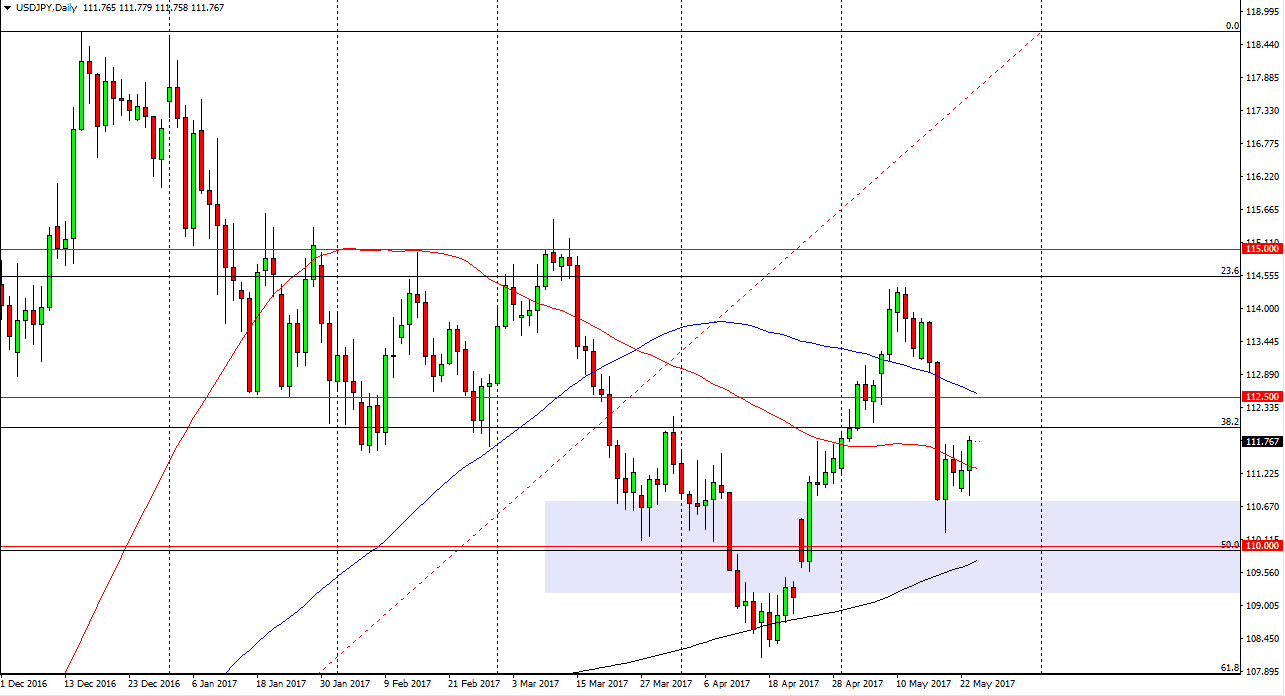

USD/JPY

The USD/JPY pair initially fell during the day on Tuesday, but found enough support near the 110.70 level to turn around and form a supportive looking candle. It now looks as if we are going to continue to go higher, and I think that the market then will go reaching towards 112.50 level, possibly even higher than that. Short-term pullback should continue to be supported, as we have seen a bit of a turnaround in not only the USD/JPY pair, but risk appetite in general. Although the stock markets aren’t exactly booming, they have wiped out most of the losses seen last week, and that’s normally a good sign for the USD/JPY pair. I do recognize there’s a lot of noise above though, so expect volatility and be quick to take profits.

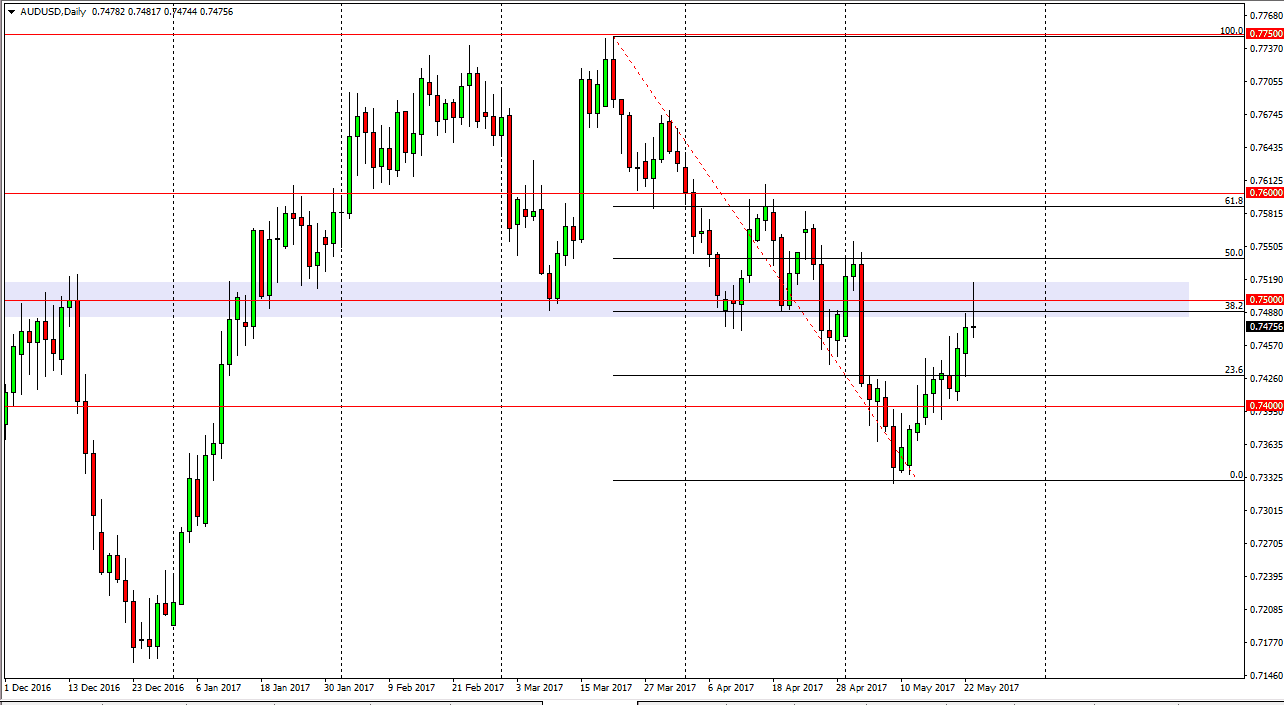

AUD/USD

The Australian dollar tried to rally during the day on Tuesday but found the area above the 0.75 level to be far too exhaustive and resistive to continue going higher. We formed a perfect shooting star and therefore breakdown below the bottom of the range for the day is a cell signal. This could send the market down to the 0.7332 level rather quickly, and possibly even lower than that. This is a perfect retracement to the 38.2% Fibonacci retracement level as well, so I think that a lot of people will be looking at this area. Pay attention gold, because of it breaks down, that will only add more fuel to the fire in this pair, and the fact that the USD/JPY pair is rising could also show signs of the market running back into the US dollar as it has gotten a bit oversold as of late. If that’s the case, the Aussie is going to continue to be punished. Alternately, if we can break above the top of the range for Tuesday, that’s a very good sign and we should continue higher.