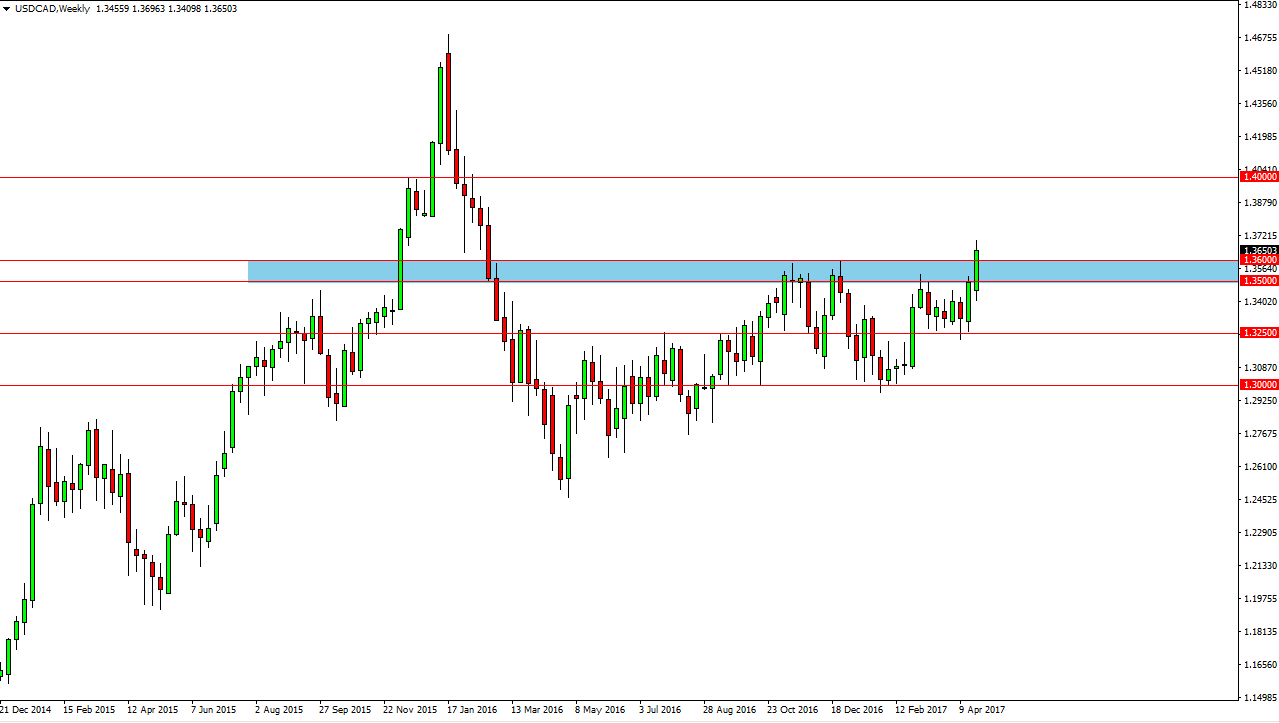

The USD/CAD pair initially fell during the month but found enough support during April trading at the 1.3250 level to break out and above the 1.36 level as we closed out the final week. This is a very bullish sign and is a major break out in my estimation. I believe that the “floor” in the market is probably close to the 1.35 handle, and oil markets falling apart or certainly helping this move. We have been in an upward channel for some time, and it looks like the channel will continue. In fact, we may be even starting to accelerate at this point, and I believe that a move towards the 1.40 level over the next several weeks could be possible.

Oil leads the way

Oil markets are currently testing a significant uptrend line, and if they breakdown I think that the USD/CAD pair will go higher much quicker. I think that’s going to happen anyway due to the Canadian economy overall, but oil will more than likely determined the velocity of the move. I believe that the 1.40 level would be massively resistive, but eventually will be taken out. That is a large, round, psychologically significant number and an area where we had seen resistance in the past.

If we do breakdown and below the 1.35 level, it would almost have to be accompanied by a rally in oil markets. I currently don’t see that as being likely but then again you never know and with that you must pay attention to the WTI Crude Oil market while trading the Canadian dollar in general. I think given enough time, we will grind to the 1.40 level, and may even make it there by the end of the month. I think the first week of the month will be very likely to influence where we go after that.