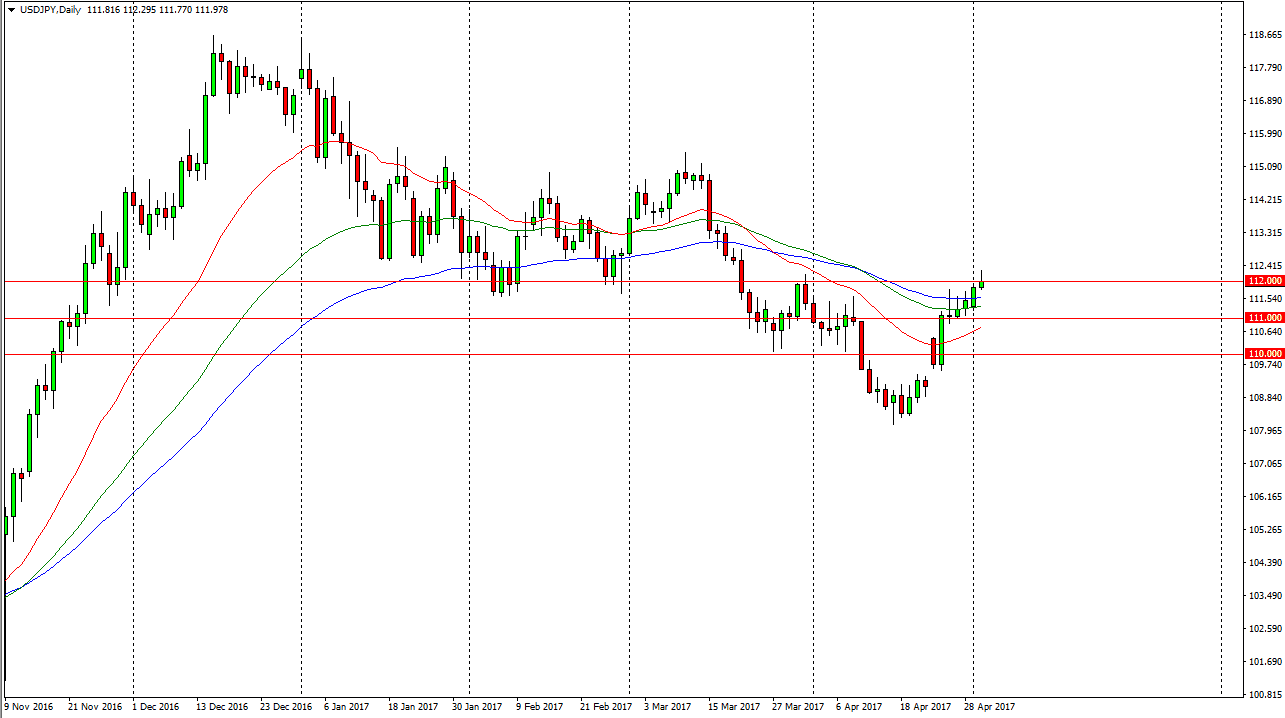

USD/JPY

The US dollar initially rose against the Japanese yen during the Tuesday session, and even broke above the 112 level. However, as the Americans closed out the session, we ended up forming a bit of a shooting star just below the psychologically important 112 level. Because of this, I think that on a breakdown below the bottom of the candle, the market will go looking for support at the 111 level. Alternately, if we break above the top of the shooting star, that’s a very bullish sign and we could see this market tried to get to the 115 level over the next couple of weeks. Either way, I think they can, quite a bit of choppiness as this is a very risk sensitive pair. However, if we are going to see a continuation of the downtrend, this is the perfect spot.

AUD/USD

The Australian dollar rallied as well, but then turned around to form a shooting star also. I believe that if we break down below the 0.75 level, the Australian dollar will drift even lower it is not lost upon me that the Australian dollar is very risk sensitive as well, and it is telling me the same thing as the USD/JPY pair. Because of this, I think that we could see some selling come into the marketplace but I also recognize that a break above the top of the shooting star would be bullish and probably have this market looking for the 0.76 level next. I believe that there is plenty of support below to keep this market from falling apart, and would expect a move lower to probably find support near the 0.74 handle. I think we are currently seeing a slow grind lower in the Australian dollar, and that may continue going forward as we simply drift with a slightly negative bias.