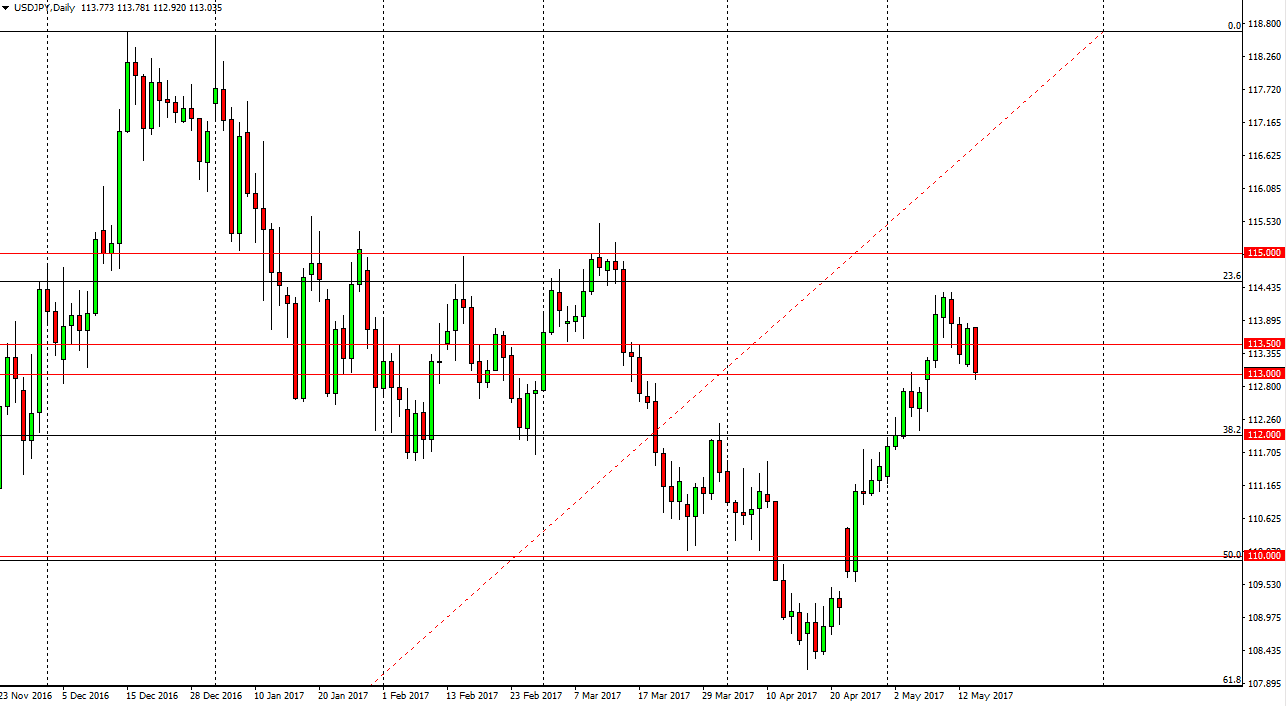

USD/JPY

The USD/JPY pair had a negative session on Tuesday, testing the 113 level. We have recently seen a move higher that started all the way down at the 110 handle, so I think that a pullback from here makes quite a bit of sense. I also recognize that the previous consolidation area extends all the way down to the 112 level, so we could pull back a little bit from here to go looking for buyers below. A supportive candle has me buying, I don’t have any interest in selling currently, mainly because of the interest rate expectations coming out of the United States and Japan. On signs of support, I think of it as value and am willing to start going long again.

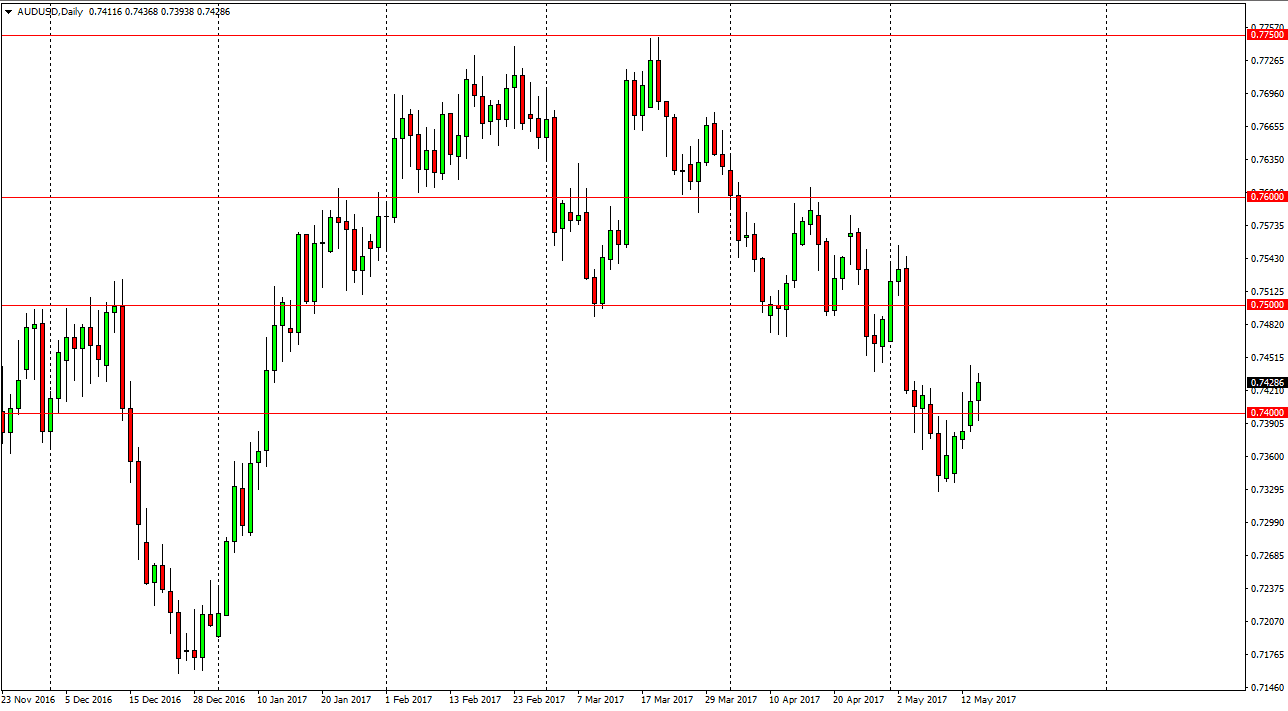

AUD/USD

The Australian dollar initially fell during the session on Tuesday but found the 0.74 level to be a bit supportive. Gold markets also looked a bit healthy as well, so now I think that a break above the top of the shooting star from the previous session should be a nice buying opportunity, perhaps breaking above the 0.7450 level. If that happens, the market should then go to the 0.75 level, and then higher than that. Ultimately, the gold markets will continue to drive the market overall, and if gold markets can continue to go higher, I think that will drive the Aussie higher as well. Alternately, if we break down below the bottom of the Friday shooting star, I think then the market starts a breakdown. Having said that, the candle from last week was a hammer, so I am more inclined to go long than to go short. Coupled with a move higher in gold, that should be a nice buying opportunity from what I can see. Either way, expect a lot of choppiness.