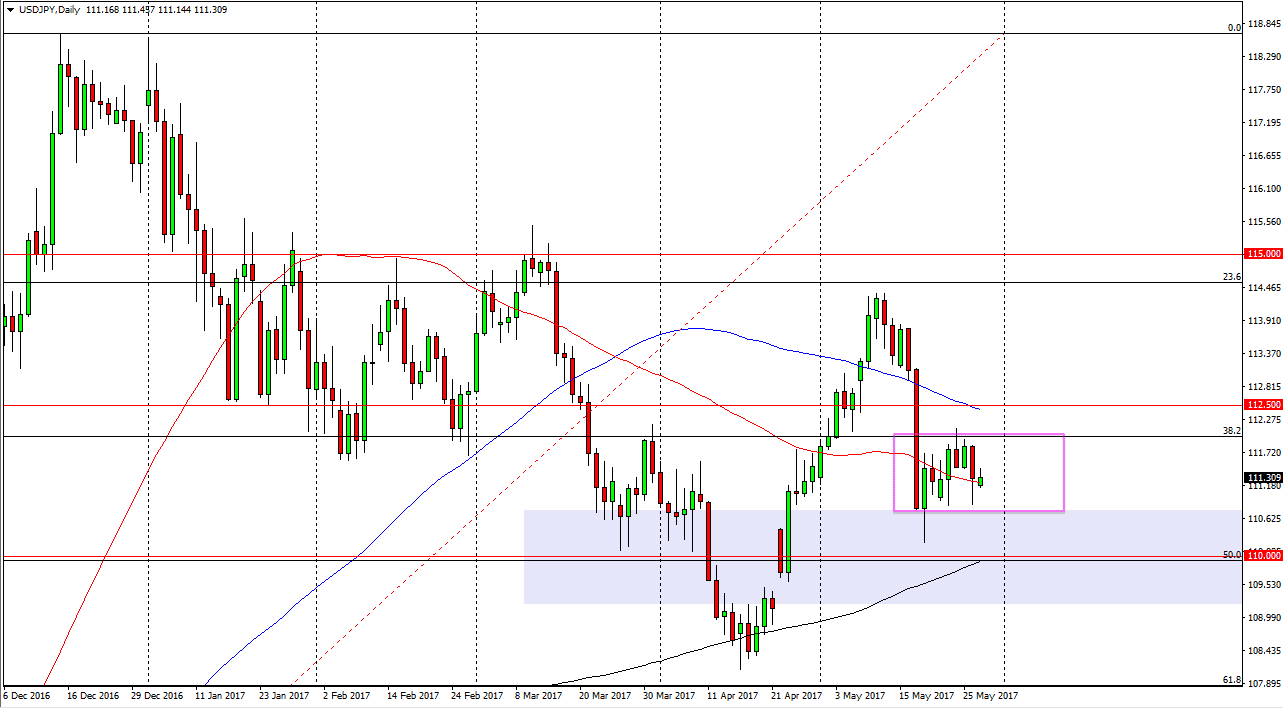

USD/JPY

The US dollar had a quiet session on Monday, as Americans would have been away for Memorial Day. Ultimately, this is a market that will cause quite a bit of noise, and with this being the case it’s likely that the market will continue to follow overall risk appetite, and of course risk appetite would’ve been almost nonexistent during the holiday. I believe that the 110 level underneath should continue to be supportive, so it’s not unless we find some type of massive bearish pressure breakthrough there that I would be comfortable selling. I believe that the markets probably going to bounce from here, and a break above the 112.50 level should send this market towards the 115 handle. Pay attention to stock markets, as they rise, this pair will as well.

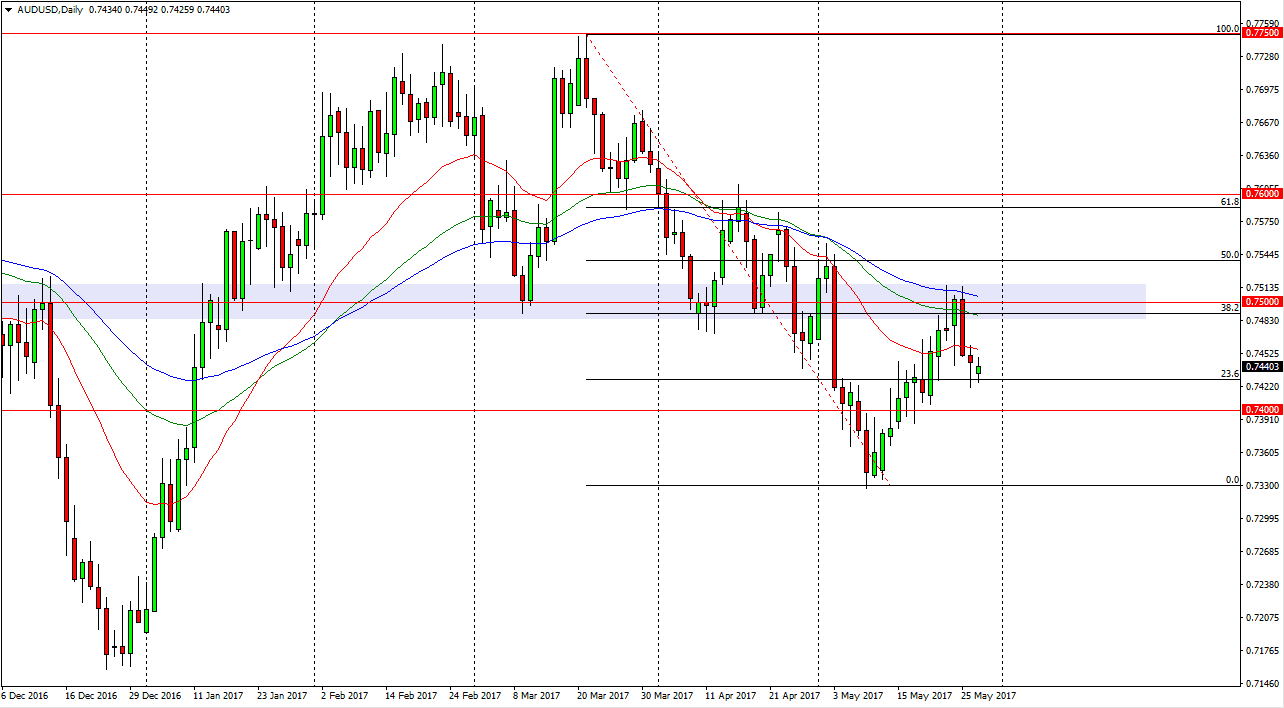

AUD/USD

The Australian dollar was very quiet as well, as it looks like the 0.7425 level continues to offer support. I believe that the market could breakdown from here, and a move below the Friday lows sends this market into the 0.74 handle, and then eventually lower than that. Alternately, we break above the top of the range for Friday, I feel that the market should then reach towards the 0.75 handle above. The market should continue to be noisy, and of course gold has its place in the market as well. If the market starts to break down over in the gold side of things, this pair will fall. If gold continues to rise, but based upon fear, that will also work against the Australian dollar. I would suspect that there is more likelihood of a breakdown than a move higher, but currently it looks as if the Australian dollar is trying to make up its mind as to go where next, with nothing but a lot of noise coming between now and that decision.