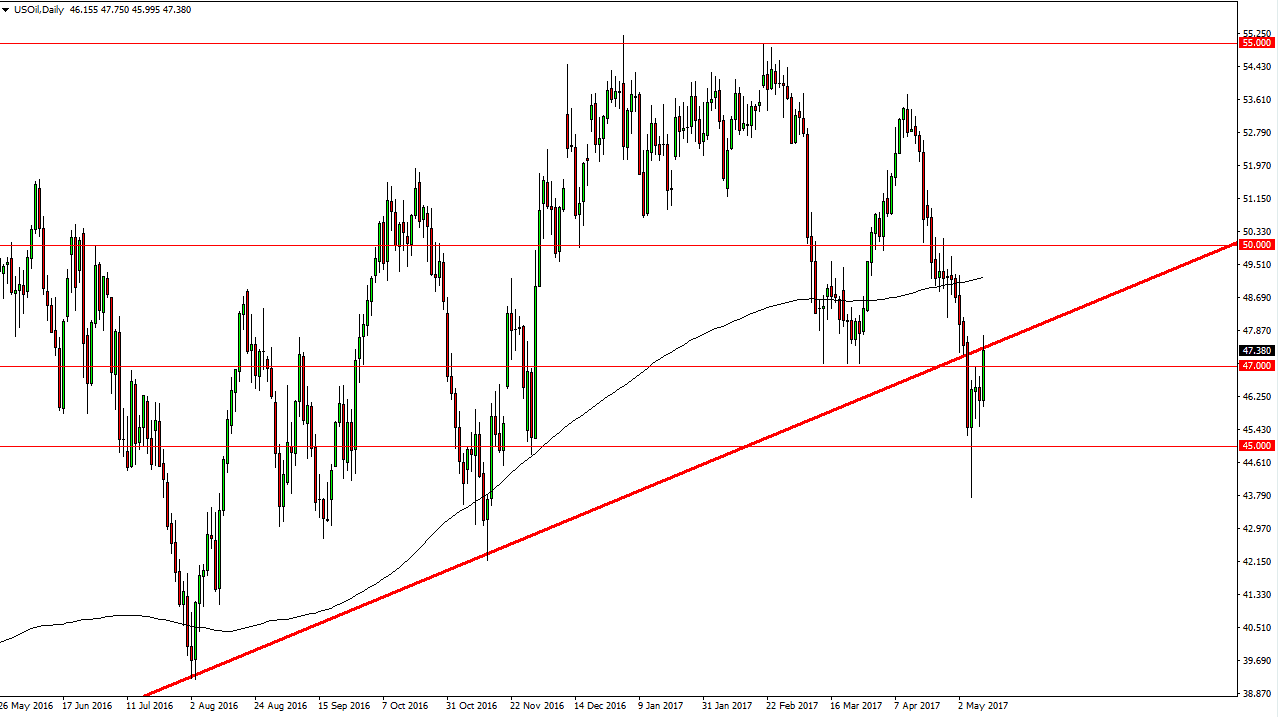

WTI Crude Oil

The WTI Crude Oil market exploded to the upside during the day on Wednesday after the Crude Oil Inventories announcement came out much more bullish than anticipated. However, the uptrend line that had previously lifted the market is now acting as reasonable resistance. Because of this, on a move below the $47 level I will not hesitate to start selling. After all, we have longer-term headwinds to deal with. Alternately, if we can break above the $48 level, it’s time to start buying as we should then go fishing towards the $49 level, and perhaps even the $50 level. Regardless what happens I would expect to see a certain amount of volatility. Oil market should continue to be very risky, so exercise caution and proper position sizing.

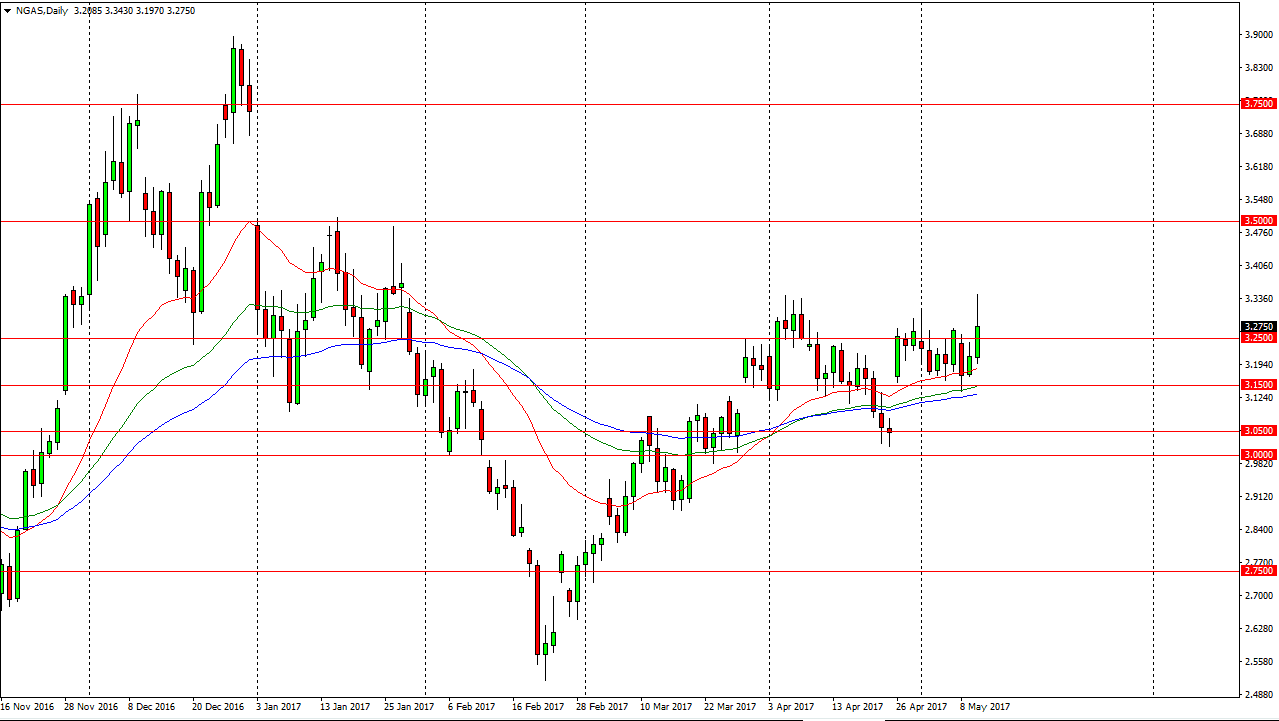

Natural Gas

Natural gas markets broke out to the upside and above the $3.33 level during the day. However, you can see that we pulled back significantly and therefore I don’t know that the market is convinced it is ready to break out for a longer-term move. I still believe that the pullbacks will offer buying opportunities from time to time, but short-term trading is about as good as the natural gas markets seem to get currently. If we can break above the top of the candle, then I feel that we will probably go to the $3.50 level above. In the meantime, the 3.15 level underneath should continue to be support, and the choppy volatility should continue to be a mainstay in this market. Back and forth short-term trading should offer the best opportunities in this market, and therefore I would not get too greedy until we get the longer-term breakout I mentioned above the $3.33 level. In the meantime, another opportunity may present itself in the binary options market if you have the ability.