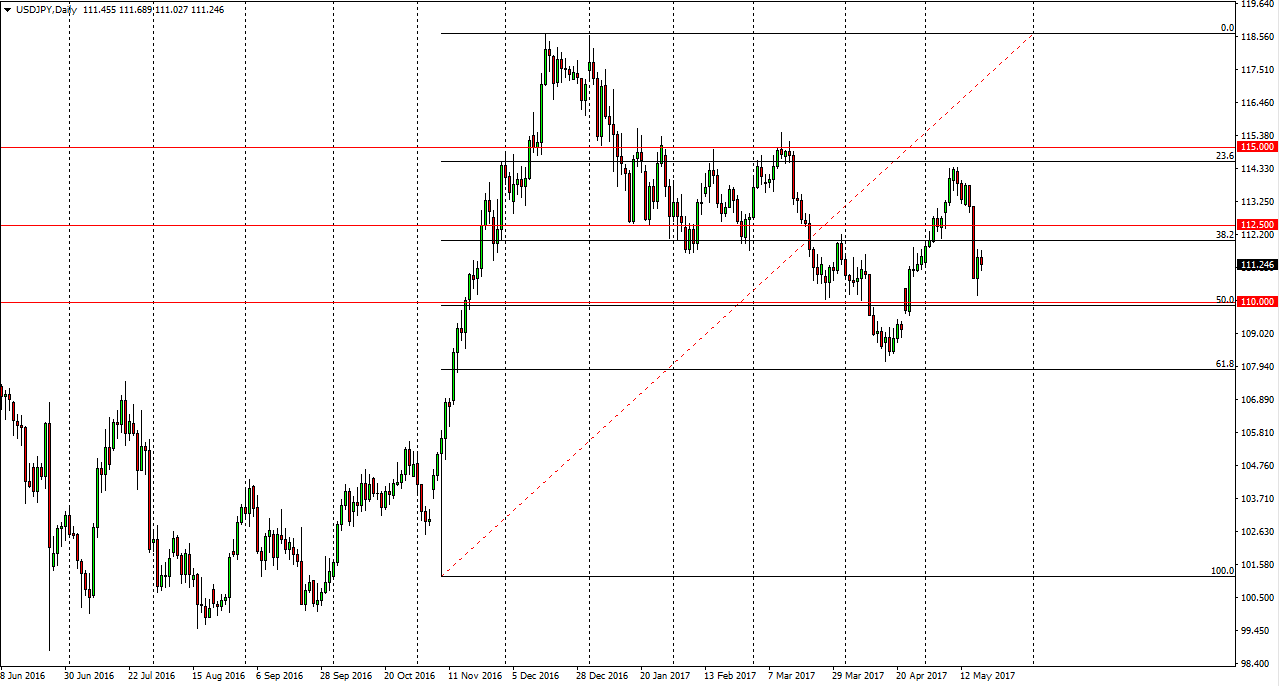

USD/JPY

The USD/JPY pair had a reasonably quiet session during Friday, as we continue to grind overall. That being the case, the market looks as if we are going to continue to see volatility, but I cannot help but notice that the 110 level has offered support. Beyond that, it is also the 50% Fibonacci retracement level, which of course is an important area also. With that being the case, I think pullbacks will continue to offer value that people are willing to take advantage of, and therefore I look at pullbacks of that show a bounce or signs of support as an opportunity to go long in a market that once to rally longer term. I recognize that there could be headlines coming out of Washington DC to shake the markets, but quite frankly every time we get one, markets move beyond it.

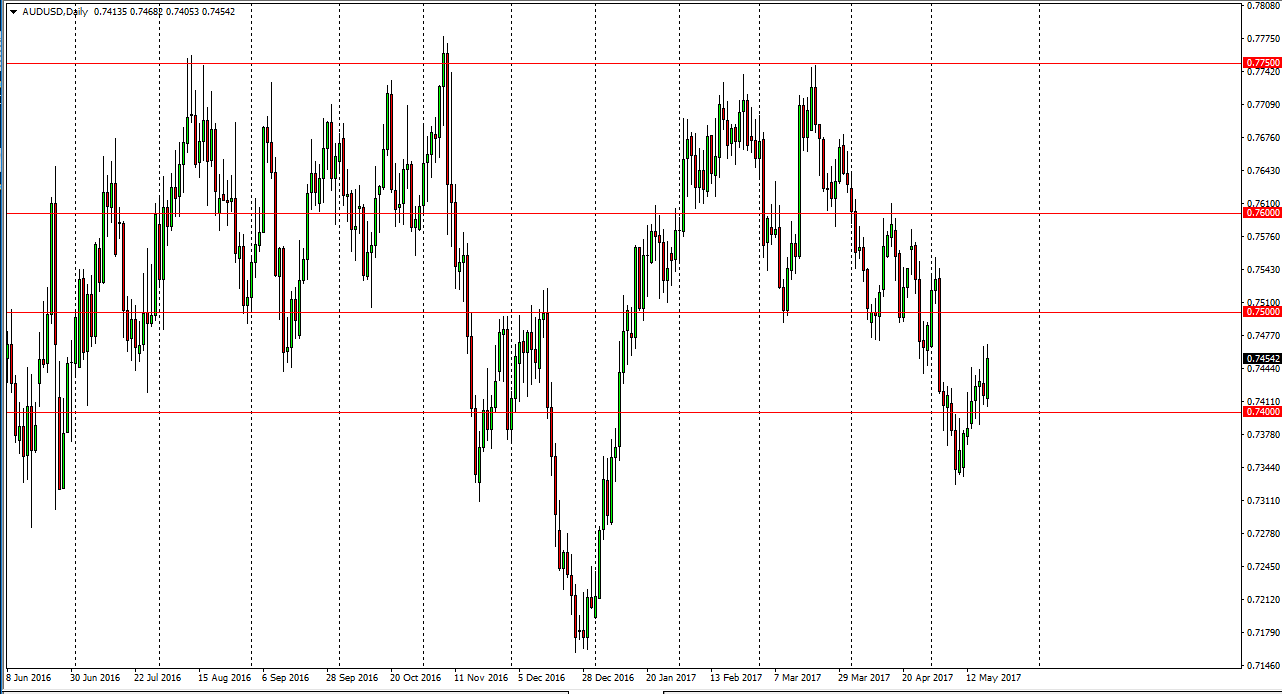

AUD/USD

The Australian dollar rallied during the day on Friday, almost taking out the top of the shooting star from the Thursday session. Having said that, the one thing that I notice is that the weekly candle forming a hammer, and that is a very bullish sign. We could reach towards the 0.75 level, but a break above there would be a very bullish sign. Ultimately, we pull back from here, I think that the 0.74 level underneath should offer support. Pay attention to the gold markets, because they will lead the way going forward. Ultimately, this is a market that I think will continue to see quite a bit of choppiness, but I think more than anything else is going to follow whatever gold does. Keep an eye on both of these markets, as they influence each other. It’s very difficult to trade this market right now, because it has been so choppy. It is actually easier to short this market on signs of exhaustion after rally near the 0.75 handle. However, we don’t have that yet.