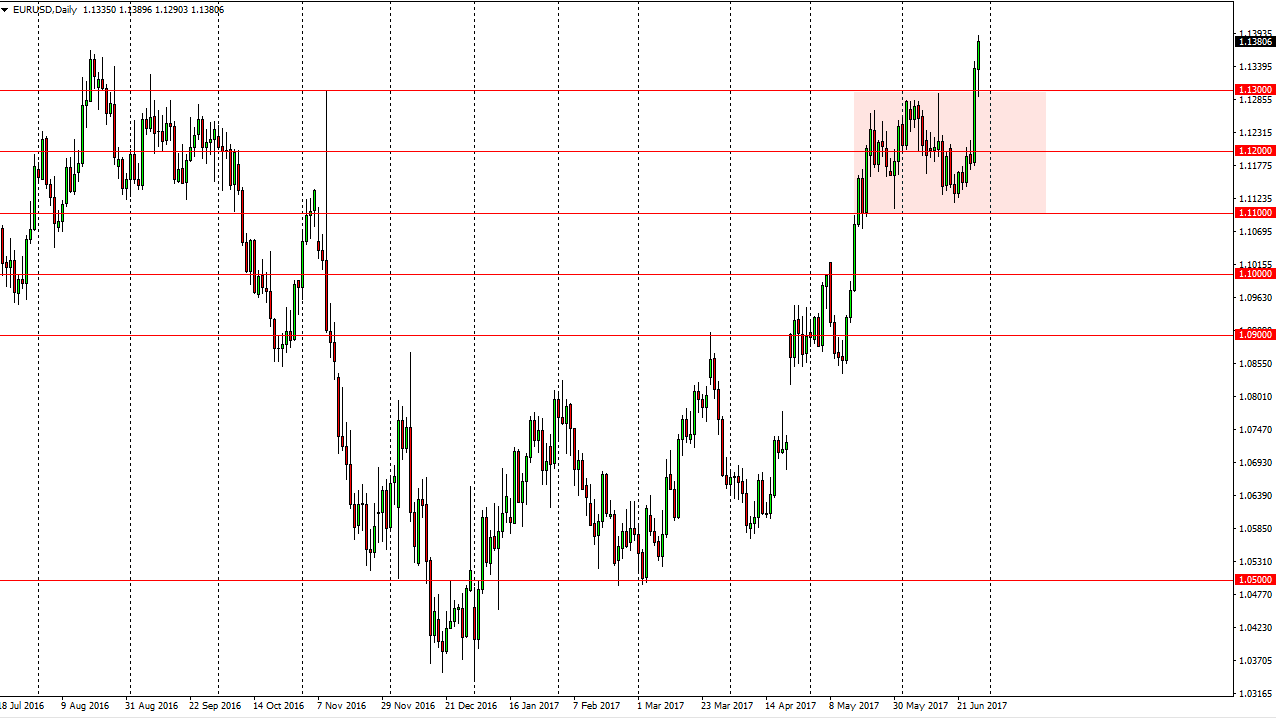

EUR/USD

The EUR/USD pair initially fell during the day on Wednesday, essentially due to the rumor going around that the ECB had been misunderstood with that statements the previous day. The 1.13 level underneath offered enough support to turn the market around and bounce to the upside. It now looks as if we are going to continue to go towards the 1.15 level over the longer term. After all, this is a market that has been consolidating between the 1.05 level on the bottom and the 1.15 level above. The market looks very bullish overall, and I think that buying the dips will continue to be the way going forward. Ultimately, I have no interest in shorting this market as we have seen so much in the way of buying pressure when it comes to this currency pair, and I believe that the 1.13 level will essentially offer a “floor” in the market.

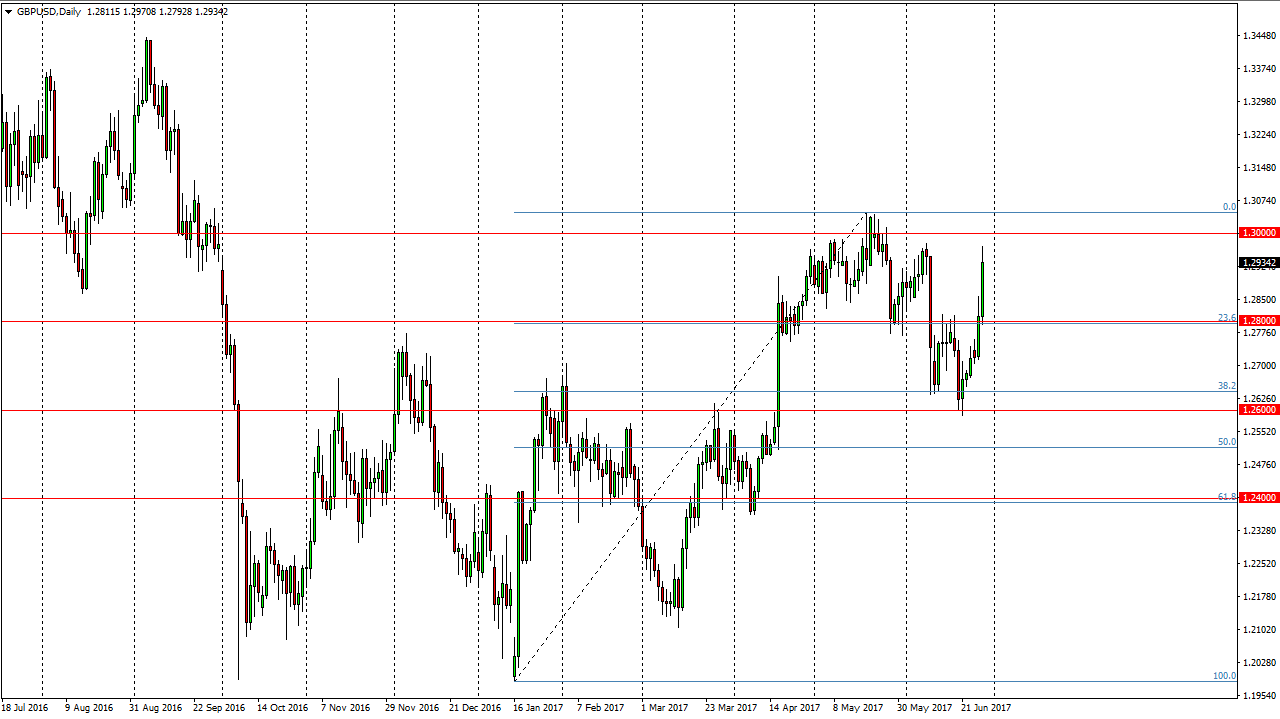

GBP/USD

The British pound skyrocketed during the day, as the 1.28 level offered support and we then broke above the 1.29 level. The market looks very likely to find buyers on dips, and I think we are going to reach towards the 1.30 level. A break above there should send this market even higher. The British pound is being lifted by the comments coming out of Mark Carney suggesting that the Bank of England will have to raise interest rates if the global market continues to heat up. That being the case, it’s likely that the buyers will continue to rally from time to time, and I believe that the 1.28 level underneath is going to be massively supportive. If we break down below there, then it would be very negative, but until then I believe that the buyers are most certainly in control.