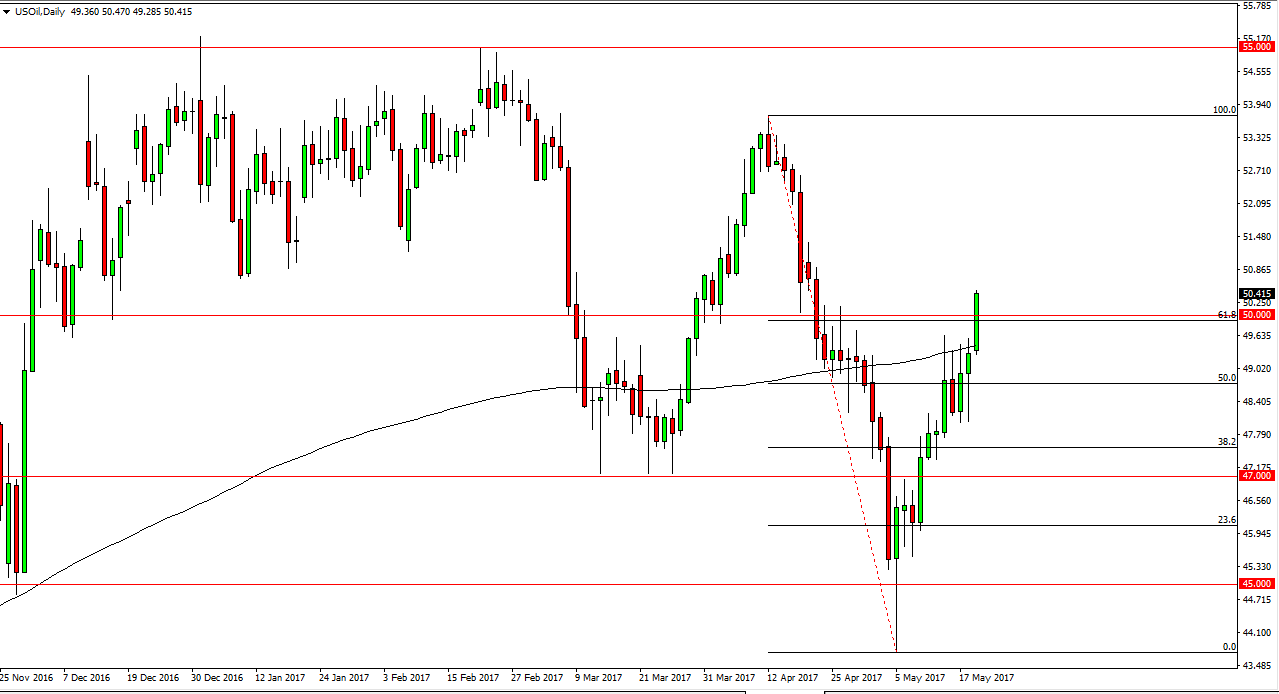

WTI Crude Oil

The WTI Crude Oil market had a very strong Friday, as we broke above the 200-day moving average finally. Not only that, we broke above the $50 handle, and it looks as if the crude oil markets are ready to continue going higher. My regular readers here at Daily Forex know that longer-term I think that oil markets are going to struggle, but it’s obvious that we are going to continue to go higher. The market is reacting to reports that not only will OPEC extend production cuts, but they may expand them, which is a very bullish move for supply, however having said that I also recognize that the higher this market goes, the more Canadians, Americans, and Mexicans start drilling. Because of this, it’s likely that the rally is short-lived, but I do certainly think that the buyers are in control currently.

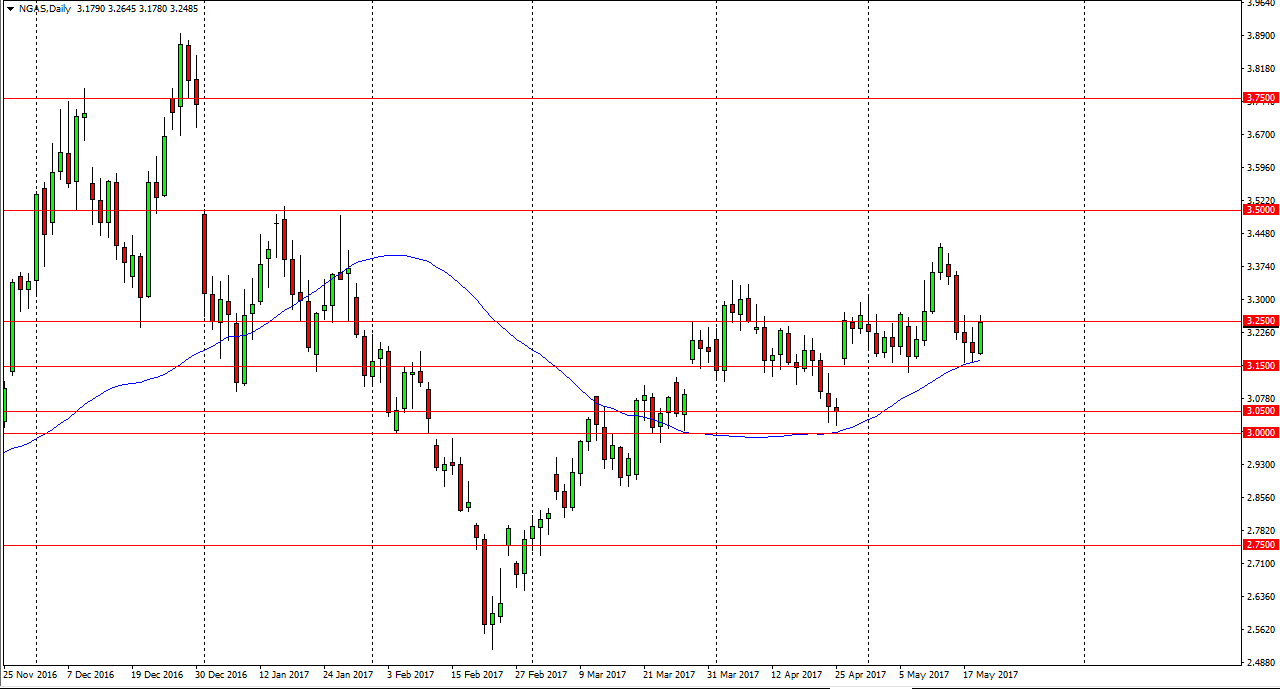

Natural Gas

The natural gas markets rallied significantly during the day on Friday, maybe not so much in range, but the fact that we broke above the shooting star from the Thursday session and slammed into the $3.25 level, an area that has been resistant. If we can break above the top of the candle for the session on Friday, the market should then go looking towards the $3.33 level, an area that has been resistive, and then potentially the $3.40 level which was the most recent higher. Ultimately, I think that the market will find buyers on dips as well, so I’m not interested in selling this market until we get below the $3.15 level again. As you can see, the 50-day exponential moving average is sitting just below current pricing, and it is offering dynamic support. However, if we break down below that $3.15 level, it makes sense that we would try to fill the gap down to the 3.05 handle.