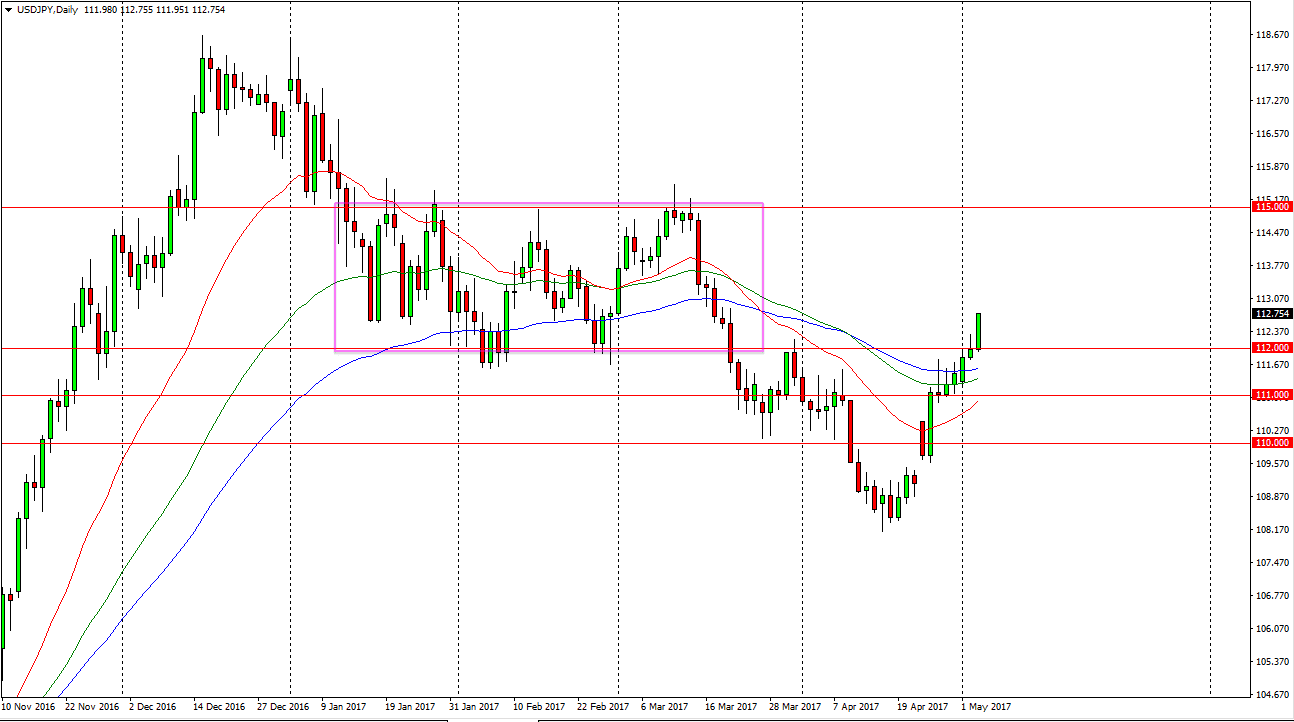

USD/JPY

The US dollar broke higher during the session on Wednesday, and more importantly breaking above the top of a shooting star from the Tuesday session. That’s a very bullish sign and I think we are going to continue to grind higher. Short-term pullbacks continue to attract buying as far as I can see and I think that the 112 level will offer a significant amount of support. We should continue going higher, and reach towards the top of the previous consolidation area which is the 115 level. It might be volatile on the way up, but certainly it looks as if we are starting to see a favoritism for the US dollar in general. I think that we are breaking out, and this move could be somewhat significant.

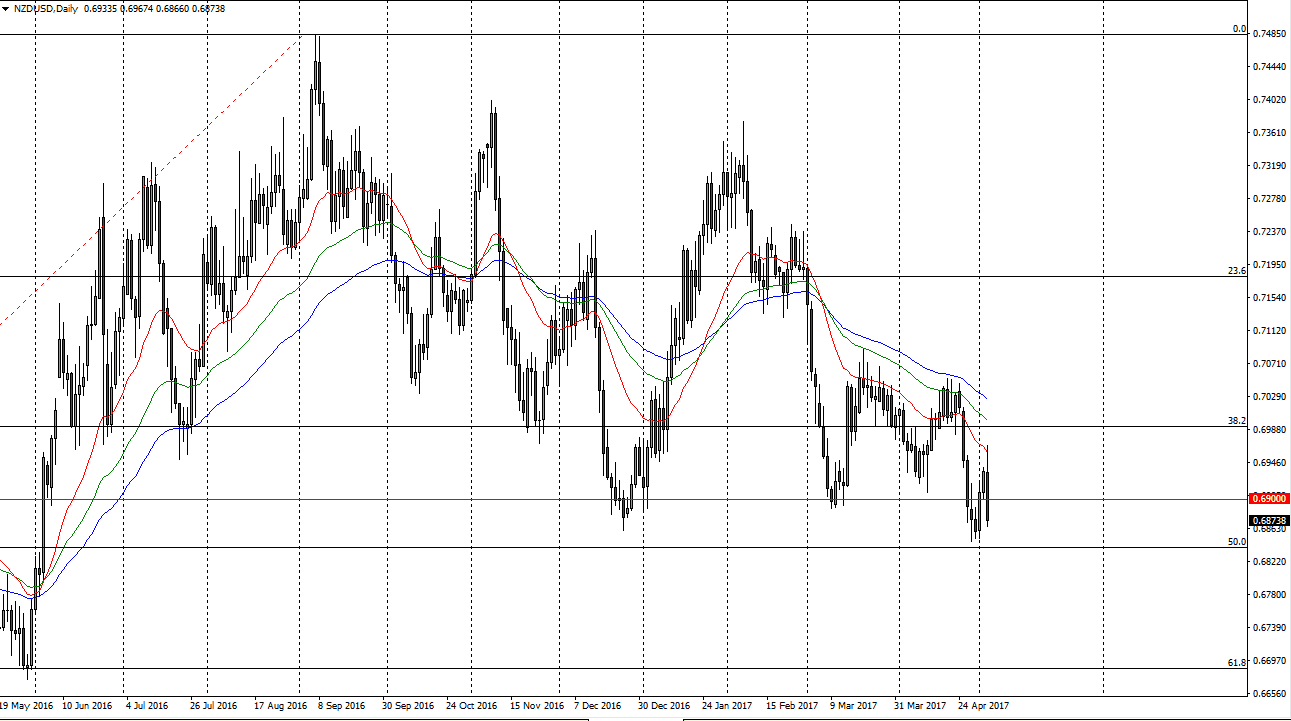

NZD/USD

The New Zealand dollar initially tried to rally during the session on Wednesday but turned around to fall significantly. We have broken below the 0.69 level, and I think it’s only a matter of time before we make a fresh, new low. If we can break down below the 0.6850 level, the market should continue to go towards the 0.67 handle. The New Zealand dollar is highly sensitive to commodity markets, which look very soft currently, especially oil. I think that selling rallies will continue to be a nice way to trade this market, and the downward pressure will certainly return time and time again.

Ultimately, I think that the selling continues to be a major driver of the market, and I have no interest in trying to go long until we break above the 0.70 level. The market continues to signify that the sellers are in control, and there’s really nothing on this chart that leads me to believe it’s going to change anytime soon. With this being the case, I will look to the short-term charts in order to take advantage of bounces.