Gold prices settled at $1228.41 an ounce on Friday as concerns that the Federal Reserve may raise interest rates as early as June, along with a rally in US equities, fueled a loss of more than 3% for the week. The Federal Reserve indicated on Wednesday that it was still on track for two more rate hikes this year despite recent mixed economic data. Strong corporate earnings and the upbeat U.S. employment data pushed the S&P 500 and Nasdaq composite to fresh records.

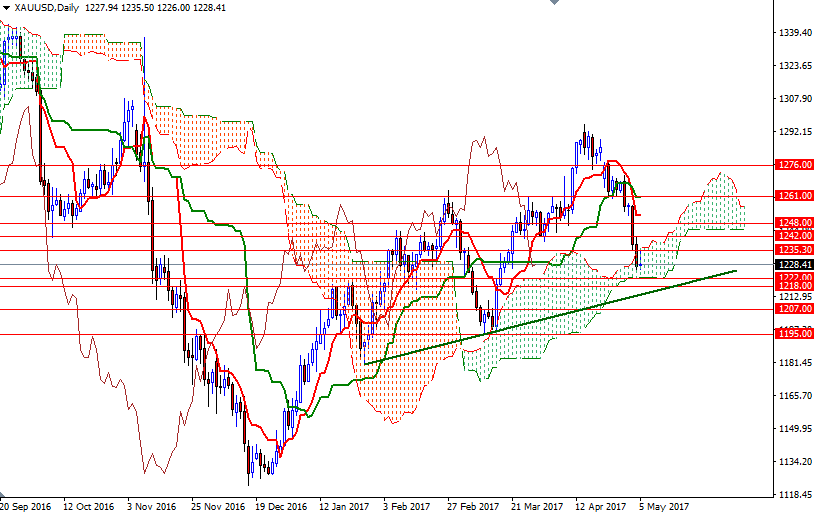

The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 189634 contracts, from 200677 a week earlier. The short-term charts are still bearish, with the market trading below the Ichimoku clouds on the H4 and the H1 time charts. In addition to that, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned, and the Chikou-span (closing price plotted 26 periods behind, brown line) is below prices on both charts.

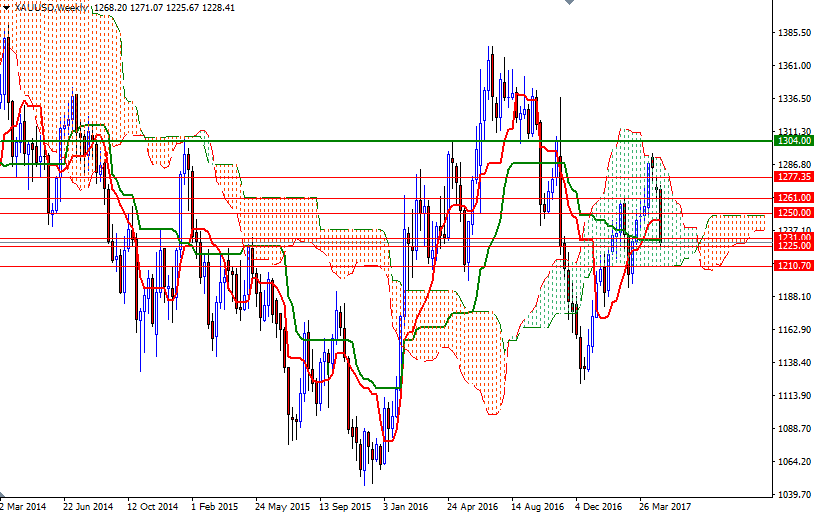

However, as I pointed out last week, XAU/USD is approaching an important an area where a medium-term bullish trend line and the bottom of the weekly and the daily charts cluster. Down below, there is an anticipated support zone that stretches from 1222 to 1218, so the market has to dive down below there to test the 1210.70-1207. If this support is broken, then the 1198/5 zone will probably be the next stop. Once below 1195, look for further downside with 1187 and 1180 as targets. To the upside, the initial resistance sits at 1235.30, followed by 1242. If XAU/USD convincingly penetrates 1242, we might see an extension towards 1250/48. A daily close above 1250 could foreshadow a move to 1265/1.