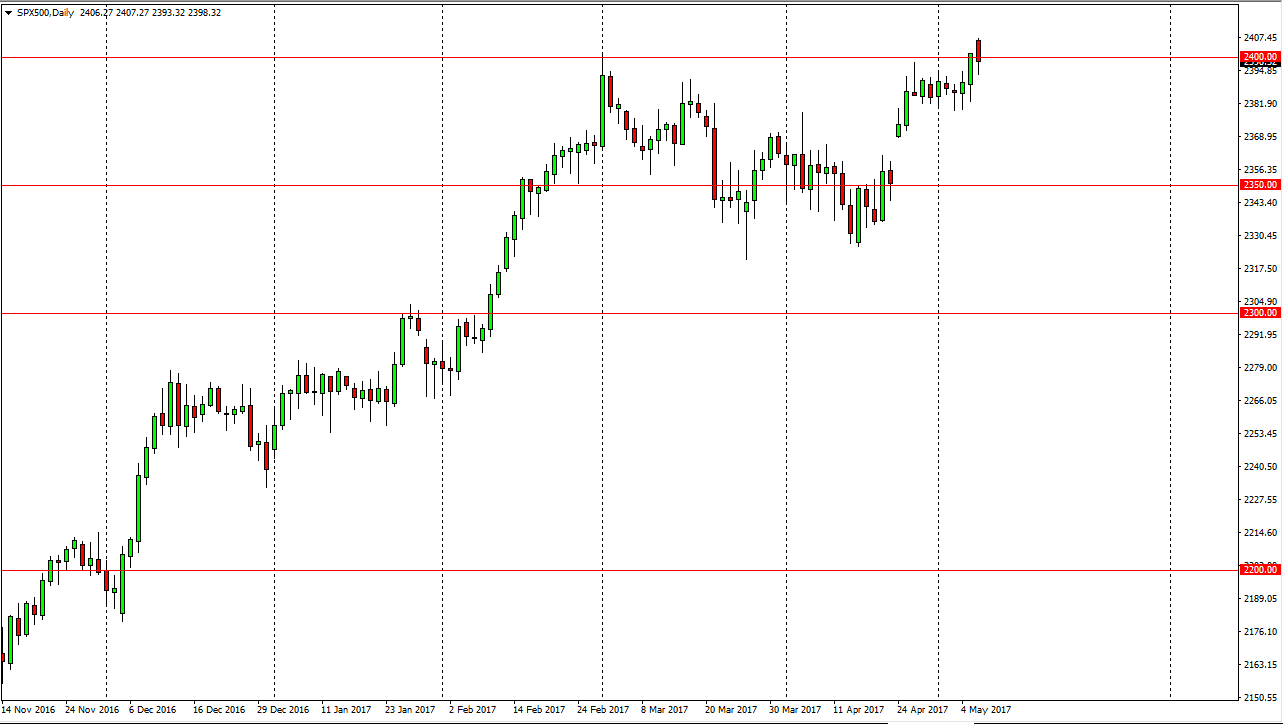

S&P 500

The S&P 500 reacted positively to the French election results, gapping higher at the open. However, we fell significantly during the day but later in the New York trading session we found enough buyers to turn things around and form a relatively supportive looking candle. Because of this, I believe that the S&P 500 is still going to continue to grind to the upside, as money flows back into the stock markets. There seems to be a significant amount of support at the 2380 handle, so it’s not until we break down below there that I would consider selling. Even then, I would be very cautious about doing so. I much prefer the uptrend of that we have seen for some time. Because of this, I believe that the buyers are simply looking at these pullbacks as value.

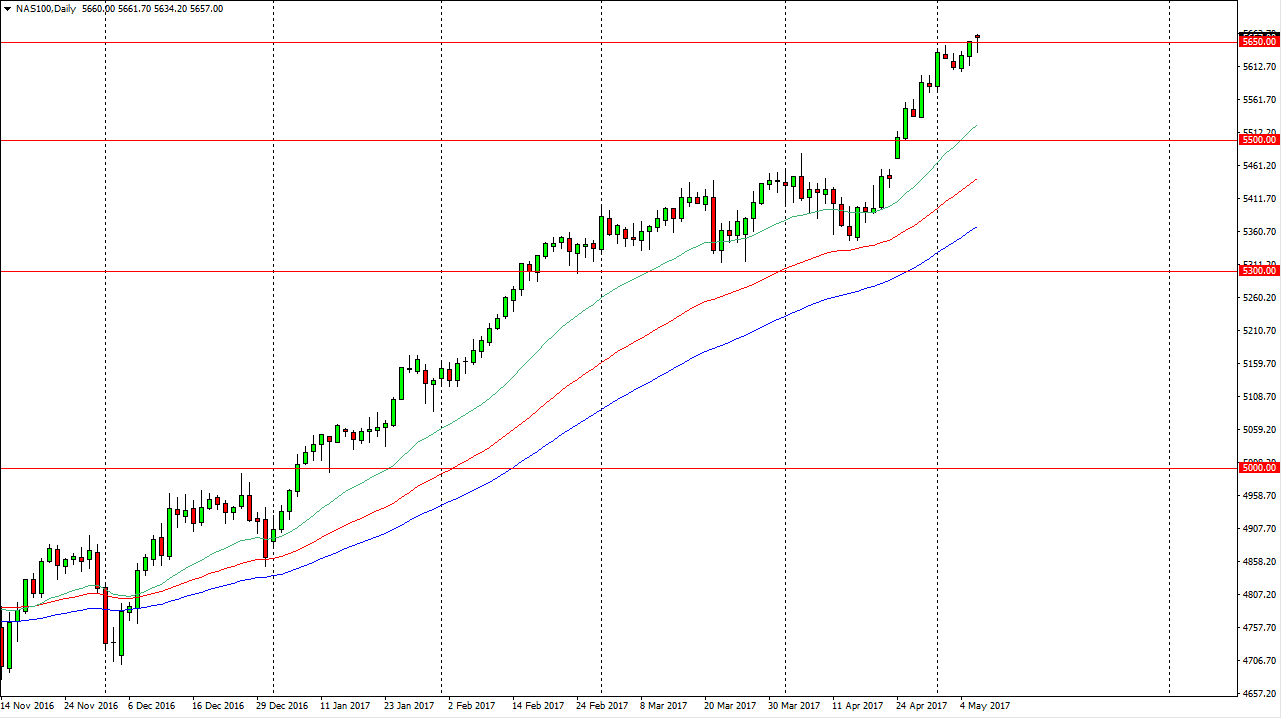

NASDAQ 100

The NASDAQ 100 initially fell after gapping as well, breaking below the 5650 handle. However, we bounced enough to form a hammer, and that suggests that there is a lot of bullish pressure underneath. A break above the top of the candle should send this market to the 5700 level above. I like this market in general, as it has lead the other US indices higher, and should continue to do so. I believe that the 5600 level underneath is massively supportive, and with this being the case it’s likely that we will continue to see value on these dips. I have no interest in shorting, and I believe that the NASDAQ 100 will continue to find value going forward. Ultimately, this is a bullish market that leads the way, and I believe that we will continue to see the NASDAQ 100 lead the rest the US, as well as the rest of the world for that matter.