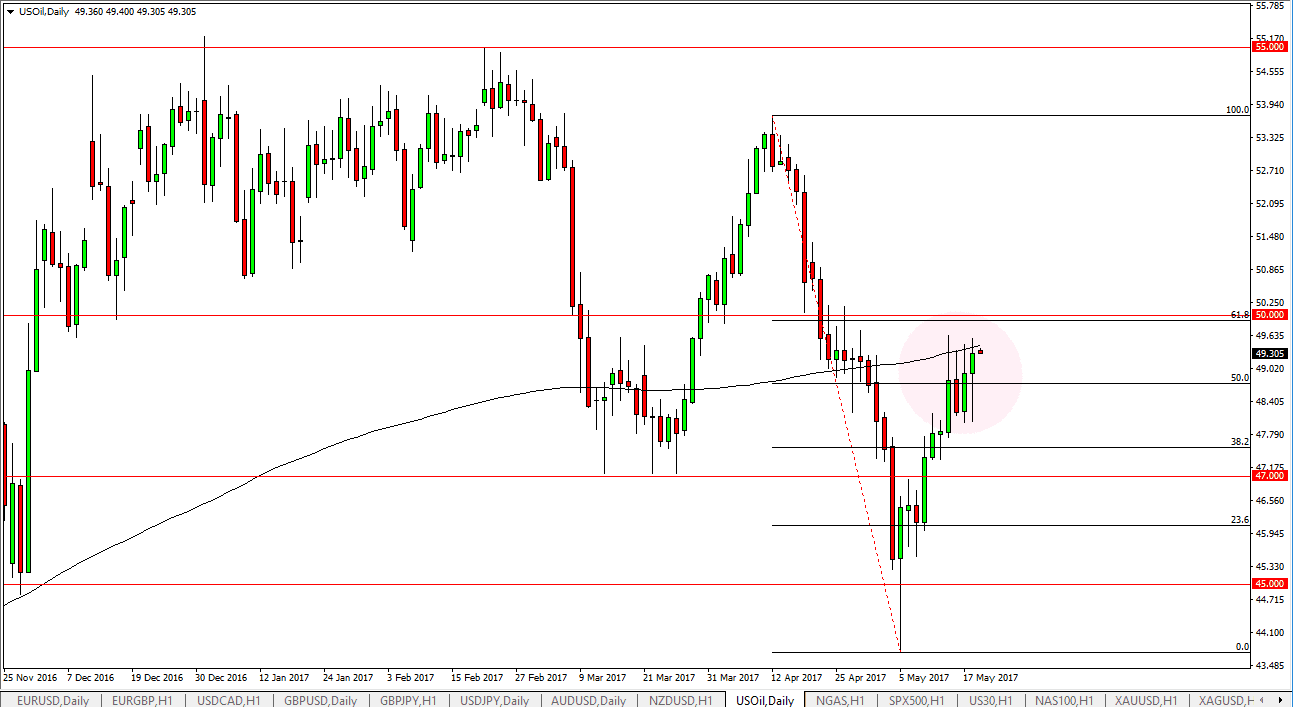

WTI Crude Oil

The WTI Crude Oil market had a volatile session on Thursday, initially falling towards the $48 handle, but turning around to show signs of support again. By forming a hammer for the day, it shows that the market is currently looking to test the $50 handle again, and perhaps try to break out above there. If we can get above the $50.50 level, I feel that the oil markets will have further to go. In the meantime, I would anticipate a bit of back-and-forth trading, as there seems to be an argument between demand versus supply right now. OPEC continues to talk about production cuts, but quite frankly they have not worked up to this point. Question now is whether or not the US economy can sustain more buying of crude oil. Expect a lot of noise and choppiness.

Natural Gas

Natural gas markets also had a volatile session, as we continue to bounce around in a very tight consolidate of area. I believe that the $3.15 level will offer support, while the $3.25 level will offer resistance. In the meantime, range bound short-term trading is probably the order of the day, and it’s not until we break out of this range that you can place any serious money to work. If we break down below the $3.15 level, we will more than likely go down to the $3.05 level underneath which would be filling a gap. Alternately, if we can break above the $3.25 level, we then will more than likely go looking for the highs again near the $3.40 level, with a certain amount of resistance near the $3.33 level. Until one of those things happen, this continues to be a scalping environment, so keep that in mind and remain nimble.