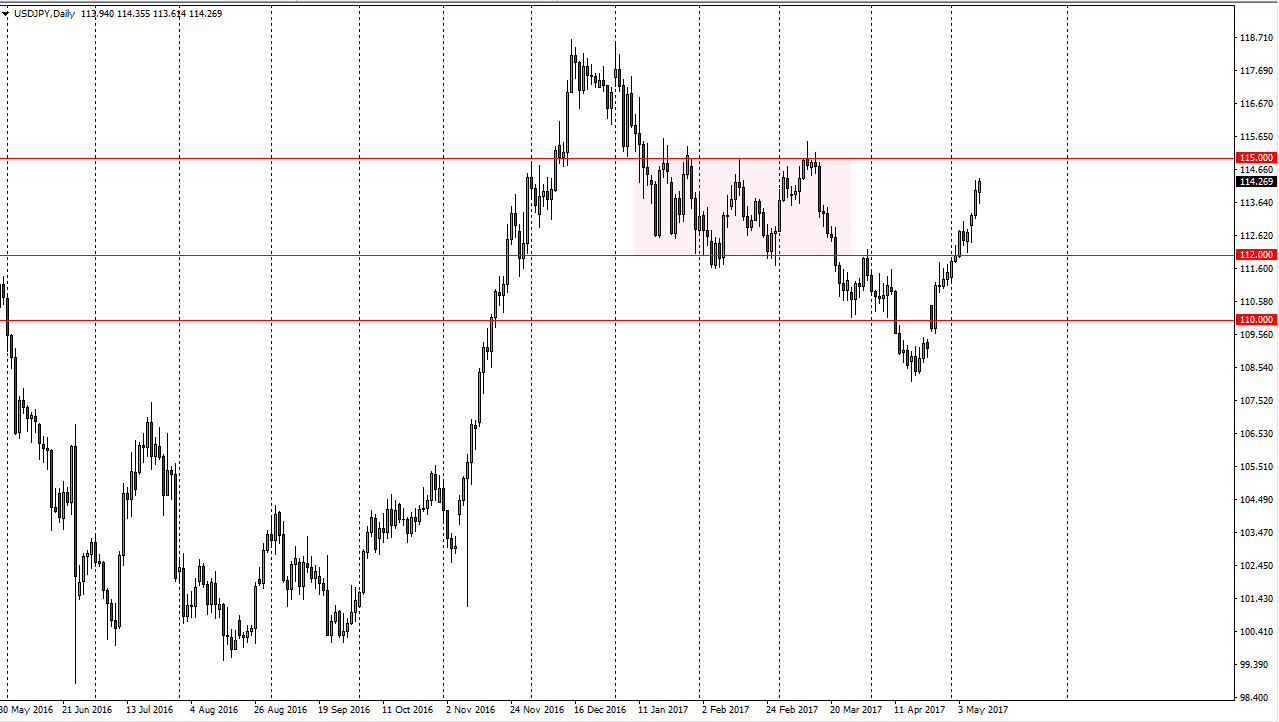

USD/JPY

The US dollar initially fell on Wednesday, but turned around to form a nice-looking hammer at the top of an uptrend by the time we closed. Because of this, looks as if the market is going to reach towards the 115 handle above. That was the top of the previous consolidation area, and I think it makes a solid target for the market to reach towards. Pullbacks could happen, but quite frankly they should be buying opportunities now that we have seen quite a bit of upward momentum. I don’t know if we can break above the 115 handle, but it will probably take a couple of attempts to do so. With this, I remain bullish but recognize that we may get a bit of choppiness as we are bit overextended.

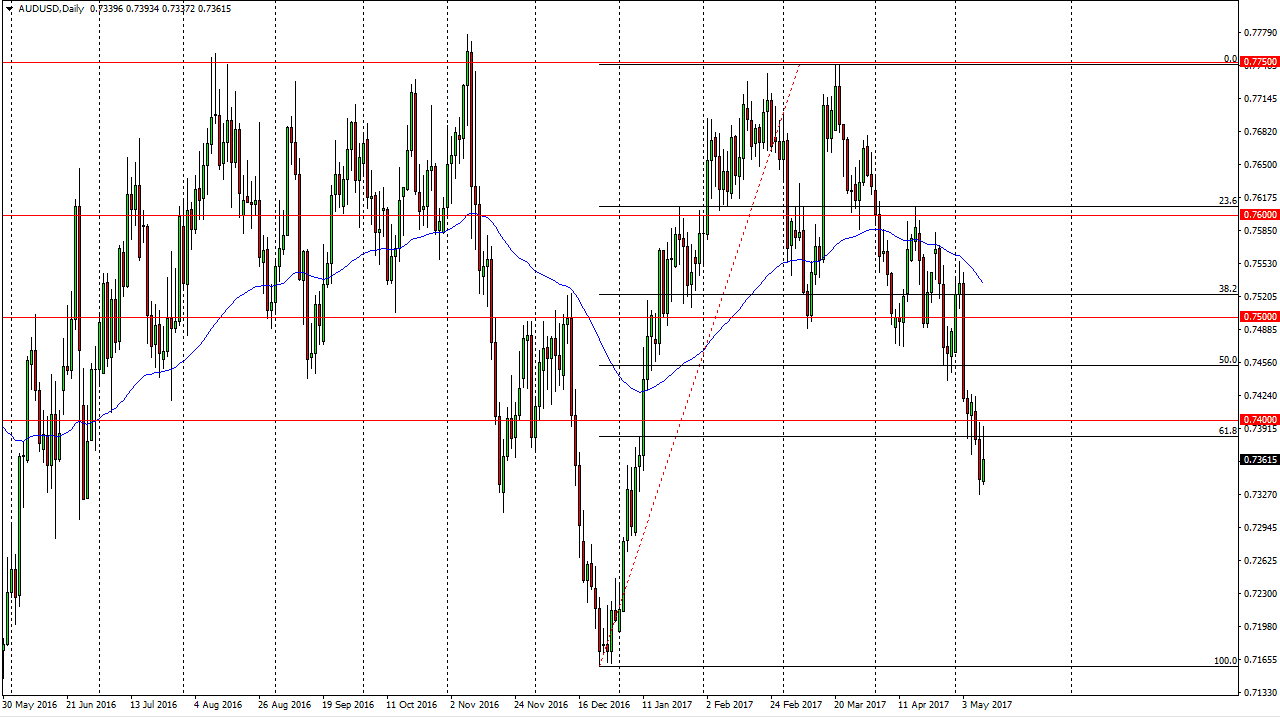

AUD/USD

The Australian dollar initially tried to rally during the session on Wednesday, but found the 0.74 level to be a bit too resistive. The fact that gold continues to fall suggests that the Aussie has a way to go as well. Beyond that, we are below the 61.8% Fibonacci retracement level, and as a rule I would suspect that the market will probably retrace all the way to the 100% level. That sends this market down to the 0.7150 level longer term, and therefore that is my target. If we broke above the 0.7425 level, I think the market could try to reach towards the 0.75 handle above. That is an area that I would expect to see quite a bit of resistance at as well, so he the way I believe that we have some downward momentum built into the market, and I think that should continue to be the overall direction of the market and I believe that the sewing of rallies will be the best way to approach this market.