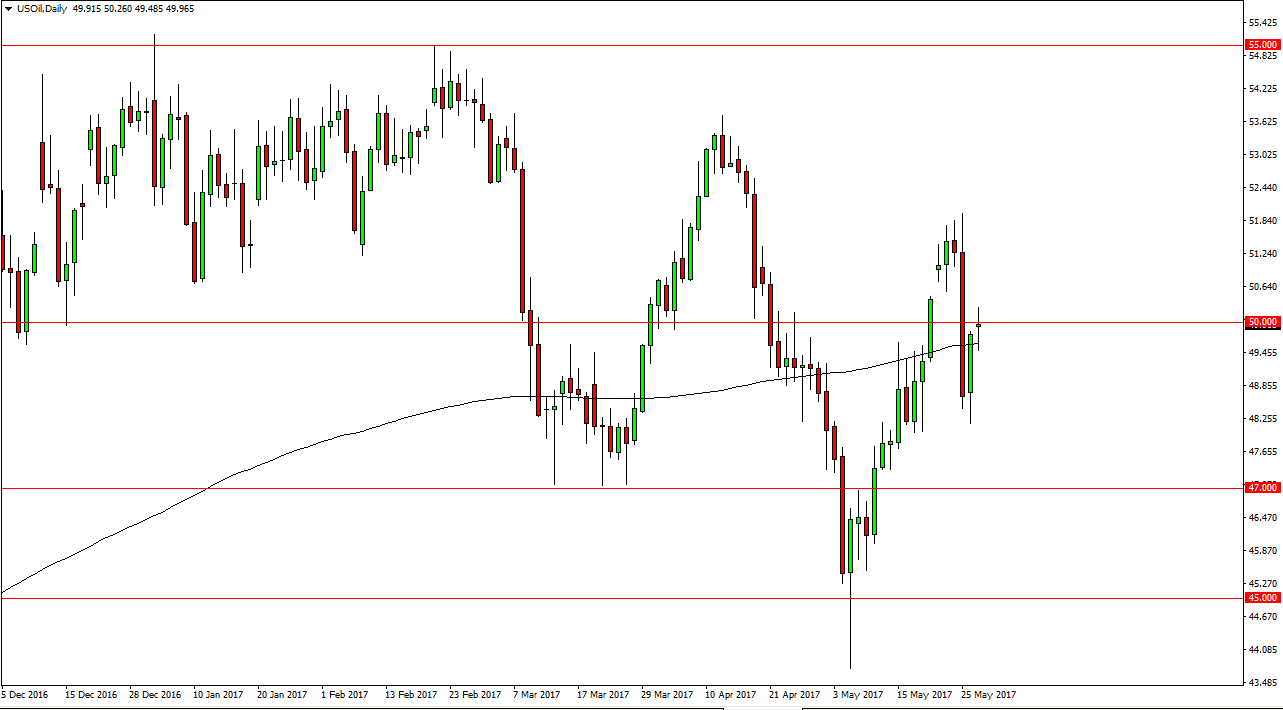

WTI Crude Oil

The WTI Crude Oil market had a volatile session, bouncing around the $50 handle. However, by the end of the day we ended up just below that level, but also just above the 200-day exponential moving average. This tells me that the market is going to continue to be volatile, and that an explosive moved could be coming. I believe that if we break above the top of the candle, that is a buying opportunity, perhaps sending this market towards the $51.75 level. A breakdown below the bottom of the candle for the session on Monday should send this market down to the $48.25 level next. Either way, I think you can say that we will probably see a violent move coming next. WTI Crude Oil markets continue to struggle in general, as although we have production cuts, we also have massive amounts of crude oil flowing out of the United States and Canada.

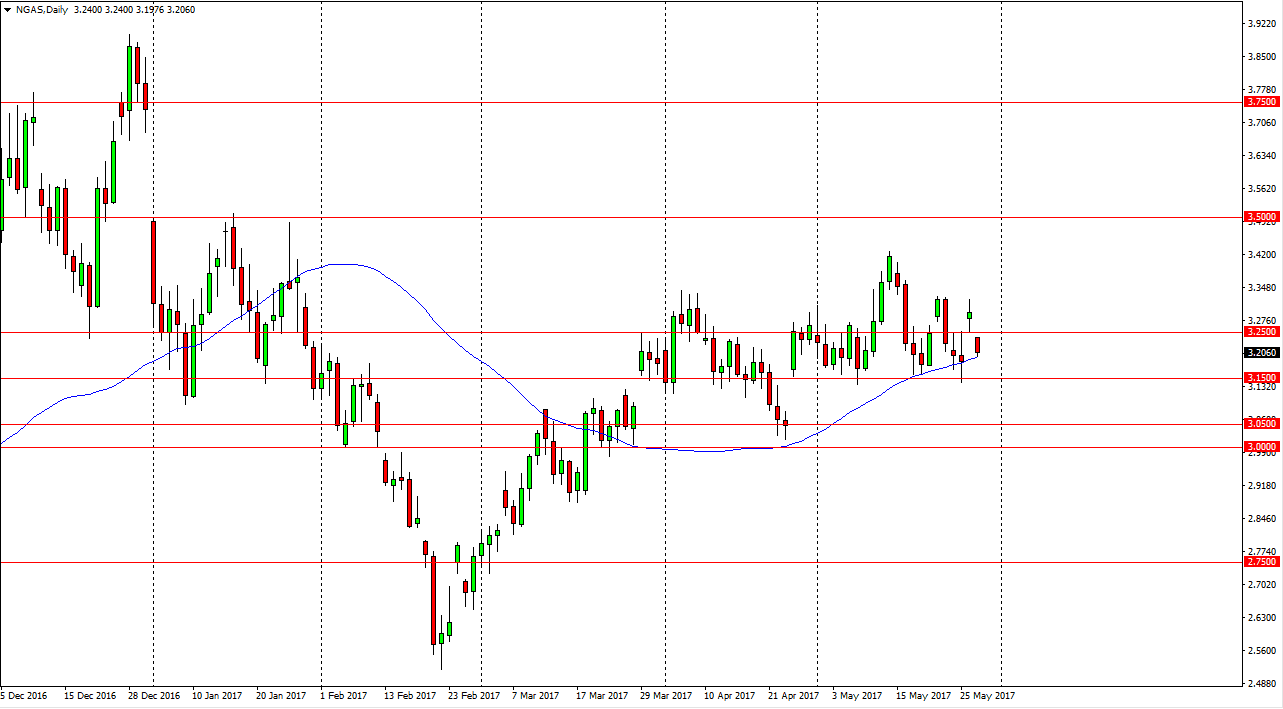

Natural Gas

The natural gas markets gapped lower during the day on Monday, but having said that it’s also worth pointing out that Monday was Memorial Day. That would have less liquidity in the market, so therefore the move may have been a little bit exaggerated. Ultimately, I believe that the $3.15 level underneath is massively supportive, and I believe that the market will probably struggle to go lower than there. However, if it does the market should continue to go down to the $3.05 level. Alternately, if we bounce from this area, I believe the market will then send this market looking towards the $3.25 level above. Regardless, expect volatility and therefore small positions will be the best way to go in this market. I think there is still a little bit of an upward bias, but clearly, we don’t have a whole lot to go on right now.