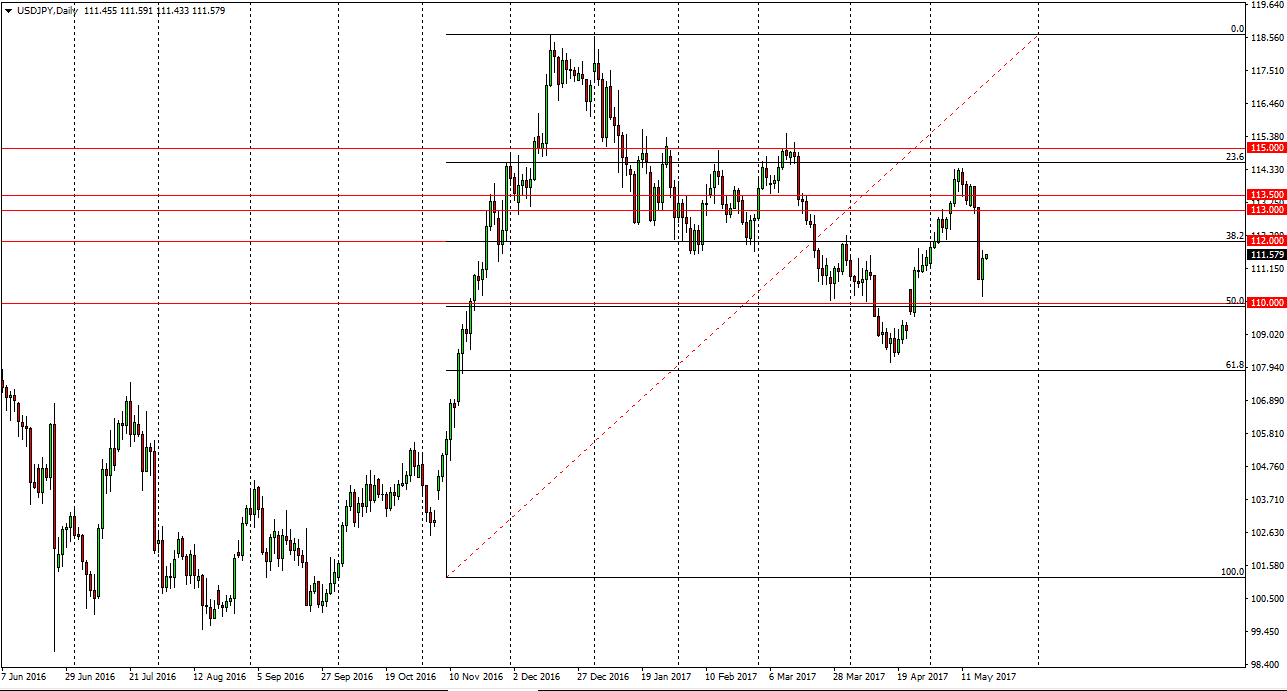

USD/JPY

The US dollar initially fell during the session on Thursday against the Japanese yen but found enough support just above the 110 level to bounce and form a significant candle. This is also the 50% Fibonacci retracement level from the surge higher, so it makes quite a bit of sense that traders may have been interested. If we can break above the 112 handle, I feel that this market can continue the uptrend, although there will be quite a bit of volatility. It should lead us into a “buy on the dips” type of mentality, as we will then go looking for the 115 handle. Alternately, if we broke down below the 110 level, I feel that the market would then probably go looking for the 108-level underneath. One thing you can count on is massive volatility I think.

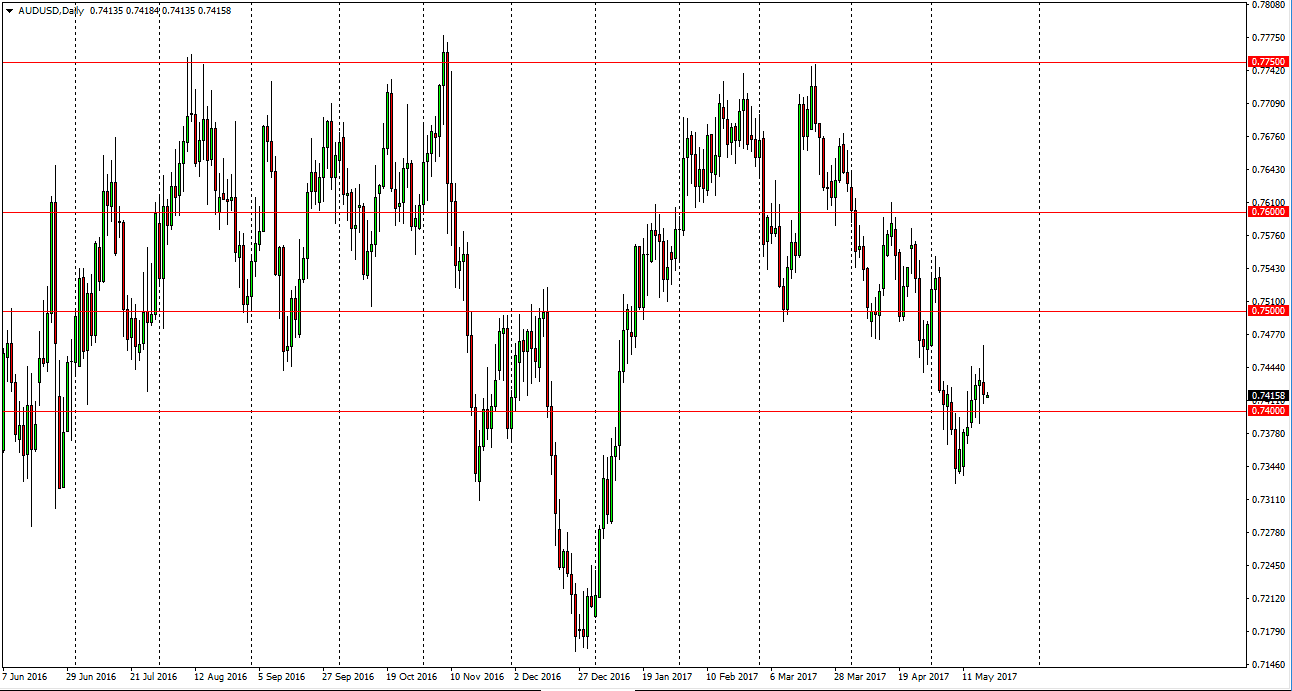

AUD/USD

The Australian dollar initially rally during the day on Thursday but found enough resistance above the turn around and form a shooting star. The shooting star of course is a negative sign, and it suggests that we are not quite ready to go higher. The hammer from the previous session also suggests that there is some buying pressure in this area, so I think we are looking at consolidation more than likely. Because of this, short-term trading is probably about as good as it gets, but ultimately, I think that the gold markets will have a massive influence on what happens next. Because of that, I will be watching both the gold and the Australian dollar going forward. I think that gold is looking very consolidated as well, so we could end up seeing very little action in this pair. Currently, I’m on the sidelines but recognize that the next couple of sessions could go a long way in determining where we are going next.