WTI Crude Oil

The WTI Crude Oil market fell significantly during the session on Tuesday as we continue to see quite a bit of bearish pressure in this market. We are sitting just on a decent uptrend line, and we did bounce from it during the trading day. It now looks as if the $47 level will be the last and of the buyers. We are below the 200-day exponential moving average, and a breakdown below the $47 level should open the way for the market to reach down to the $45 handle. I believe that any bounce at this point is probably going to end up being and I selling opportunity on signs of exhaustion, and would be surprised to see this market break above the $50 level. Until it does, I have absolutely no intentions of buying.

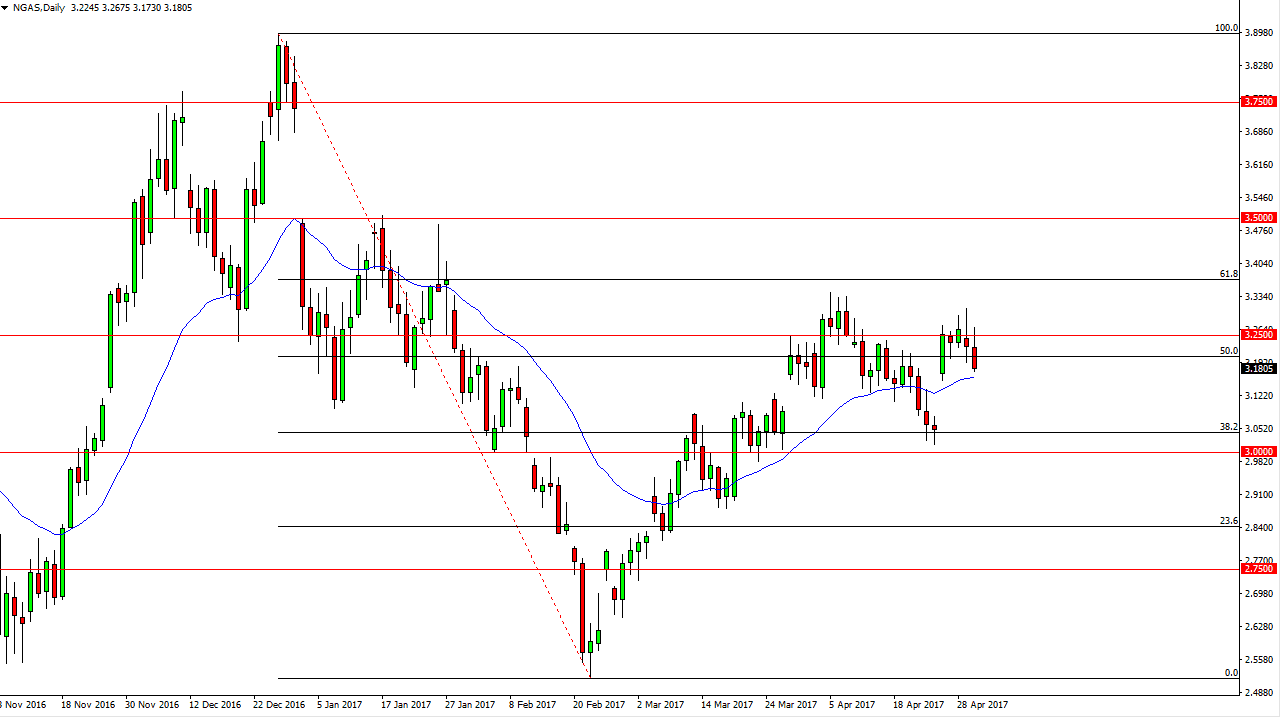

Natural Gas

Natural gas markets initially tried to rally but found enough resistance above the $3.25 level to turn things around and form a bearish candle. By doing so, we ended up dropping all the way down to the $3.18 level. A breakdown below the $3.17 level should send this market lower looking for the opportunity to fill the gap from last week. That could have the market falling as low as $3.05, and still be consolidated. I think short-term traders will look to sell this market, but is not until we break down below the $3 level that I would be concerned for the longer term viability of what has been a decent uptrend. If we break down below the $3 level, I don’t see the reason why the market doesn’t go looking for the $2.90 level and then eventually the $2.75 level. This is a market that will continue to be very volatile as we are starting to come out of the high demand season for natural gas.