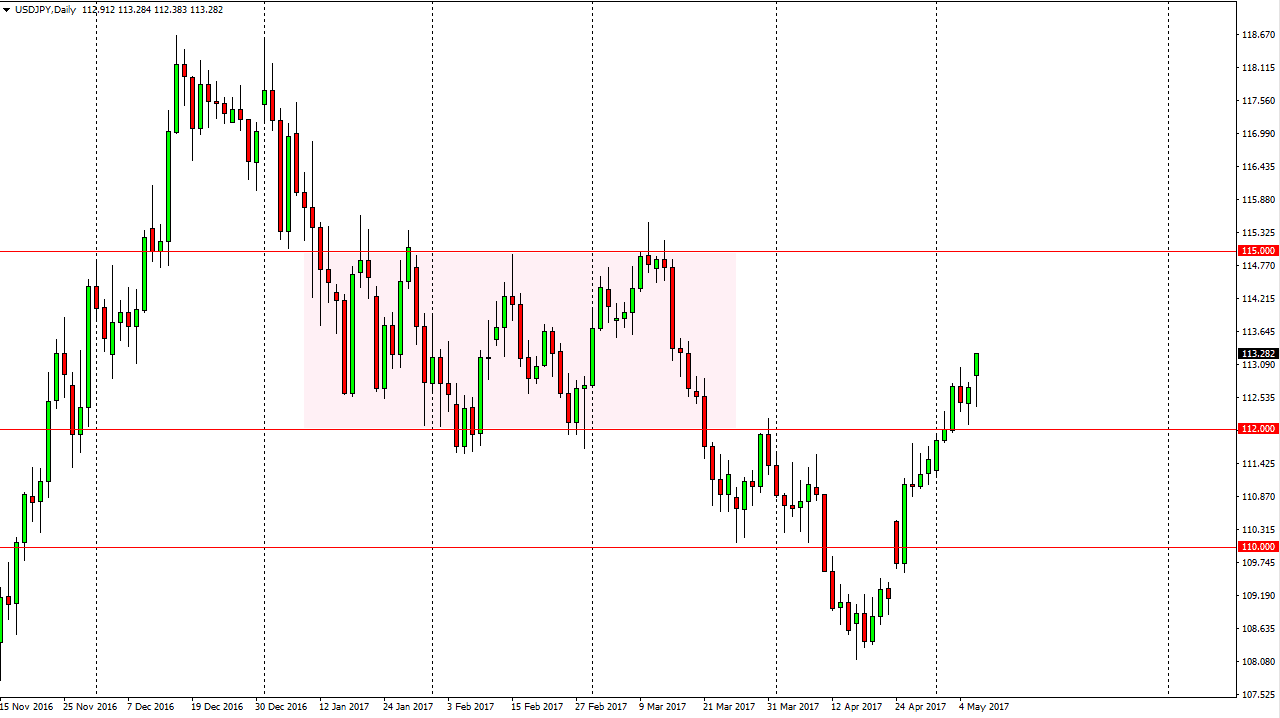

USD/JPY

The US dollar initially gapped higher at the open on Monday and reaction to the French elections, as traders put a “risk on” attitude into the market. However, we turned around to fall but what I found interesting is that we turned right back around to form a hammer. The hammer looks very bullish and I still believe that a break above the 112 level was extraordinarily bullish longer-term. I think we will go towards the top of the previous consolidation area, which is the 115 handle. Being above the 113 level at the end of the day is a very bullish sign, and I suspect that every time we pull back the buyers will return. I have no interest in shorting this market, and believe that the 112 level will be the “floor” in the market.

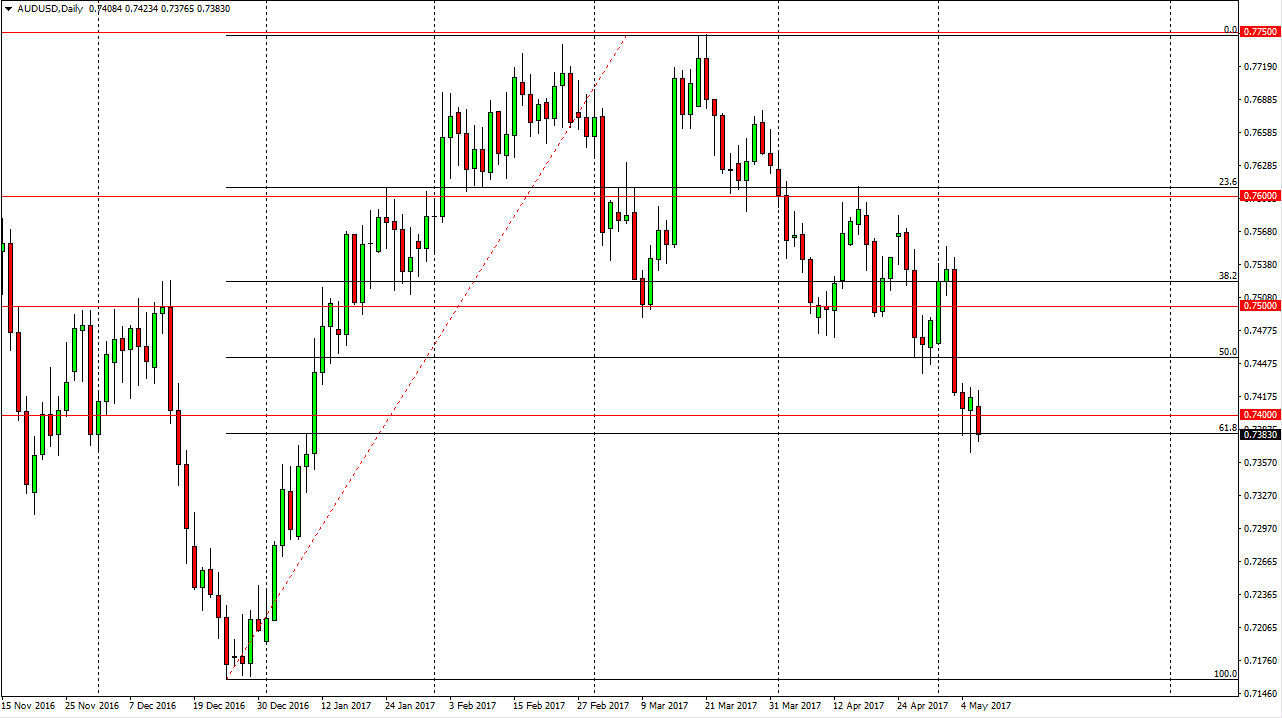

AUD/USD

The Australian dollar initially tried to rally during the day on Monday, but turned around to break below the 0.74 level. We are testing the bottom of the hammer from the Friday session, and if we break down below there, this market should fall apart. Keep in mind the gold markets look very susceptible as well, so more than likely it will happen in both markets at the same time. In a sense, that will be a feedback loop that we can continue to see negative pressure in. I think that a breakdown from here should send this market looking for the 0.72 level next, and then perhaps even lower than that. Alternately, if we break above the top of the hammer from the Friday session, the market could then go to the 0.75 level above.

The market has pulled back significantly, testing the 61.8% Fibonacci retracement level. Because of this, it should show quite a bit of interest, but I don’t think that the buyers look very healthy now.